Whale Loads Up on $612M in BTC, ETH & SOL Longs—Is a Broader Crypto Market Rally Coming?

A major whale has accumulated massive long positions across ETH, BTC, and SOL, signaling high-conviction bullish sentiment despite muted market volatility.

The size and distribution of the positions suggest expectations of a broad market continuation rally, led by Ethereum strength.

Crypto markets continue to trade in a cautious but steady range, with Bitcoin price holding between $91,500 and $93,800, while bulls attempt to regain control. Ethereum price has pushed back toward the $3,250 zone, and Solana price remains firm above $135, hinting at underlying buyer interest even as volatility remains compressed across major assets.

Against this backdrop, one wallet has been aggressively increasing exposure—and the scale of these positions is now drawing the market’s attention.

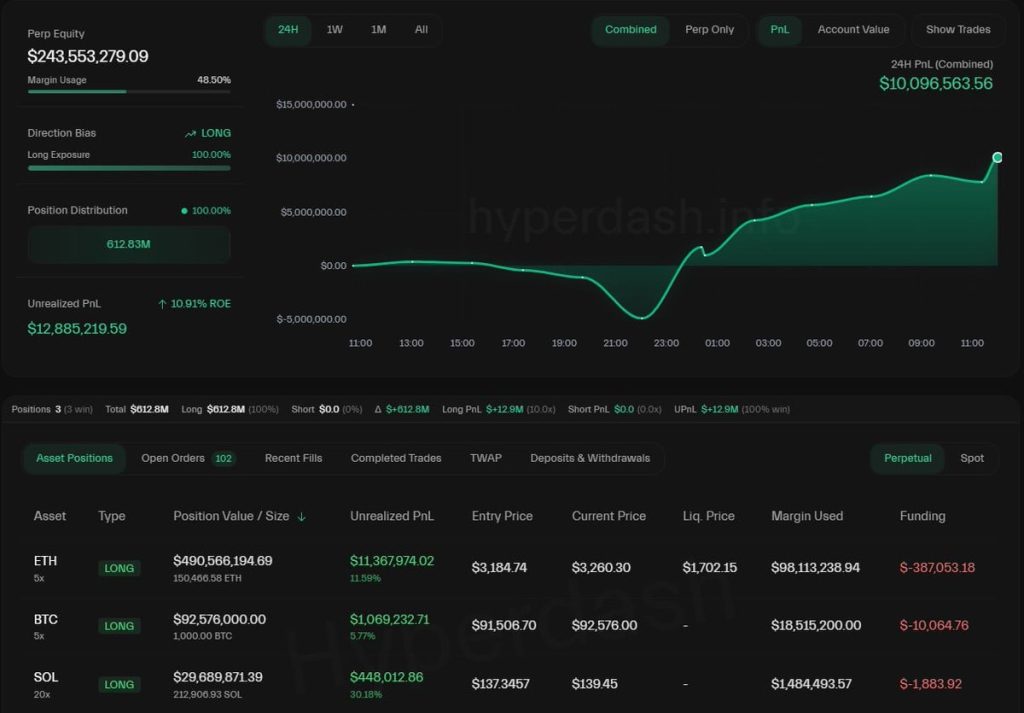

Whale Adds Over $612 Million in Long Exposure

A closely watched crypto whale has ramped up long exposure to more than $612 million, adding heavily to ETH, BTC and SOL positions. The move comes as market volatility tightens, suggesting large players may be positioning early for a potential shift in momentum.

The long positions are distributed across three top assets, Ethereum, Bitcoin and Solana, with $490.5M, $92.5M and $29.8M in long positions, respectively. The account currently shows an unrealised profit of $12.8M, yet instead of scaling out, the whale has continued adding size—a behaviour that typically signals confidence, not hesitation. With 100% long exposure and moderate 5x leverage, the structure of the portfolio reflects a clear directional view: the next meaningful move will be higher.

Does This Accumulation Hint Towards a Major Bullish Move?

This isn’t a random accumulation. The distribution across ETH, BTC, and SOL shows a deliberate, structured strategy. ETH is the highest-conviction play, with nearly half a billion in exposure; BTC acts as the market anchor, offering stability and directional correlation; and SOL provides high-beta upside, capturing momentum during strong alt-led rallies.

Whales don’t add to weakness unless they believe the downside risk has faded. Besides, wave structures across these cryptos are coiling, which aligns with volatility expansion setups. The positioning suggests the markets are preparing for an upside breakout, but not a breakdown.

Here’s What May Come Next!

As the whale’s long exposure grows, market structure is tightening around key levels, and liquidity is clustering on both sides of the price. This setup now points to two potential scenarios depending on how momentum develops in the coming sessions. If the momentum expands from the current levels, the Ethereum price could retest the $3,300 to $3,500 range, the Bitcoin price may challenge $95,000, and the Solana price may revisit the $142 to $145 range.

This isn’t just one trader taking oversized risks—it’s a signal of where conviction capital believes the market is heading. With over $612 million deployed on the long side, smart money is clearly preparing for a broader crypto rally. Therefore, it would be interesting to know how the upcoming trade dynamics unfold.

The whale holds $490.5M in ETH, $92.5M in BTC, and $29.8M in SOL, with 100% long exposure using moderate leverage.

Large-scale long additions typically indicate confidence in upside momentum, suggesting a potential bullish breakout in major crypto assets.

Whale positions reflect smart money sentiment, highlighting areas of potential liquidity and signaling likely market direction for major assets.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.