On-chain data analysis shows that Pepe whales have been offloading recently.

The Pepe futures Open Interest has dropped to multi-month lows amid heightened fear of further crypto capitulation.

PEPE price has been retesting a crucial support level year-to-date, which must hold to invalidate further selloff.

Pepe (PEPE) price is on the verge of a further selloff. The top-tier frog-themed memecoin has been forming a potential macro reversal pattern year to date (YTD).

According to market analyst Aksel Kibar, PEPE price is on the precipice of a major correction with a price target of $0.0000146. The crypto analyst noted that Pepe’s price, in the weekly timeframe, has been forming a potential head and shoulders (H&S) pattern coupled with a bearish divergence of the Relative Strength Index (RSI).

Source: X

Why is the Pepe Price Facing Bearish Sentiment?

Top whale investors capitulate on heightened fear of further crypto capitulation

The overall demand for Pepe has significantly declined in the recent past. With the fear of further crypto capitulation at extreme levels, the overall demand for memecoins has remained relatively low.

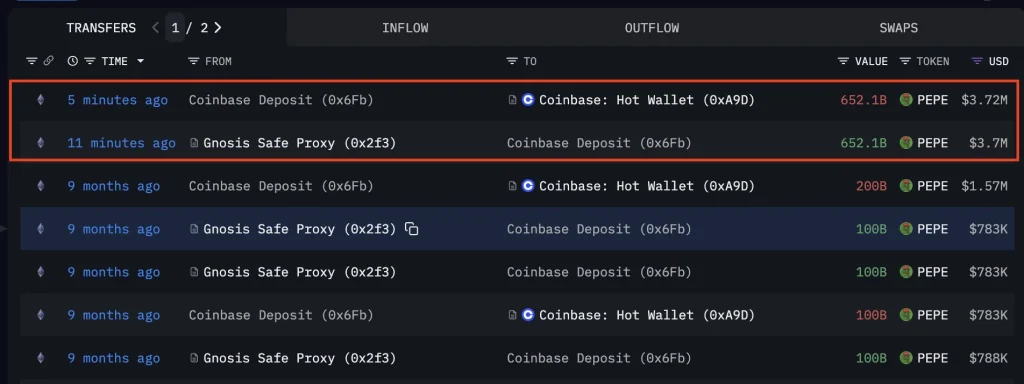

According to on-chain data analysis, whale investor 0x2f3 moved the final $3.7M worth of PEPE to Coinbase. As such, this whale investor has completely exited their Pepe position, which was once valued at $46 million, after holding since at least June 2024.

Source: X

Deleveraging market as Bitcoin further weakens against Gold

The Pepe Futures Open Interest (OI) has significantly dropped amid the ongoing crypto selloff. According to market data analysis from CoinGlass, Pepe’s OI has declined from nearly $1 billion to around $194 million in 2025.

Source: CoinGlass

The notable deleveraging of PEPE has coincided with the ongoing crypto liquidity crunch. Moreover, Bitcoin has been bleeding to Gold in the past few months, although the latter has signaled topping out.

What’s Next?

From a technical analysis standpoint, PEPE price is likely to rebound from its current support range and rally towards its new all-time high. With its correlation with Bitcoin and Ethereum still high, their potential rebound fueled by the Fed’s policy change will be a line of hope for the frog-themed meme.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.