Bitcoin (BTC) has formed a bearish rising wedge pattern and is on the verge of breaking down.

Bitcoin could drop to the $78,700 level if it fails to hold itself above the $86,200 level.

It seems like Bitcoin (BTC) is preparing for a major price decline. On March 26, 2025, the overall crypto market has experienced significant volatility, leading to major price swings from gains to losses.

Bitcoin (BTC) Price Action and Technical Analysis

The overall cryptocurrency market has been experiencing significant price fluctuations over the past few days. In late February and early March 2025, the market was quite favorable. During this period, the crypto market saw impressive upside momentum while forming a bearish price action pattern.

Bitcoin Price Prediction

Bitcoin (BTC) has formed the same pattern on the four-hour timeframe. According to expert technical analysis, BTC has developed a bearish rising wedge pattern and is on the verge of breaking down.

Based on recent price action and historical patterns, if BTC breaks down from the pattern and closes a four-hour candle below the $86,200 level, there is a strong possibility it could drop by 8.5%, bringing the price down to $78,700.

As of now, BTC is trading below the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating a downtrend.

$232 Million Worth of BTC Outflow

Despite market uncertainty and bearish price action, whales and long-term holders have been accumulating BTC, according to on-chain analytics firm Coinglass.

Data from spot inflow and outflow reveals that exchanges have witnessed a significant outflow of $233 million worth of BTC in the past 24 hours, indicating potential accumulation that could create buying pressure and drive further upside momentum.

This marks the fourth consecutive day of continuous BTC outflows from exchanges.

Traders’ Bearish Outlook

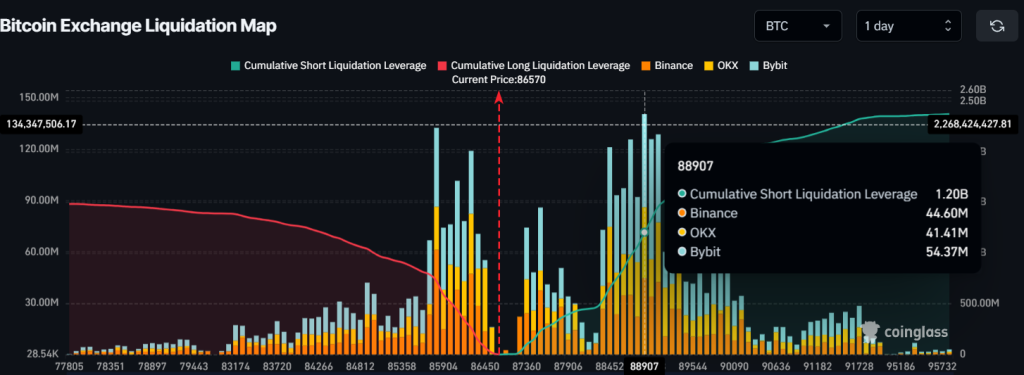

However, traders appear to be supporting the current market sentiment as they are heavily betting on the short side. Data from Coinglass reveals that traders are over-leveraged at $88,907 on the upper side and $85,813 on the lower side, with $1.20 billion worth of short positions and $722 million in combined short and long positions.

This clearly highlights that bears are currently dominating the asset, and the price won’t rise above the $88,907 level.

Current Price Momentum

At press time, BTC is trading near $86,690, having dropped 1.50% in the past 24 hours. During the same period, its trading volume declined by 10%, indicating lower participation from traders and investors compared to the previous day.