Bitcoin & Ethereum Trigger Major Liquidity Sweep – What’s the Next Move for BTC and ETH?

Bitcoin and Ethereum have flushed key liquidity zones, leaving the market at crucial support levels that could decide the next major move

A bullish defence may lift BTC toward $118,000 and ETH toward $2,750, while failure to hold support risks deeper tests at $108,000 and $2,480, respectively

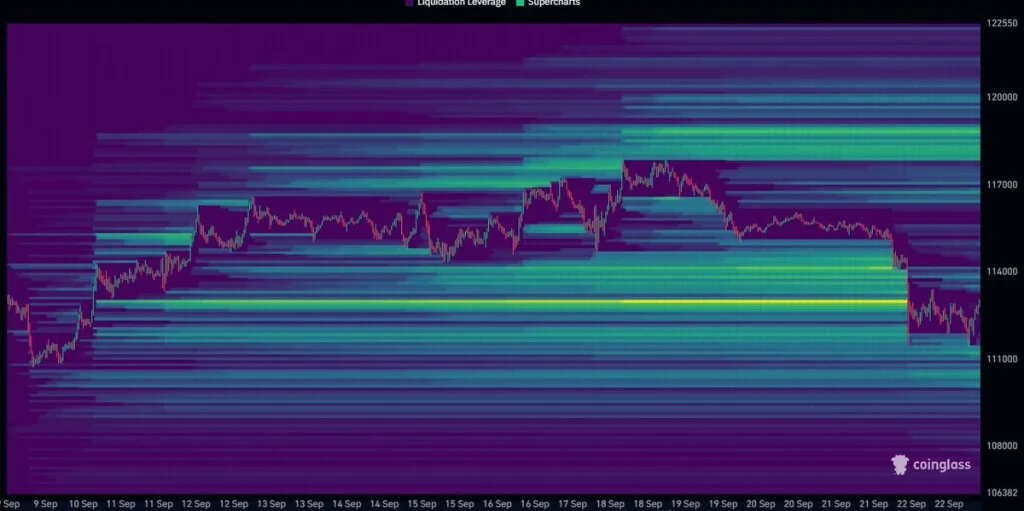

After a huge sell-off, Bitcoin and Ethereum prices seem to be stabalising with the bulls gaining some strength. BTC price rebounded after hitting lows below $112,000, while ETH price stood firmly above $4000. The recent data reveal that the top 2 tokens have squeezed out liquidity after reaching specific levels, which has shaken the flattened volatility across the markets. The Coinglass data shared by a popular analyst, Daan Crypto Trades, hints towards a bullish continuation.

This liquidity heatmap highlights how Bitcoin price action recently hunted down heavily clustered liquidation zones. The dense yellow-green regions around the $111,000–$113,000 range reveal where leveraged longs were forced out as the market dipped sharply. Such moves are common in crypto, as price often gravitates toward areas of high liquidity to reset market positioning. With this sweep complete, BTC now sits in a consolidation phase, leaving traders to watch whether bulls can defend this zone or if the market will extend lower toward the next liquidity pocket near $110,000.

Considering Ethereum, the analyst says,

“ETH also took out a big cluster.

Currently, most liquidity in close proximity sits higher as the local range lows have been swept”

With this, the analyst mentions key levels to watch for Bitcoin and Ethereum, as $118,000 and $4700. In the times when the BTC price is struggling to rise above $113,000 and ETH is trading in and out of $4200, the question arises whether the top two tokens will make it to the mentioned target.

What’s Next for BTC & ETH Price?

Bitcoin recently swept major liquidity zones, triggering a sharp drop toward the $111,000–$113,000 range, where dense liquidations were cleared. The price is now consolidating just above this zone, signalling a potential relief bounce if buyers defend current levels. Immediate resistance sits near $115,500, with a breakout opening the path to $118,000. On the downside, a failure to hold above $111,000 could expose BTC to deeper tests toward $108,000. Traders are closely eyeing whether this flush sparks recovery or continuation lower.

Meanwhile, Ethereum followed Bitcoin’s liquidity sweep, sliding toward the $2,550–$2,600 range where leveraged longs were cleared out. Price is currently stabilising after the flush, suggesting short-term consolidation before the next move. If buyers step in, ETH price could rebound toward $2,680 and potentially $2,750 as immediate resistance levels. However, if selling pressure persists and $2,550 fails to hold, the next liquidity pocket sits near $2,480. Traders are now watching whether Ethereum can recover strength alongside BTC or extend its corrective decline.

Wrapping it Up

Both Bitcoin and Ethereum have cleared significant liquidity zones, resetting market positioning and shaking out leveraged traders. With prices stabilizing near key support, the immediate outlook hinges on whether bulls can defend these zones to trigger a relief rally. BTC eyes $115,500–$118,000 while ETH targets $2,680–$2,750 if momentum builds. Conversely, a breakdown below $111,000 for BTC or $2,550 for ETH could open the door to deeper liquidity pockets. The coming sessions will be pivotal in shaping short-term trend direction.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

A liquidity sweep occurs when price rapidly moves to an area with many stop-loss orders, ‘sweeping’ out leveraged traders before often reversing direction.

The drop was likely a liquidity sweep, where the market moved to trigger a large number of leveraged long positions before stabilizing.

Prices are stabilizing after the sweep, suggesting a potential relief bounce. The next move depends on whether bulls can defend the current support levels.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.