Bitcoin price drops to $114K after Fed’s 25 bps rate cut, failing to spark a rally.

Ethereum accumulation stalls as institutions/whales pull out of staking and move ETH to exchanges.

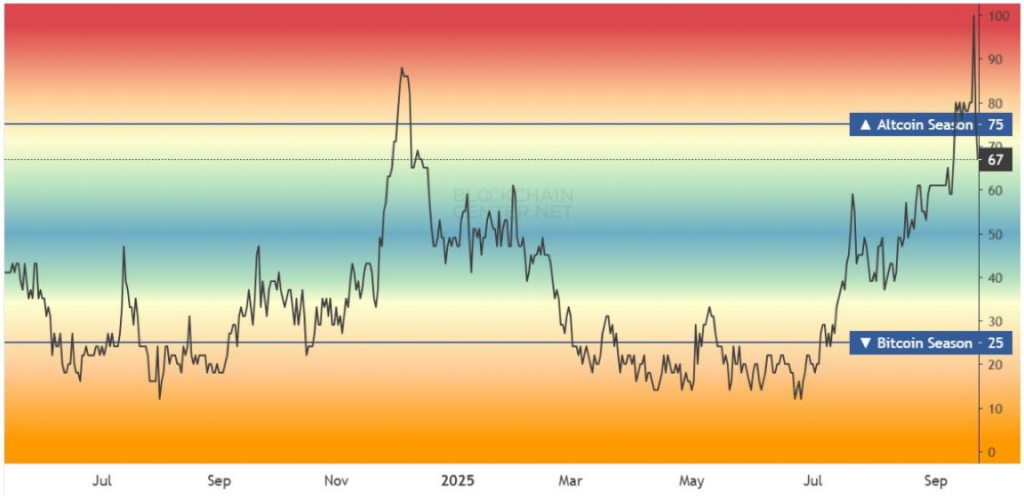

Altseason Index crashes from 100 → 67, showing fading altcoin momentum.

Crypto markets are starting the week on a bearish note, with Bitcoin, Ethereum, and major altcoins under pressure despite the U.S. Federal Reserve’s 25 basis-point rate cut.

Bitcoin Price Today Falls to $114K Despite Fed’s Move

Bitcoin price today dropped sharply to $114,000 after the Fed announced a quarter-point rate cut. While traders initially expected lower interest rates to fuel a rally, volatility has remained contained, and capital flows into Bitcoin ETFs are slowing.

Market data shows that weekly Bitcoin trading volume fell to $43.7 billion, nearly 23% lower than average, signaling weaker conviction among both retail and institutional buyers.

Ethereum Price Today Struggles as Institutions Exit Staking

Ethereum price is also under pressure, with accumulation stalling as institutions and whales withdraw from staking. Instead, ETH is moving onto centralized exchanges, increasing supply and adding to selling pressure. Ethereum network fees remain extremely low just 0.17 Gwei, in the 6th percentile range pointing to weak on-chain activity and subdued demand.

Crypto ETF Inflows Wane, Weakening Institutional Adoption

One of the biggest drivers of crypto prices in 2024 and early 2025 has been ETF inflows. However, the latest data indicate that Bitcoin ETF inflows are waning, with traditional investors reducing their exposure. This could threaten crypto’s deeper integration with Wall Street if the slowdown persists.

Stablecoin issuance and derivatives positioning also show a cautious stance, suggesting investors are preparing for turbulence ahead rather than piling in.

Altcoins Under Pressure as Bitcoin Dominance Rises

While Bitcoin struggles, altcoins like Ethereum (ETH) and Ripple (XRP) are facing even steeper declines, with capital rotating back into Bitcoin dominance. The Altseason Index crashed from 100 to just 67, highlighting weakening momentum for smaller-cap tokens.

Why is the Crypto Market Crashing Today?

The macro backdrop is amplifying the selloff:

- Federal Reserve policy: The 25 bps cut has sparked debate on whether more cuts will follow this year. If inflation remains sticky, the Fed could slow easing — a bearish outcome for risk assets.

- Inflation data: Uneven U.S. inflation reports are raising fears of “higher for longer” rates, dampening speculative appetite.

- Profit-taking: After a strong rally earlier this year, many investors are locking in gains, leading to selling pressure.

- Weak global sentiment: Equities, bonds, and global assets remain shaky, feeding into crypto’s downturn.

- Whale activity: Large players reducing exposure have accelerated the selloff across exchanges.

Crypto Market Outlook: Calm Before the Storm?

Despite the bearish tone, some analysts see this as a calm before a decisive move. Bitcoin’s volatility structure shows short-term calm but steepening longer maturities a sign traders expect turbulence ahead.

Interestingly, Ethereum’s options market suggests downside hedging demand has collapsed and call options are regaining premiums, which could indicate traders are positioning for a rebound if macro conditions stabilize.

Binance founder Changpeng Zhao (CZ) added fuel to speculation, saying “maybe we haven’t hit the real bull market yet.”

His comments come as many traders question whether Bitcoin’s explosive 2025 rally is losing steam.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The market is down due to profit-taking after a strong rally, fears of persistent inflation limiting future Fed rate cuts, and a significant slowdown in institutional investments into Bitcoin ETFs.

Yes, despite a 25 basis-point cut, Bitcoin’s price fell as the move was already expected. The focus has shifted to future Fed policy and concerns that fewer cuts may come, which dampens risk-asset appetite.

Some analysts see this as a consolidation before a bigger move. While short-term sentiment is bearish, options markets suggest some traders are positioning for a potential rebound if macroeconomic conditions stabilize.

While most majors are down, Ethereum’s options market shows a shift. Demand for downside protection has collapsed while call options are gaining value, suggesting some traders are positioning for a potential rebound.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.