As Bitcoin trades sideways, traders are shifting liquidity into altcoins, pushing altcoin trading volume to nearly half of the total market

Besides, the BTC dominance has reached a crucial juncture where a pullback may trigger a strong Altseason

The crypto market is entering a pause-to-rotate phase where the top two tokens are consolidating within a tight range. The Bitcoin price is compressing between $89,000 and $94,000, and the Ethereum price is holding firmly above $3,000. This suggests the indecision and uncertainty with BTC, but the relative strength of ETH rises as it is not following the top crypto’s deeper consolidation.

While majors stall, several altcoins like MYX Finance, Polygon, Render, Virtuals Protocol, and a few more are posting sharp gains. This shift has raised an important question: is money rotating into altcoins, and could this be the early stage of an altseason?

Liquidity Is Flowing Into Altcoins—But Not Blindly

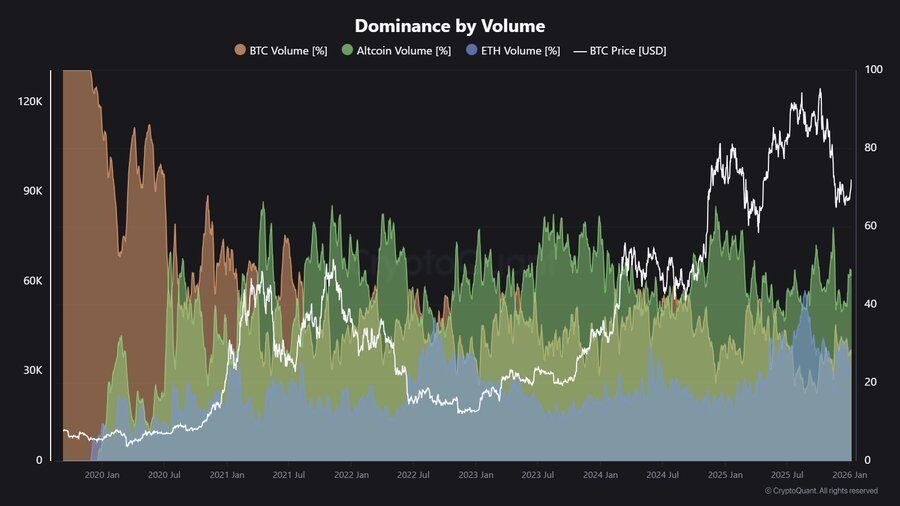

Recent volume data shows a notable shift in trader behavior. Altcoins now account for roughly 50% of total cryptocurrency trading volume, overtaking Bitcoin at around 27% and Ethereum at nearly 23%. This marks a clear shift toward higher-beta assets as traders seek faster percentage returns.

Importantly, this does not suggest capital is leaving crypto. Instead, liquidity is being redeployed within the market. When Bitcoin ranges after a rally, traders often rotate into assets with higher volatility to maintain momentum.

However, this flow remains selective. Volume expansion is concentrated in specific names and narratives, rather than broad-based accumulation across the entire altcoin market. That distinction matters.

Bitcoin Dominance Is at a Crucial Technical Juncture

The stronger confirmation comes from Bitcoin dominance (BTC.D), viewed on the weekly timeframe. After failing near the 66% region, dominance has printed a lower high, followed by a failed retest of the cloud and a confirmed weekly sell signal.

Currently hovering around 59%, Bitcoin dominance sits above key downside liquidity zones between 58% and 56%. A sustained move lower would historically favor altcoin outperformance, while a bounce from this region would signal a Bitcoin to regain control.

What Both Charts Are Really Saying

Taken together, the message is clear: Volume rotation is already happening, while Dominance structure is beginning to confirm it. This combination often supports continued strength in altcoins. However, history shows that this process happens in stages. Ethereum usually leads first. Large-cap tokens like Solana, BNB, and XRP tend to follow. Smaller altcoins typically move later.

This is not yet a “buy everything” environment. It is a rotation phase, not a speculative frenzy. There are also clear invalidation risks. A sharp breakdown in Bitcoin price below $89,000, or a rebound in BTC dominance above ~62%, would weaken the current altcoin thesis quickly.

What Comes Next—Could This Lead to Altseason in 2026?

If Bitcoin continues to trade sideways and dominance keeps falling, altcoins could extend their gains. Ethereum holding above $3,000 remains a key signal to watch.

A true altseason will need:

- A steady drop in Bitcoin dominance

- More altcoins are joining the move

- Strong spot buying, not just leverage

For now, the market appears to be building a base rather than entering a full rally. If current trends continue, 2026 could still shape up as an important year for altcoins.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.