BTC price outflows from Kraken signal accumulation rather than distribution.

Institutions and public companies are steadily increasing Bitcoin holdings.

Liquidation levels suggest both short-term volatility and a possible $130K upside target.

Today, the BTC price remains under the spotlight, hinting at more room for growth due to elevated exchange outflows and institutional demand. Recent data points toward a continued accumulation trend that could uplift BTC price in the near term, and the liquidation levels are tightening, placing September as a pivotal month for the Bitcoin USD’s next big move.

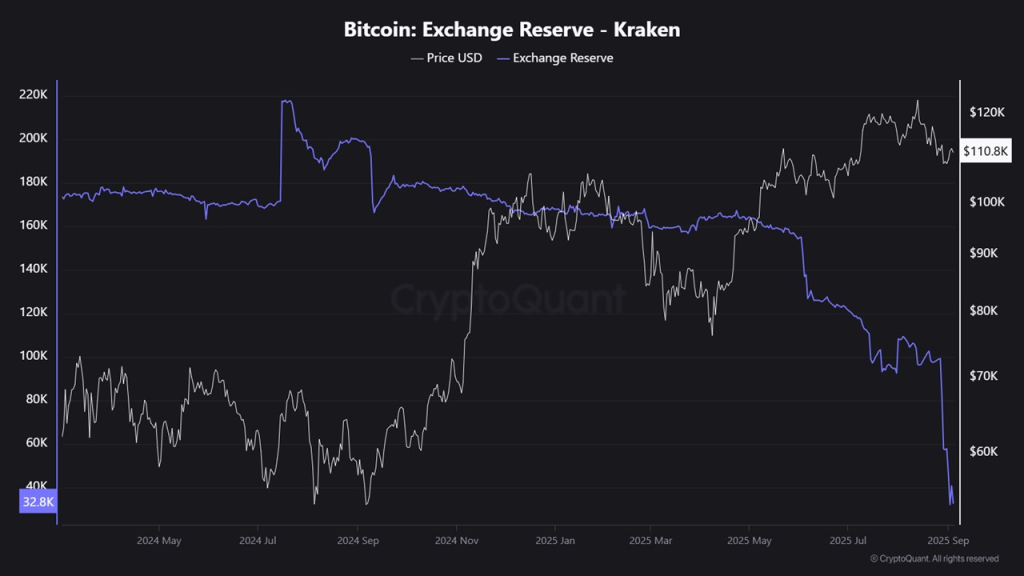

Bitcoin Exchange Outflows Show Accumulation Trend

According to recent CryptoQuant insights, the Kraken exchange has most recently witnessed the withdrawal of nearly 65,000 BTC over the past two days.

This is a major stash that came out of exchange, and this move stands in sharp contrast to typical market-top behavior, where inflows to exchanges dominate as investors prepare to distribute holdings.

Instead, the current Bitcoin price chart reflects a climate of quiet but determined accumulation.

This divergence suggests that while retail demand remains muted, large players are stepping in to scoop up supply. Historically, it has been observed that the retail demand only surges near the very peak of bull markets.

With conditions showing otherwise, it is possible that the BTC price forecast narrative still firm and has at least one major bullish leg ahead.

Institutions Boost Confidence in BTC Crypto

Adding to this sentiment, while retail demand might be weak but institutional demand continues to grow. Recently, Bitcoin treasuries data now confirm that publicly traded companies now collectively hold over one billion BTC crypto for the first time in history.

Such aggressive accumulation on every dip from deep-pocketed investors aligns with a broader bullish BTC price prediction narrative, suggesting that downside moves may be limited in scope and duration. While the long-term appeal of the Bitcoin price USD remains intact, fueled by both scarcity and increasing mainstream adoption.

Liquidation Levels Signal Potential Volatility Ahead in BTC price

While the long-term picture is constructive, but short-term price action hints that it could remain volatile. This outlook is due to CoinGlass liquidation data, which highlights that a cluster of liquidations on the upside between $112,600 $114,000 is present.

At the same time, local downside liquidations are set near $109,500, with deeper sweeps potentially extending to $107,000.

These levels imply that before a breakout for the upside, Bitcoin USD could see sharp wick-driven moves, often forming a hammer candle that shakes out leveraged positions.

If this scenario plays out, it could build the strength required to flip the all-time high of $124,000. Similarly, now the analysts see $130,000 as a realistic round-number target for September once this resistance breaks.

At present, BTC price today is exchanging hands at $110,890, down 0.75% intraday, and hovers near a critical zone, with both institutional support and exchange data reinforcing the outlook.

With supply leaving exchanges and companies holding record levels of BTC, the broader BTC crypto market narrative remains one of long-term strength.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

As per Coinpedia’s BTC price prediction, the Bitcoin price could peak at $168k this year if the bullish sentiment sustains.

With increased adoption, the price of Bitcoin could reach a height of $901,383.47 in 2030.

As per our latest BTC price analysis, Bitcoin could reach a maximum price of $13,532,059.98

By 2050, a single BTC price could go as high as $377,949,106.84

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.