The Federal Open Market Committee meeting is creating market uncertainty due to potential "wait-and-see" approach on interest rates.

The cryptocurrency market has experienced a significant 24-hour drop (3.1%), with Bitcoin and Ethereum seeing notable decreases.

US tariffs are a key factor causing economic uncertainty, potentially driving inflation and influencing the Fed's decisions.

The Federal Open Market Committee (FOMC) meeting is set for Tuesday and Wednesday, and investors are on edge. Markets are watching closely for any signals on interest rates, especially after Federal Reserve Chairman Jerome Powell hinted at a wait-and-see approach. The US economy is already facing uncertainty due to new policies, particularly aggressive tariffs, and the impact is starting to show.

Stocks are wobbling, investor sentiment is shaky, and the crypto market is feeling the heat. In just 24 hours, the global crypto market has dropped by 3.1 percent, with Bitcoin and Ethereum both sliding.

Are we headed for trouble? Let’s take a closer look at what’s happening.

Bitcoin and Ethereum Face Losses

Bitcoin recorded a sharp single-day drop of 2.09 percent yesterday, closing at $82,577. Over the past 24 hours, it has declined by another 1.9 percent. However, as of now, it is trading slightly higher at $82,888, up 0.37 percent from yesterday’s closing price.

Ethereum also saw a significant drop, falling from $1,935 to $1,886 yesterday, a decline of 2.52 percent. In the last 24 hours, it has lost another 2.4 percent, though it has slightly recovered to $1,888.

Analysts believe this drop in sentiment is largely driven by concerns over economic policies and regulations.

Will the Fed Keep Interest Rates Steady?

As the FOMC meeting begins, most experts predict that the Fed will not make any changes to interest rates. Currently, the federal funds rate remains between 4.25 percent and 4.5 percent, with no immediate adjustments expected.

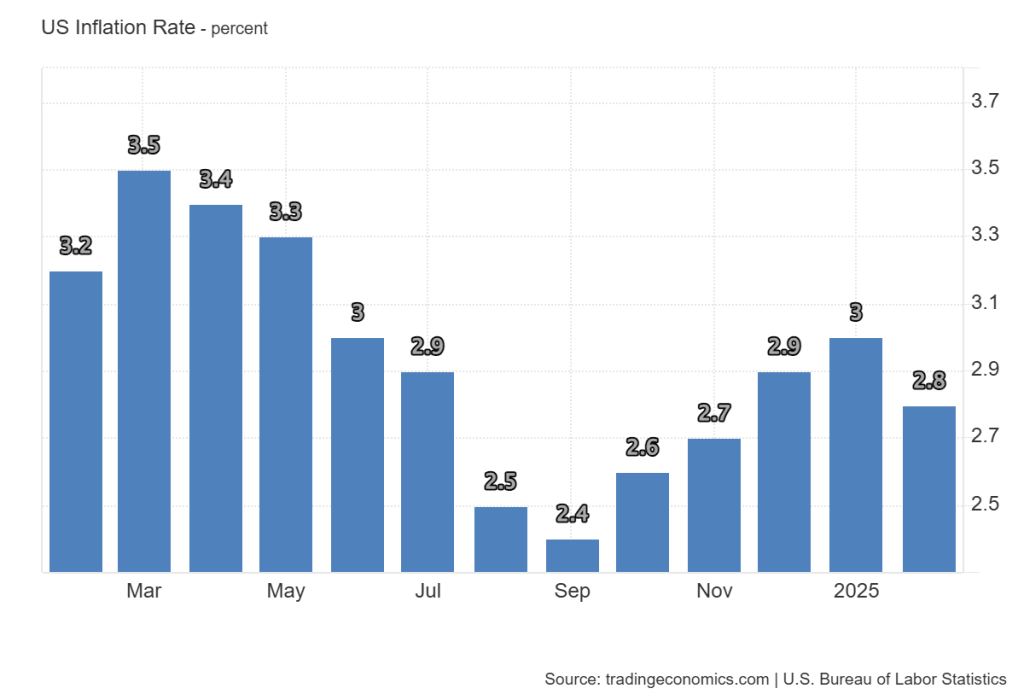

At the same time, inflation in the US has been gradually decreasing. In February, it dropped from 3 percent to 2.8 percent, and forecasts suggest it could fall further to 2.5 percent in March.

Trump’s Tariff Policy Creates More Uncertainty

President Donald Trump

Many believe the Fed will avoid making any major decisions on interest rates until the economic impact of these trade policies becomes clearer. However, some experts warn that tariffs could drive inflation higher, which could complicate the Fed’s future approach.

US Markets Show Signs of Weakness

Stock markets have also been affected by the uncertainty. Futures tied to the Dow Jones, S&P 500, and Nasdaq Composite have all declined, reflecting cautious investor sentiment.

The cryptocurrency market has followed suit, with nearly all top-ten digital assets experiencing losses over the last 24 hours:

- Bitcoin is down 1.9 percent

- Ethereum has dropped 2.4 percent

- XRP has fallen 1.9 percent

- Solana has declined 4.6 percent

- Cardano is down 3 percent

Despite $253 million in crypto futures liquidations over the past day, leverage remains high, suggesting that traders are still taking risks. Funding rates have stabilized at neutral levels, indicating mixed sentiment in the market.

For now, crypto traders are looking for a clear signal to determine the market’s next move. A shift in Fed policy or a major institutional investment could provide that catalyst. Until then, volatility is likely to continue.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.