Hedera Price Prediction 2026, 2027 – 2030: Will HBAR Price Hit $0.5?

Story Highlights

- The live price of Hedera crypto is $ 0.09396001.

- Hedera Price prediction highlights HBAR could reach $0.45-$1.05 in 2026.

- The Long-term forecasts suggest HBAR could hit $2.20 by 2030, indicating stable growth potential.

Hedera has been making waves in the cryptocurrency space, with a fast and secure blockchain that offers a distinct approach to transaction processing compared to Ethereum and other smart contract chains. It’s permission-only, meaning the blockchain is managed by private companies. Limiting what types of decentralised applications are allowed is what makes Hedera stand out from the rest.

Having entered the top 20 digital assets by market cap in 2024, it is now eyeing a potential leap into the top 10 by the end of 2025. Hedera has also recently ramped up its development activities for its ecosystem. Its ecosystem is strengthening, despite its capped price action. With increasing real-world use cases, institutional interest, and strategic partnerships, many are closely tracking HBAR price chart 2025 to gauge how high the token can rise.

With major companies like Google, IBM, and Chainlink Labs backing the project, and discussions about SEC approved HBAR ETF would flood string liquidity. Many are intrigued that: Will the HBAR Price Reach $1? Let’s discuss this in our Hedera price prediction 2025 article.

Table of Contents

Hedera Price Today

| Cryptocurrency | Hedera |

| Token | HBAR |

| Price | $0.0940 |

| Market Cap | $ 4,040,601,783.17 |

| 24h Volume | $ 74,720,059.0416 |

| Circulating Supply | 43,003,421,569.1817 |

| Total Supply | 50,000,000,000.00 |

| All-Time High | $ 0.5701 on 16 September 2021 |

| All-Time Low | $ 0.0100 on 02 January 2020 |

Coinpedia’s HBAR Price Prediction 2026

HBAR fell back under $0.100 by early 2026, and it recently tested key dynamic support in February, indicating potential demand. For a bullish outlook, it needs to reclaim $0.120; otherwise, it may pull back to $0.0800. For the long run, holding $0.0800 is crucial to avoid testing $0.0453.

HBAR Price Prediction 2026: What’s Next for Hedera?

Previously, the HBAR price began a prolonged period of consolidation below $0.120, lasting nearly 2 years from 2023 to the third quarter of 2024. Then a rally in Q4 2024 pushed it to $0.4010. But the surprising part is that by the end of 2025, it is back below $0.120, and by the end of January 2026, it has even slipped below $0.100 in February. The question is whether it is an opportunity or something else.

Since the extended decline of 2026 has retested a key support that strongly aligns with the lower border of the pattern, and some reaction from this level confirms the presence of demand at this dynamic support. That makes the current price action an important play that could shape the next big move.

Also, it has an ETF, where odds are suggesting that once a catalyst arrives inflows could resume sooner or later, and the price of HBAR, which is currently experiencing lower demand, that could change. Also, this setup of falling wedge still looks intact with bears ruling for now, and it cannot be confirmed yet whether the recent support taken changes towards the bullish wind. So far, only on the micro level is it bullish, but the long-term chart still doesn’t care about micro momentum because the larger momentum is still dominated by bears, and this needs a big catalyst to break the range.

In the short term, either it will claim its position back above $0.1200 and aim for $0.1836, or it will take a pullback from $0.1200 back to $0.0800.

However, for the majority of this year, holding on to $0.0800 is key; if that’s compromised, it will be very hard to stop HBAR from testing $0.0453 support. Right now in Q1, the initial rally that fruited in late 2024 began from this zone, and if demand manifests, this could be a possible opportunity to accumulate, but caution still comes first.

HBAR On-Chain & ETF analysis

The HBAR ETF is gaining momentum once again, with $1.46 million in inflows this week. The last time we saw such significant inflows was in early December, when it reached $1.78 million. This suggests liquidity is flowing into HBAR, potentially signaling a price rise.

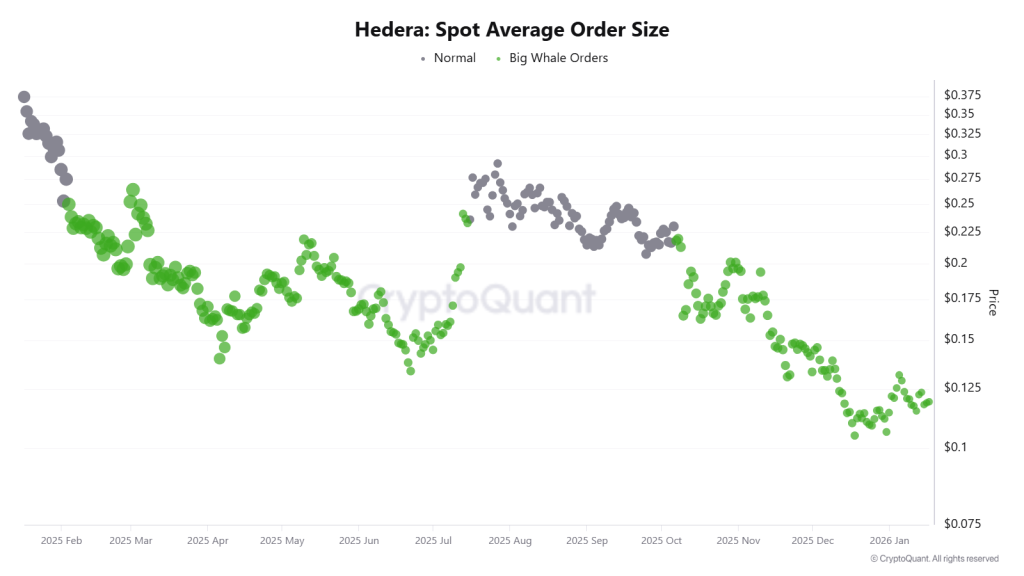

Also, large orders from whales have been increasing since mid-October, suggesting that they are purchasing HBAR on every price decline.

| Year | Potential Low | Potential Average | Potential High |

| 2026 (conservative) | $0.15 | $0.40 | $0.75 |

HBAR Price Prediction 2026 – 2030

| Year | Potential Low | Potential Average | Potential High |

| 2026 | $0.45 | $0.80 | $1.05 |

| 2027 | $0.60 | $0.95 | $1.20 |

| 2028 | $0.65 | $1.10 | $1.40 |

| 2029 | $0.70 | $1.35 | $1.60 |

| 2030 | $0.95 | $1.70 | $2.20 |

HBAR Price Prediction 2026

Moving forward to 2026, forecast prices and technical analysis project that Hedera’s price is expected to reach a minimum of $0.45. The price could escalate to $1.05 on the higher end, with an average trading price hovering around $0.80.

HBAR Price Forecast 2027

Looking ahead to 2027, the optimism around Hedera will lead to steady growth. Hence, the HBAR price is forecasted to reach a low of $0.60, with a potential high touching $1.20 and an average forecast price of $0.95.

Hedera Price Forecast 2028

As we advance to 2028, with moderate gains, the HBAR predictions indicate that the price of a single HBAR could reach a minimum of $0.65, with the ceiling potentially rising to $1.40. Within the range, the average price will be $1.10.

HBAR Price Target 2029

By the time 2029 rolls around, it’s predicted that Hedera’s price will maintain its upward trajectory, reaching a minimum of $0.70, with the maximum price possibly reaching $1.60 and an average of $1.35, reflecting cautious optimism.

Hedera Price Prediction 2030

By the end of this decade, HBAR is predicted to touch its lowest price at $0.95, aiming for a high of $1.70 and an average price of $2.20. Hence, the prediction suggests stable long-term growth for Hedera’s market value.

Market Analysis

| Firm | 2026 | 2030 |

| Changelly | $0.370 | $1.74 |

| priceprediction.net | $0.40 | $1.99 |

| DigitalCoinPrice | $0.50 | $1.07 |

Coinpedia’s Hedera Price Prediction

By the end of 2025, the recovery run in HBAR prices is expected to continue with a gradual rise in momentum. Hence, by the end of 2025, Coinpedia’s HBAR price forecast expects a potential high of $0.80 with a solid support at $0.40, making an average of $0.60.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $0.40 | $0.60 | $0.80 |

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

HBAR price in 2026 is projected to trade between $0.45 and $1.05, with an average near $0.80 under favorable market conditions.

By 2030, HBAR price could rise to around $2.20 if network growth, partnerships, and broader crypto adoption continue steadily.

Hedera shows long-term potential due to enterprise adoption, real-world use cases, and strong governance, though price cycles still affect returns.

Disclaimer and Risk Warning

The price predictions in this article are based on the author's personal analysis and opinions. CoinPedia does not endorse or guarantee these views. Investors should conduct independent research before making any financial decisions.