Bitcoin dips 2% to $122K ahead of FOMC Minutes and Powell’s speech as traders brace for clues on Fed policy, inflation, and U.S. shutdown risks.

Analysts eye $120K support as key macro events loom; a dovish Fed could spark another Bitcoin rally, while hawkish signals may extend the pullback.

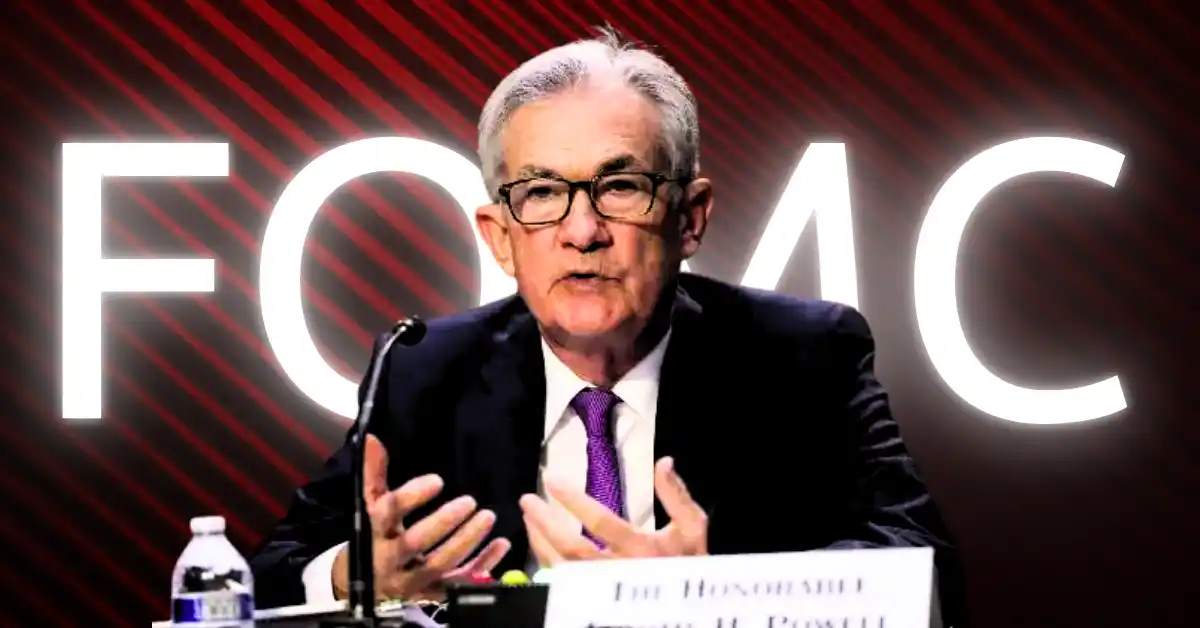

Bitcoin’s momentum cooled today as traders turned cautious ahead of key macroeconomic events, including the release of the FOMC Minutes and Fed Chair Jerome Powell’s upcoming speech.

The top cryptocurrency, which recently touched a fresh all-time high of $126,200, has slipped over 2% in the past 24 hours and is currently trading near $122,495. This pullback comes as investors digest a volatile mix of rising inflation, fears of a prolonged U.S. government shutdown, and uncertainty around future monetary policy direction.

The broader crypto market mirrored Bitcoin’s cautious tone, with major altcoins like Ethereum and Solana experiencing mild corrections. As risk sentiment wavers, the next major move in Bitcoin and the cryptocurrency market may hinge on whether the Federal Reserve adopts a dovish or hawkish stance this week.

FOMC Minutes and Jerome Powell Speech in Focus

The Federal Open Market Committee (FOMC) Minutes, due for release today, are expected to provide critical insight into the central bank’s thinking regarding future interest rate cuts.

Meanwhile, Fed Chair Jerome Powell is scheduled to speak on Thursday, addressing inflation trends, the cooling U.S. labor market, and the economic risks posed by Washington’s ongoing budget gridlock.

“Investors will be closely watching Powell’s remarks for any hints about the Fed’s policy trajectory,” said Michaël van de Poppe, a prominent crypto analyst. “A dovish tone could quickly reignite Bitcoin’s bullish momentum, while hawkish signals may extend the current pullback.”

Treasury yields have steadied near 4.13%, while the U.S. Dollar Index (DXY) has climbed toward 99, signaling renewed strength in the greenback. This shift has put pressure on Bitcoin, which historically performs better when the dollar weakens.

At the same time, gold and silver prices continue to rise as investors pivot to safe-haven assets, a move often referred to as the “debasement trade”, where money flows into alternatives like gold and Bitcoin to hedge against currency erosion.

Analysts Split on Bitcoin’s Next Move

Despite the recent price dip, sentiment among top crypto analysts remains largely optimistic. Michaël van de Poppe noted that profit-taking after a new all-time high is normal, calling the retracement a “healthy reset” and a potential dip-buying opportunity for Bitcoin investors.

CrediBULL Crypto also maintained that Bitcoin’s trend remains bullish, suggesting that the market may be entering a parabolic phase capable of triggering another major rally.

In contrast, analyst Ted Pillows cautioned,

“Failure to hold above the $120,000 support zone could push Bitcoin lower toward $117,000–$118,000 before any meaningful recovery.”

Bitcoin Awaits Macro Signals

As the Fed’s decisions loom, Bitcoin’s short-term direction rests squarely on macroeconomic signals. A dovish tone from the Fed could revive the rally, while a stronger dollar and hawkish policy hints may keep BTC in consolidation. Traders are now watching the $120K level closely, a make-or-break zone that could determine Bitcoin’s next major price move.

“With the FOMC Minutes and Powell speech on the horizon, Bitcoin investors should remain vigilant and monitor key support levels,” added van de Poppe. “This week could set the tone for Bitcoin’s trajectory in the final quarter of the year.”

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Bitcoin’s price is down due to trader caution ahead of key macroeconomic events, including the release of the FOMC Minutes and an upcoming speech from Fed Chair Jerome Powell.

The Federal Reserve’s interest rate policy influences Bitcoin’s price. A dovish stance (hinting at rate cuts) can boost Bitcoin, while a hawkish one (suggesting higher rates) often pressures its price.

Analysts remain largely bullish, viewing the current pullback as a healthy reset. However, a break below the $120,000 support could lead to a deeper correction toward $117,000.

Some analysts see the current dip as a potential buying opportunity, but caution is advised as the short-term direction depends heavily on the Federal Reserve’s upcoming policy signals.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.