Ethereum, XRP, Dogecoin Price Predictions: ETFs Are Quietly Shaping the Next Big Move

XRP remains the only one of the three showing consistent ETF inflows this week.

ETH ETF outflows dominated except one day boosted by an ecosystem upgrade.

DOGE ETF inflows remain too small to impact current price action.

All three assets price's trade below the 20-day EMA, signaling short-term weakness.

This week’s Top crypto analysis reveals a shifting dynamic across XRP, Ethereum, and Dogecoin as ETF inflows and outflows reflect market-wide bearish sentiment. Although XRP ETF products continue to see positive momentum throughout the week, ETH and DOGE ETFs remain under pressure. Many are watching this data, having expectations that it will be reflected in price action, so let’s examine which ETF is stronger and how it influences the price movements of its respective assets.

ETF Inflows Show Divergence Across Leading Assets

In the latest ETF data, XRP stands out as the only asset among the three to register consistent inflows, even while the broader crypto market experiences sustained declines. Despite these positive movements into XRP ETF products, the XRP price chart continues to slide because the overall market trend remains firmly bearish.

XRP ETF holdings represent only 0.71% of the total market cap, with net assets near $861 million and cumulative inflows of $897 million. Though they are strong numbers, but not yet large enough to influence XRP price USD in isolation.

Similarly, DOGE ETF inflows remain too small to generate meaningful impact. Total net assets account for just 0.02% of the Dogecoin market cap, amounting to roughly $5.51 million.

Although the week recorded inflows, but this contribution is minimal, keeping the DOGE price aligned with broader market direction rather than ETF-driven momentum.

Both XRP and DOGE are therefore moving with market sentiment, not against it highlighting that positive inflows alone are insufficient unless supported by deeper liquidity and stronger capital rotation.

Ethereum ETF Trends Reflect Strong Market Influence

In contrast, the ETH ETF landscape paints a very different picture. With nearly two years of history, Ethereum’s ETF ecosystem holds a much larger footprint, representing 5.19% of Ethereum’s market cap and totaling $18.94 billion in net assets. The cumulative total net inflow of $12.88 billion is significantly multifold times higher than XRP and DOGE combined, meaning movements in ETF flows materially influence the ETH price USD and overall altcoin market strength.

This week, however, the ETH ETF market reflected persistent bearish control. Most days recorded outflows, except December 3rd. This was the only session showing inflows tied to Ethereum’s Fusaka (Fulu-Osaka) upgrade aimed at improving scalability. This single green day stands out amid otherwise negative ETF activity, contributing to notable pressure on the Ethereum price chart and weakening the short-term ETH price prediction outlook.

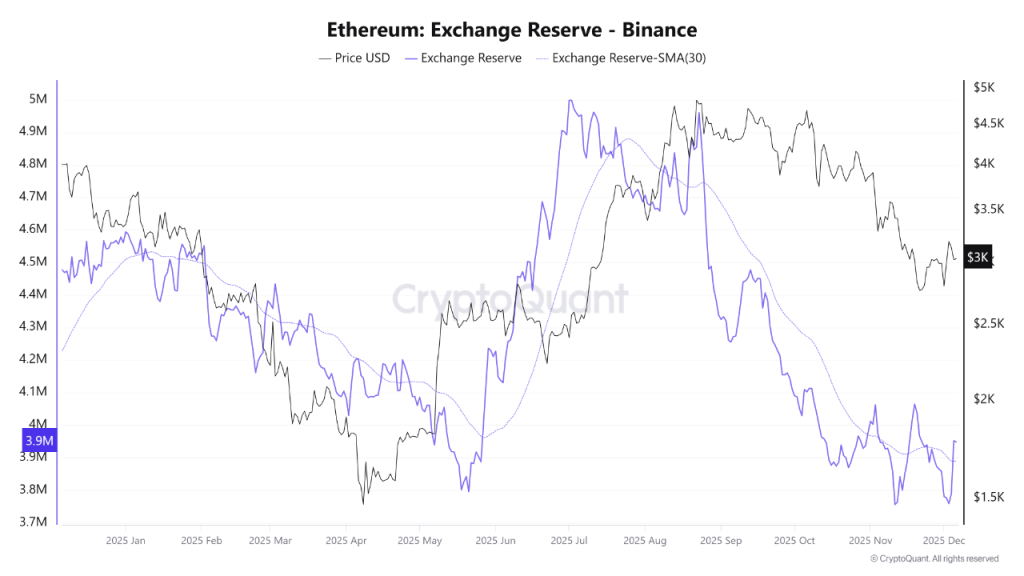

With Ethereum Binance reserves rising, additional selling pressure appears to be leaning toward the downside.

Critical Support Levels Define Next Moves

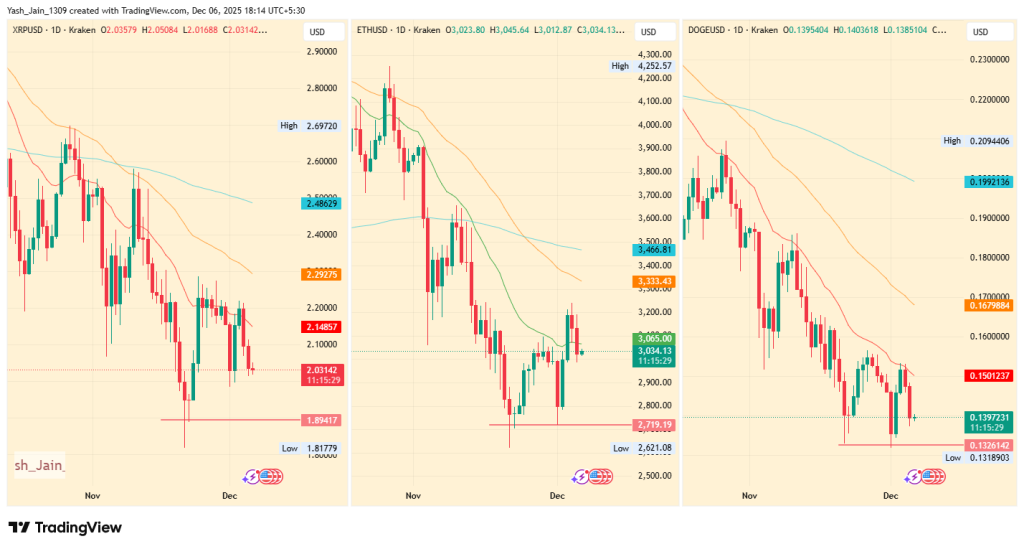

Technical structure across all three assets underscores the market’s fragility. Each of ETH, XRP, and DOGE is now trading below the 20-day EMA, signaling short-term bearish continuation.

For XRP/USD, $1.89 remains the key demand zone losing it could accelerate declines.

Meanwhile, the DOGE price USD must hold support at $0.1326 to avoid a deeper correction. As for Ethereum, maintaining levels above $2719 is crucial; a breakdown here could trigger significant weakness across the broader altcoin market.

These converging technical and ETF indicators reinforce the cautious sentiment highlighted in this week’s Top crypto analysis, especially as market momentum still favors the downside.

Altogether, ETF behavior, market-wide sentiment, and key support structures continue to define this week’s Top crypto analysis, giving traders a clearer view of how ETH, XRP, and DOGE may react in the sessions ahead.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.