Consider this!

You walk into a coffee shop in 2030. You tap your phone, and just like that, you’ve paid for your cappuccino. But wait, you didn’t use your credit card or cash. You paid with Bitcoin.

We know that it sounds a lot like a scifi movie.

Butl, the future might be closer than you think. Let’s talk about Bitcoin– what it is, how it works, and why everyone’s talking about it.

What Is Bitcoin?

We will start simple. Bitcoin is digital money.

So, unlike the cash in your wallet, you can’t touch or see it. But it works just like regular money. You can buy things, pay for services, or even send it to someone halfway across the world.

The difference?

Bitcoin is decentralized. No government or bank controls it.

Now, that’s a big deal. Why?

Because most of the money we use today is controlled by banks and governments. They decide how much money to print, set interest rates, and manage transactions. Bitcoin flips this system. It’s run by people like you and me through a technology called blockchain.

Now, what is blockchain? We’ll get to it.

How Did Bitcoin Start?

Bitcoin was created in 2009 by a person (or group) named Satoshi Nakamoto. Till today, no one knows who they really are. Satoshi wanted to create a system where people could transfer money directly without needing a middleman like a bank.

Why was this needed?

Well, think about the 2008 financial crisis. Banks failed, people lost savings, and trust in the financial system took a big hit. Bitcoin was designed to solve this problem. It’s a system where trust isn’t placed in a person or an institution. Instead, it’s placed in technology.

How Does Bitcoin Work?

Here’s where things get interesting.

Bitcoin uses blockchain technology.

Blockchain is like a digital ledger. Every Bitcoin transaction is recorded on this ledger. But instead of one person controlling it, everyone who uses Bitcoin has a copy of it.

Now, let’s say you send Bitcoin to your friend.

That transaction gets added to the blockchain.

Before it’s added, though, it needs to be verified.

This is done by computers called miners. They solve complex puzzles to confirm the transaction.

Once verified, the transaction is locked in the blockchain forever.

No one can change or delete it. This makes Bitcoin super secure.

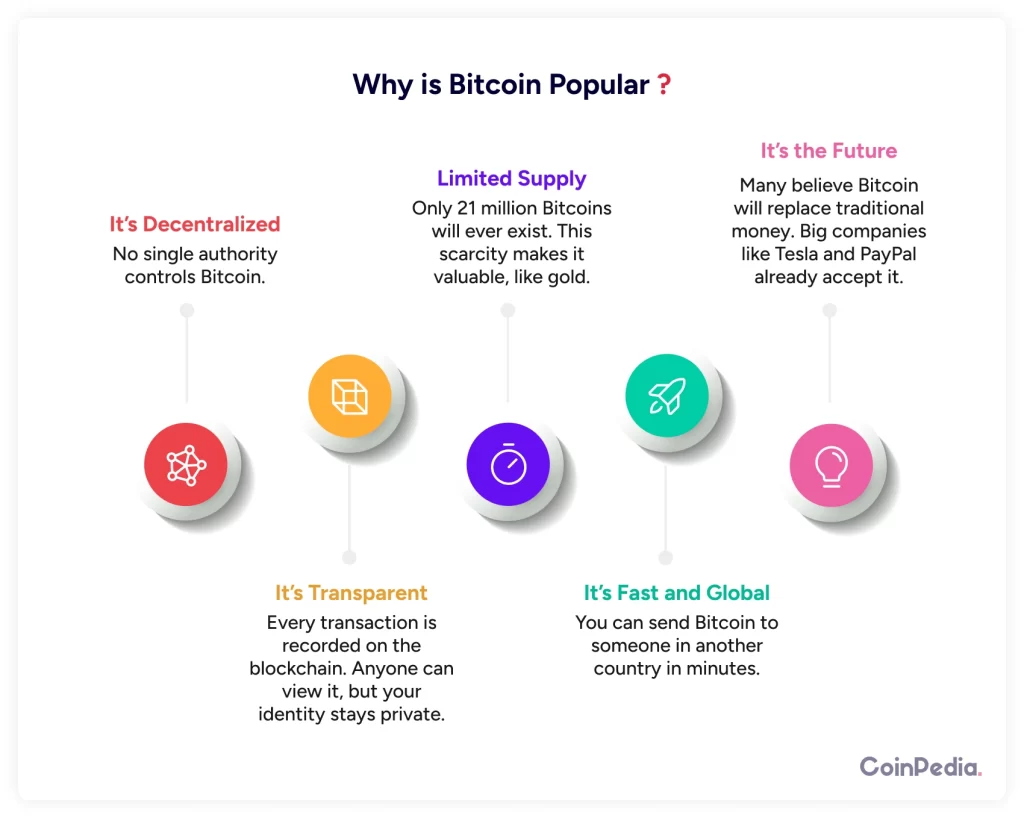

Why Is Bitcoin So Popular?

There are a few reasons people love Bitcoin:

- It’s Decentralized: No single authority controls Bitcoin. This makes it immune to government interference or manipulation.

- It’s Transparent: Every transaction is recorded on the blockchain. Anyone can view it, but your identity stays private.

- Limited Supply: Only 21 million Bitcoins will ever exist. This scarcity makes it valuable, like gold.

- It’s Fast and Global: You can send Bitcoin to someone in another country in minutes. No banks, no delays.

- It’s the Future: Many believe Bitcoin will replace traditional money. Big companies like Tesla and PayPal already accept it.

And, Is Bitcoin Safe?

Now, I know what you’re thinking. If Bitcoin is digital, can’t it be hacked? The answer is both yes and no.

Bitcoin itself is very secure. The blockchain technology behind it is nearly impossible to hack. But, how you store your Bitcoin matters. If you keep it in an online wallet and someone gets your password, they can steal your coins. That’s why many people use hardware wallets – physical devices that store your Bitcoin offline.

Step-by-Step Process on How to Invest in Bitcoin

So, you want to invest in Bitcoin but don’t know where to start? Let’s go through it step by step.

1. Understand What Bitcoin Is

Before you jump in, it’s important to know what you’re investing in. Bitcoin is a digital currency that operates on a technology called blockchain. We all know now that blockchain is like a public ledger that records every transaction, without help from banks or middlemen.

Example: Imagine you’re sending money to a friend, but instead of using a bank, your transaction gets recorded on a giant digital notebook visible to everyone.

2. Choose a Reliable Crypto Exchange

You’ll need a platform to buy Bitcoin. Popular options include Coinbase, Binance, and Kraken. When choosing, look for:

Security: Does it have two-factor authentication (2FA)?

Fees: Are the transaction fees reasonable?

Ease of use: Is the app simple to navigate?

Tip: If you’re a beginner, Coinbase is beginner-friendly but may have slightly higher fees.

3. Set Up Your Account

Create an account on your chosen exchange. This usually involves:

Providing your email and creating a strong password.

Verifying your identity (uploading ID documents) — a process called KYC (Know Your Customer).

Pro Tip: Use a unique password and enable 2FA for extra security.

4. Deposit Funds

To buy Bitcoin, you need money in your account. Most exchanges let you deposit using:

Bank Transfer: Usually lower fees but slower.

Credit/Debit Card: Instant but higher fees.

Example: Let’s say you deposit $100. You can use this to buy Bitcoin at the current market price.

5. Buy Your First Bitcoin

Now comes the fun part! On the exchange, you’ll see an option to buy Bitcoin. You can choose:

Market Order: Buy instantly at the current price.

Limit Order: Set a price you’re willing to pay and buy only when the price hits that level.

Example: You place a market order for $50 worth of Bitcoin. The exchange instantly gives you Bitcoin at the current rate.

6. Store Your Bitcoin Safely

After buying, store your Bitcoin securely. You have two main options:

Exchange Wallet: Convenient but less secure.

Personal Wallet: Safer, with full control of your funds.

Wallet types include:

Hot Wallets: Online wallets (e.g., Trust Wallet) — easy to use but vulnerable to hacking.

Cold Wallets: Offline wallets (e.g., Ledger, Trezor) — safer but less convenient.

Tip: For long-term holding, use a cold wallet.

7. Monitor Your Investment

Track how your Bitcoin performs using apps like CoinMarketCap or Blockfolio. But remember, Bitcoin prices can be volatile.

Example: You bought Bitcoin at $30,000. A week later, it’s $32,000 — that’s a 6.7% gain!

8. Have a Strategy

Decide on your investment plan. Common strategies include:

HODLing: Buying and holding long-term.

Dollar-Cost Averaging (DCA): Investing a fixed amount regularly (e.g., $50 every month).

Example: With DCA, if Bitcoin’s price is high this month and low next month, you still invest the same amount. Over time, your average buying price smooths out.

9. Stay Informed and Be Patient

The crypto market moves fast. Follow news from reliable sources like CoinDesk and stay updated. But don’t panic if prices drop; Bitcoin has a history of bouncing back.

What Can You Do With Bitcoin?

When Bitcoin first started, you couldn’t do much with it. But today, the list of uses is growing:

- Shopping: Companies like Microsoft, Overstock, and AT&T accept Bitcoin.

- Investing: Many people buy Bitcoin as an investment, hoping its value will grow.

- Sending Money: It’s great for sending money to friends or family overseas. No need to pay high fees to banks or services like Western Union.

- Charity: Some organizations accept Bitcoin donations.

- Travel: Websites like Expedia let you book flights and hotels with Bitcoin.

Why Do Bitcoin Prices Go Up and Down?

If you’ve heard about Bitcoin, you’ve probably also heard about its crazy price swings. One day it’s worth $20,000; the next, it drops to $15,000. Why does this happen?

Bitcoin’s price is driven by supply and demand. When more people want to buy Bitcoin, the price goes up. When they sell, it goes down. News also plays a big role. If a country bans Bitcoin, the price usually drops. If a big company starts accepting it, the price often rises.

Should You Invest in Bitcoin?

Great question. Bitcoin has made many people rich. But it’s also very risky. Its price can go up or down a lot in a short time. Before investing, ask yourself:

- Can I handle losing the money I invest?

- Do I understand how Bitcoin works?

- Am I okay with long-term risks?

If you’re new to investing, start small. Learn about Bitcoin first. And never invest more than you can afford to lose.

Bitcoin vs. Other Cryptocurrencies

Bitcoin was the first cryptocurrency, but it’s not the only one. Today, there are thousands of cryptocurrencies, like Ethereum, Ripple, and Litecoin. Each has its own purpose.

For example, Ethereum is great for building apps, while Ripple is designed for fast bank transfers.

But Bitcoin is still the king. It’s the most popular and valuable cryptocurrency. Most people see it as digital gold.

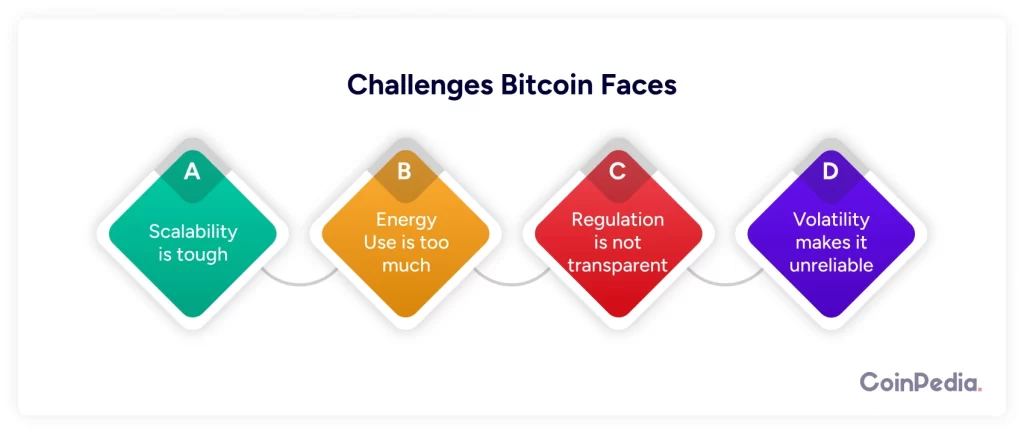

The Challenges Bitcoin Faces

While Bitcoin has a lot of potential, it’s not perfect. Here are some challenges:

- Scalability: Bitcoin’s network can handle only a limited number of transactions at a time. This leads to delays and high fees when the network is busy.

- Energy Use: Mining Bitcoin uses a lot of electricity. Critics say it’s bad for the environment.

- Regulation: Some governments don’t like Bitcoin. They’ve banned or heavily regulated it.

- Volatility: Its price swings make it unreliable for everyday use.

The Future of Bitcoin

So, what does the future hold? No one knows for sure, but here are some possibilities:

- Wider Adoption: More companies and people might start using Bitcoin.

- Better Technology: Upgrades could make Bitcoin faster and more efficient.

- Government-Backed Cryptos: Some countries are creating their own digital currencies. This could compete with Bitcoin.

- Higher Prices: Some experts believe Bitcoin’s price will keep rising as its supply becomes scarcer.

Bitcoin isn’t just money. It’s more like a revolution. It challenges the way we think about finance, trust, and value. Whether you decide to use it, invest in it, or just learn about it, one thing is clear –

Bitcoin is here to stay.

So, the next time you hear someone talking about Bitcoin, you won’t feel left out. In fact, you might even have a few things to share. And who knows? Maybe one day, you’ll be buying your coffee with Bitcoin too.

FAQs

Bitcoin is digital money powered by blockchain technology, allowing peer-to-peer transactions without government or bank control.

Bitcoin is decentralized, transparent, scarce, fast, and global, making it a revolutionary digital currency that many believe will replace traditional money.

Bitcoin’s blockchain is secure, but how you store it matters. Use offline hardware wallets for extra security against hacks.

Bitcoin’s price is driven by supply and demand, news, and market sentiment, causing frequent price swings.

Bitcoin can be risky due to its price volatility. Start small, do your research, and only invest what you can afford to lose.

We'd Love to Hear Your Thoughts on This Article!

Was this writing helpful?

Yes

Yes  No

No

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.