Money Flooding into Ethereum—Will This be a Bullish Catalyst to Propel ETH Price to $3000?

Ethereum is attracting strong institutional inflows, largely due to optimism around the spot ETFs

Besides, the network fundamentals support long-term bullish sentiment, which could elevate the levels to $2800

Ethereum (ETH), the second-largest crypto, is once again in the spotlight as institutional investors have begun to flood the network with capital. With the growing excitement around spot ETFs and a steady increase in staking and network activity, many analysts predict that the ETH price could be poised to break past the $3000 mark. Now, the question arises whether this bullish momentum is sustainable.

Institutions & Bulls Gain Momentum as Liquidity Floods into Ethereum

One of the strongest indicators of market confidence is institutional interest. According to reports from the on-chain analytical platforms, Ethereum investment products have seen a significant uptick in inflows. While whales are accumulating ETH at a rapid pace, the market participants are also bringing back their assets onto the Ethereum network.

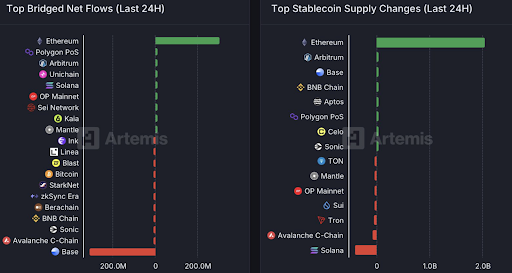

As per the data from Artemis, the influx of bridged tokens has been on a huge rise, while the Base blockchain witnessed a major drop. On the other hand, the stablecoin supply on Ethereum has grown significantly, while Solana experienced a decent outflow. On the other hand, once the staking ETF gets approved, the ETH price is expected to explode as the number of ETH validators has surged above 1 million while the staking amount has surged past 35 million.

Will Ethereum Ever Rise Above $10,000?

Beyond the speculative hype, Ethereum’s underlying fundamentals are pointing in a bullish direction. After a steady rise in the staking, it has seen consistent growth in Layer-2 activity through Arbitrum, Optimism, and Base. Besides, rising gas fees and network usage also signal a notable rise in demand. With less ETH available for trading and more being locked into staking contracts, the supply-demand dynamic is leaning toward higher prices.

The above chart displays the ETH price being largely compressed between the 50-day & 200-day MA since May, hinting towards a strong accumulation. While Bollinger bands are also going parallel, both the MAs are heading towards a bullish crossover that could validate a Golden Cross. Meanwhile, the RSI is attempting a bullish rebound and setting up a fine recovery curve. If this happens, the Ethereum price could gain momentum and break the resistance at $2700 and reach $2800. This could pave the way for the token to reach $3000.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.