The crypto market faced a sharp sell-off over the past three days, wiping out recent gains.

Analysts attribute the drop to a “sell the news” reaction after the Federal Reserve’s meeting, but historical seasonal trends suggest a potentially strong Q4 rally.

The cryptocurrency market faced a sharp sell-off over the past three days, wiping out weeks of gains and causing panic among traders. While some analysts call this a “sell the news” reaction following the Federal Reserve’s latest meeting, historical seasonal trends suggest this dip could create the perfect setup for a strong fourth-quarter crypto rally.

Bitcoin recently saw a small retracement after market liquidations, but analysts suggest this is a healthy retest before the next upward move. Fake price drops can trigger sell orders, which may help push Bitcoin higher.

Julian Patel, a well-known crypto analyst, explained on X that Bitcoin’s four-year cycle is extending alongside the macroeconomic business cycle. “Most people overcomplicate it,” he said. “If the business cycle extends, the crypto cycle extends.”

This aligns with recent market moves, where Bitcoin and Ethereum are showing expected price dips as part of a broader macro trend.

Crypto Whales Are Buying These Top Altcoins Amid Market Crash

XRP

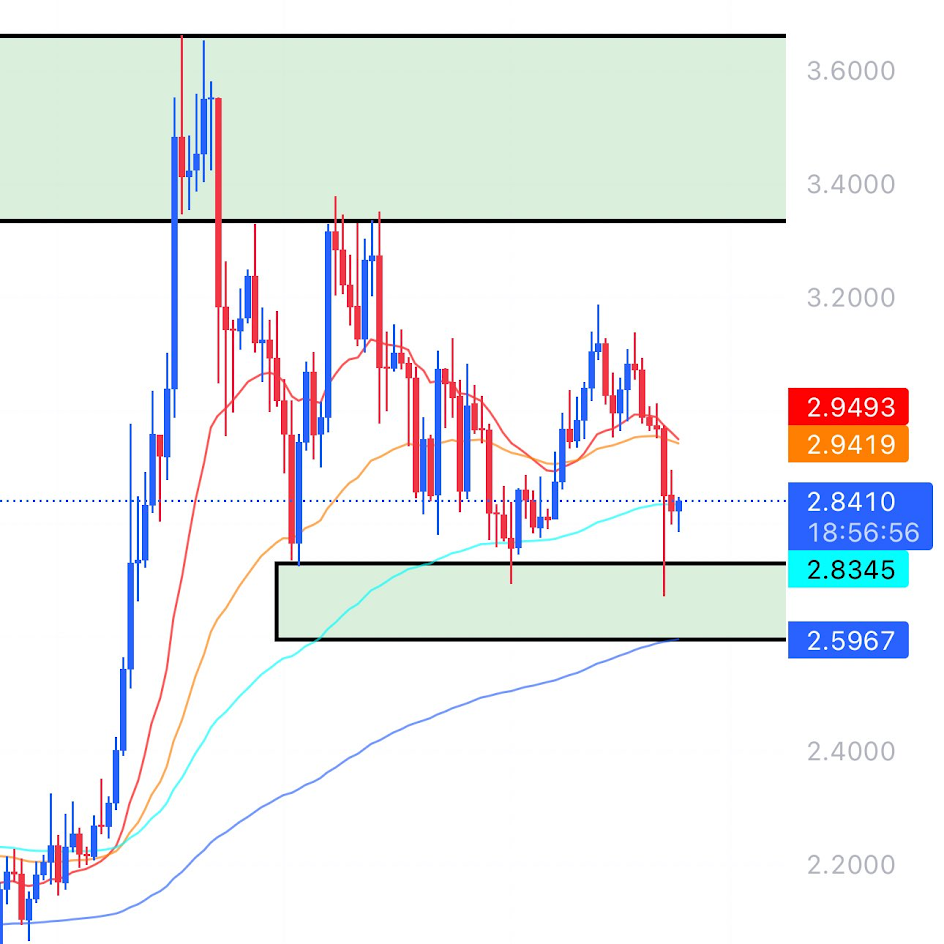

XRP has seen significant whale buying following the recent sell-off. A single 30 million XRP purchase in the last 24 hours highlights strong institutional interest in XRP. Ripple has also launched a new phase of institutional DeFi on the XRP Ledger, including over $1 billion in stablecoin volume and upcoming native lending protocols.

Traders are watching for a high-low-high pattern formation, indicating XRP could move toward $3.50 if support holds between $2.70–$2.95. XRP is emerging as a top altcoin that whales are buying after the crypto market crash, making it a key altcoin to watch in Q4 2025.

Chainlink (LINK)

Chainlink (LINK) continues to attract whales, with over 800,000 LINK purchased recently and 5.5 million LINK removed from exchanges. This shows institutional confidence in Chainlink for long-term DeFi growth.

Chainlink powers advanced DeFi applications, cross-chain compliance, and secure data connectivity. With total DeFi value locked (TVL) hitting $300 billion, LINK is positioned for further growth as more institutions integrate blockchain solutions. LINK as a must-watch altcoin for Q4 crypto gains.

Avalanche (AVAX)

Avalanche (AVAX) has shown strong performance amid recent volatility. Major corporate strategies, including Hive Miners’ $550 million AVAX investment and creation of AVAC1, indicate growing institutional adoption of Avalanche.

AVAX has surpassed Chainlink to become the 12th largest cryptocurrency, with a 30-day TVL of $417 million. AVAX could continue upward momentum, targeting around $44 after consolidating near support levels. Avalanche is now one of the top altcoins whales are accumulating after the crypto market crash.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The crypto market crash was largely a “sell the news” event following a Federal Reserve meeting, combined with a seasonal downturn often seen in September. This liquidates over-leveraged positions.

Crypto cycles are increasingly mirroring the broader macroeconomic business cycle. An extended period of economic growth and expansion can lead to an extended, long-term bull run for cryptocurrencies.

These altcoins are attracting whales due to their strong fundamentals and institutional adoption. XRP is gaining traction in institutional DeFi, Chainlink is key for real-world data, and Avalanche is seeing major corporate investments.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.