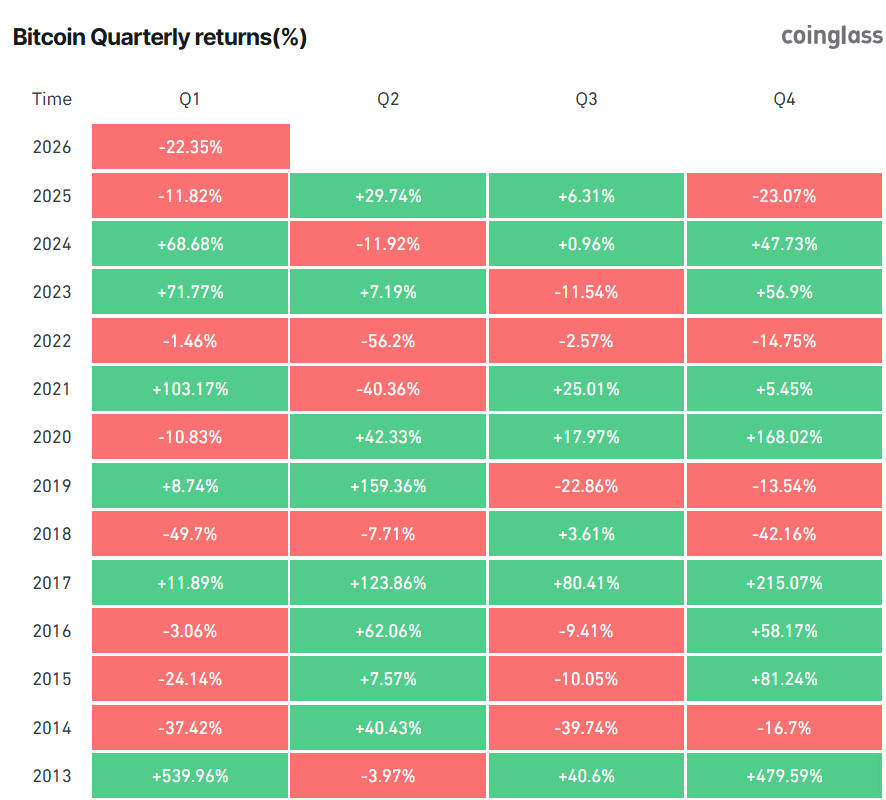

Bitcoin price recorded worst Q1 performance in eight years, dropping over 22% recently.

Institutional demand remains strong as BlackRock Bitcoin ETF holds over $52 billion currently.

Bitcoin halving cycle and key support levels suggest potential recovery and future bullish momentum.

Bitcoin price today has recorded its worst quarter (Q1) performance in 8 years, falling more than 22% from its 2026 high of $97,689 to around $68,000.

However, the sharp decline mirrors the historical data, which suggests the current Bitcoin price correction may be part of a market reset rather than the start of a new Bitcoin bear market.

Bitcoin Price Shows Red Q1 Is Not Unusual

According to data highlighted by crypto analyst That Martini Guy, current Bitcoin value has closed the Q1 in negative territory seven times over the past 13 years. Meanwhile, this pattern shows that weak Q1 performance is not uncommon in the Bitcoin market cycle.

Looking at the coinglass data, the most severe Q1 decline occurred in 2018, when Bitcoin value dropped nearly 50%. Despite the heavy losses, Bitcoin later entered one of its strongest recovery phases.

A similar trend was seen in 2020, when Bitcoin value fell sharply during the COVID-19 market crash before starting a major bull run that pushed prices to new all-time highs in 2021, when price of bitcoin hit $69000.

Meanwhile, these historical patterns suggest that the current Bitcoin price drop may be part of a normal cycle, especially following a strong rally that previously pushed Bitcoin toward record levels.

Institutional Demand and Bitcoin Halving Cycle Remain Strong

Despite the recent Bitcoin price decline, the core factors supporting Bitcoin’s long-term growth remain unchanged. Institutional demand for Bitcoin has continues to expand through Bitcoin ETFs. Meanwhile, Blackrock Bitcoin ETF onle hold 761,665.6 worth around $52.5 billion.

Additionally, the Bitcoin halving cycle remains intact. Earlier Coinpedia news reported that after the April 2024 halving, Bitcoin entered a strong 18-month rally.

Based on past cycles, the next major bull run could begin in early to mid-2026.

Whale Moves Bitcoin to Exchanges

Recent data from CryptoQuant shows rising whale activity on Binance. The Whale Inflow Ratio increased from 0.40 to 0.62 between February 2 and 15, which means large holders moved more Bitcoin onto the exchange.

One major holder, known as the “Hyperunit whale,” reportedly transferred nearly 10,000 BTC to Binance.

Overall, Bitcoin exchange reserves have been falling and now sit around 2.74 million BTC.

When large amounts of Bitcoin move to exchanges, it can signal possible selling, especially during uncertain market conditions.

Bitcoin Price Reset, Not Collapse?

Market analysts Martini Guy, also note that Bitcoin is currently approaching key support levels between $64,000 and $65,000. These levels could act as a foundation for future price recovery if buying demand strengthens.

While short-term volatility has shaken investor confidence, the broader Bitcoin market structure remains stable.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Bitcoin could enter a new bull run mid-2026, potentially testing $80K–$90K if support holds and demand rises.

Based on past cycles, Bitcoin could surpass $97K after stabilizing, following historical post-correction rallies.

Past patterns indicate early to mid-2026 as a likely start for the next significant upward trend.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.