Bitcoin price today is consolidating between $114,600–$117,100 with bullish sentiment at 68.8%, awaiting the Fed’s rate decision.

FOMC Expectations: Markets price in a 25 bps cut with 90% probability, seen as supportive for both Bitcoin and gold near record highs.

The cryptocurrency market is holding steady as traders await the U.S. Federal Reserve’s highly anticipated interest rate decision. Bitcoin (BTC) is consolidating between $114,600 and $117,100, currently trading in the upper range. Analysts view this setup as constructive, with market sentiment at 68.8%, a level close to peak bullishness.

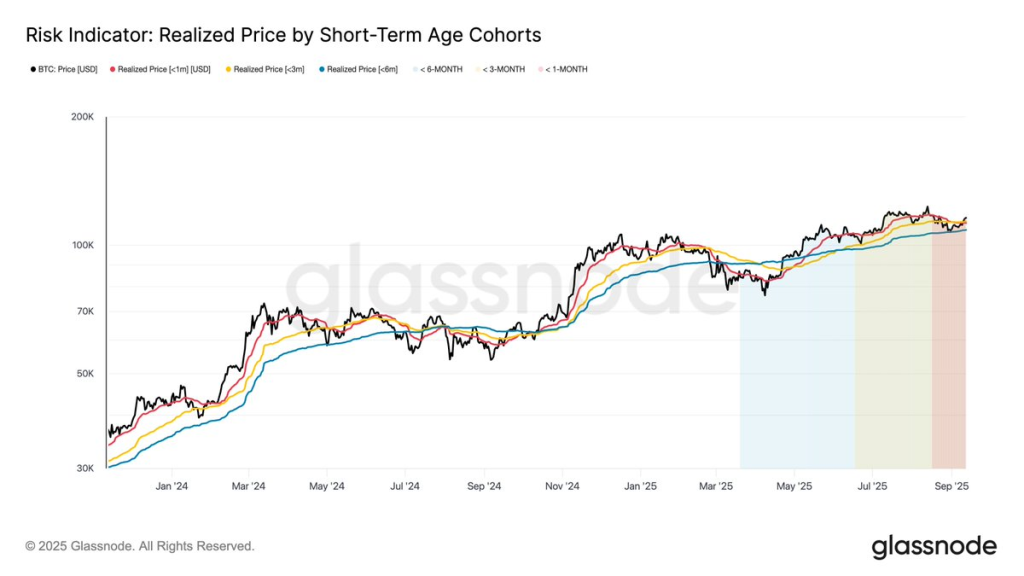

According to Glassnode, Bitcoin is respecting its short-term holder cost basis bands. Staying above the 1-month and 3-month realized price levels is seen as a sign of optimism heading into the Fed’s announcement.

Gold Price Today: Record Highs Before the Fed

Gold is also in focus as it trades just under $3,700 per ounce, holding firm near record highs. However, gold mining stocks dipped as investors booked profits ahead of the Fed decision.

Commenting on this divergence, economist Peter Schiff noted: “Gold remains strong even as miners take a breather. I expect buyers to come rushing back once the FOMC outcome is known.”

The connection between gold and Bitcoin lies in liquidity. A Fed rate cut not only strengthens gold as a hedge but also channels speculative flows into Bitcoin and other risk assets.

What Markets Expect from Powell’s Speech Today

Traders overwhelmingly expect a 25 basis point cut, with market odds above 90%. Such a move would keep the bullish structure intact for both crypto and gold. Still, analysts warn that front-running and leverage could spark short-term volatility.

Crypto strategist Biupa explained: “A 25 bps cut may continue the uptrend, but we could still see a pullback driven by profit-taking and liquidations, not by deteriorating fundamentals.”

For Bitcoin, the key level to watch is $117,900. A breakout could open the path toward new highs, while rejection might trigger a temporary dip toward the $113,300–$110,000 zone.

- Also Read :

- Top 5 Altcoins To Buy Before FOMC Meeting Today

- ,

FED Interest Rate Expectations

While unlikely, a 50 basis point cut could shock markets. In that case, Bitcoin might briefly spike to $120,000 as retail traders rush in before a possible “sell-the-news” reversal if recession fears take hold.

On the other hand, if the Fed were to skip a cut, analysts expect a sharp drop in both crypto and gold, followed by the potential for an emergency larger cut later, which could set the stage for a V-shaped recovery.

The setup closely mirrors September 2024, when the Fed cut rates and Bitcoin initially dipped before doubling to over $100,000 by year-end. With Powell set to speak, traders are bracing for volatility.

Whether it’s the expected 25 bps cut or a surprise move, the outcome of today’s FOMC meeting could set the tone for the next major trend in Bitcoin, gold, and the broader crypto market.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The FOMC announcement is scheduled for 2:00 PM Eastern Time (ET). This is followed by a press conference with Fed Chair Powell at 2:30 PM ET.

A 25 bps rate cut is expected to maintain Bitcoin’s bullish trend, though short-term volatility from profit-taking is likely. Key resistance is at $117,900 for a breakout.

Both act as liquidity-sensitive assets. Fed rate cuts weaken the dollar, boosting gold as a safe haven and Bitcoin as a speculative risk-on asset.

A surprise hold could trigger short-term drops in Bitcoin and gold, but may lead to larger emergency cuts later, potentially fueling a rapid V-shaped recovery.

While momentum is bullish, high leverage and “sell-the-news” risk mean cautious entry near support levels ($113,300–$110,000) may be prudent post-announcement.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.