Bitcoin has surged recently, fueled by post-election optimism and broader market trends.

The potential for a CME gap fill and upcoming CPI data could introduce short-term volatility.

While long-term bullish sentiment prevails, analysts advise caution for short-term traders due to potential price corrections.

Lately, Bitcoin has shown explosive growth, surging 9.5% in just the last 24 hours. Many analysts are predicting that this momentum could push the cryptocurrency to break the coveted $100K barrier. In a recent post on X, cryptocurrency analyst Michael van de Poppe highlighted key indicators that short-term Bitcoin traders should monitor closely.

Let’s dive into these factors and what they mean for Bitcoin.

Post-Election Boost: Bitcoin Rockets 30% in Days

Following the U.S. presidential election, the Bitcoin market experienced a remarkable 30.14% surge. Over the past week alone, it has climbed by 29.8%, pushing the current Bitcoin price to $88,244.01. This impressive rally has uplifted the entire cryptocurrency market, which has recorded a 5.5% rise in the last 24 hours.

CME Futures Gap: A Key Level to Watch

On the CME Futures chart, there’s a significant gap around the $77,000 level—a level that often attracts attention from market watchers. Historically, such gaps can trigger retracements as markets tend to fill these levels over time. For instance, on November 8, the Bitcoin CME Futures market closed at $77,305 and opened the following session at $81,205.

With Bitcoin currently around $89,200, this gap remains unfilled and could influence future price movements.

CPI Data Incoming: Will Inflation Numbers Rattle the Market?

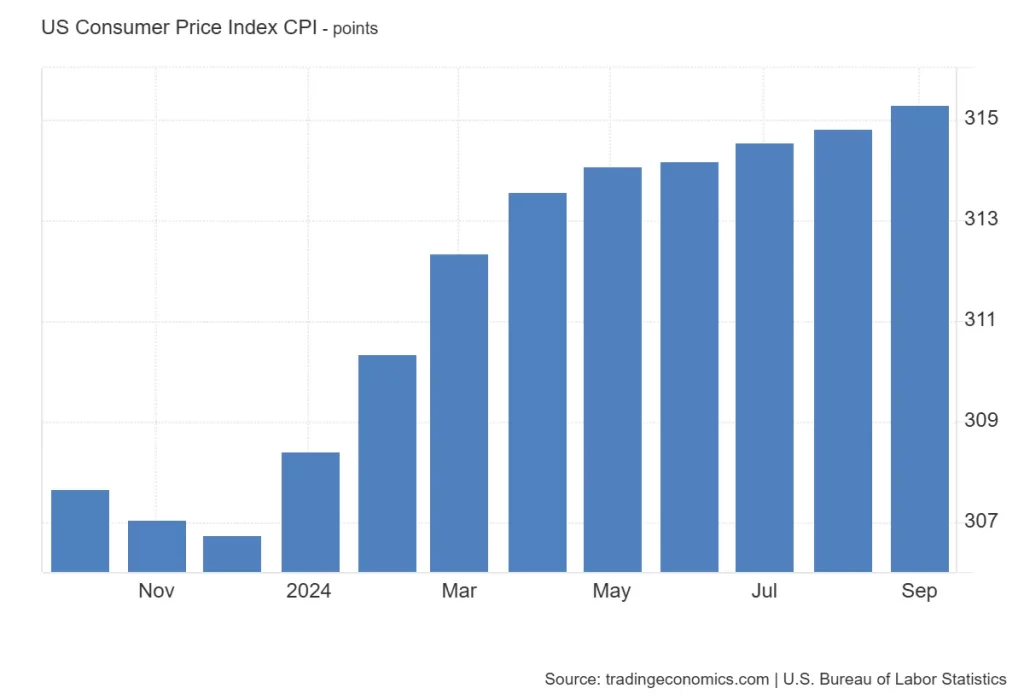

The US CPI report is set to be released on November 13. Last month, the index was at $315.3 Points – slightly higher than the August range of 314.8 Points. At the beginning of this year, the index was at 308.417 Points. Since then, it has grown consistently. Though during the first three months, the growth was sharp, later it has been comparatively moderate. The Trading Economics forecast says that this time the index will climb slightly to 315.7 Points.

CPI data often influences market sentiment, especially if inflation numbers are surprising.

FOMO Drives Bitcoin Market Sentiment

According to Poppe, the recent spike in Bitcoin’s value has triggered a wave of FOMO among traders, fueling higher trading activity as investors rush to enter the market.

He advises day traders to hold off for a potential price dip, suggesting a better entry point may be on the horizon. Some analysts predict that Bitcoin’s price may undergo a correction before rallying further, as volatility appears set to continue in the short term.

- Also Read :

- Why Is Crypto Going Up Today?

- ,

Will Bitcoin Reach $100K?

With Bitcoin currently around the $88,000 mark, the path to $100K may come with twists and turns. Traders are keeping a close watch on the CME gap and the upcoming CPI report, as both could play influential roles in shaping Bitcoin’s next moves.

While significant growth is anticipated, caution is advised due to potential short-term fluctuations.

Bitcoin could reach $100K soon, but short-term volatility and corrections may occur before it continues its upward trend. The CME gap and the upcoming CPI report will play a role in market movements.

Will this bull run make history? Only time will tell!