ETHFI price jumps 6.23% in a day, 25.85% this week, market cap hits $545M

Arthur Hayes’ $517K ETHFI buy sparks whale-led accumulation trend

Breakout above $1.30 may push ETHFI toward $1.50–$1.60 range

Ether.fi is gaining traction after a strong 7-day rally, fueled by whale buying and Ethereum’s broader ecosystem growth. The ETHFI price rose 6.23% in the past 24 hours to $1.29, with its market cap chugging up to $544.91 million. Trading volume surged 23.54% to $268.88 million, showing rising retail participation alongside institutional activity. Curious about the next big pitstop? Read this analysis for all details.

Why ETHFI Price Is Going Up?

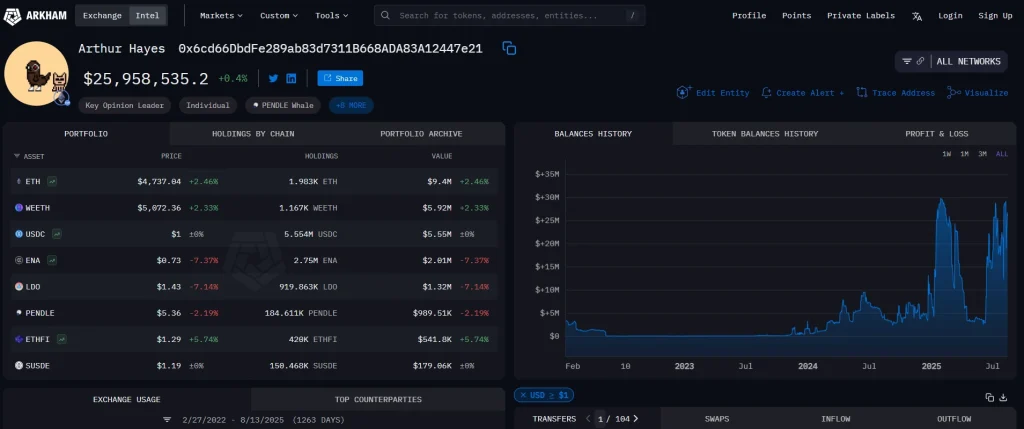

On August 11, BitMEX co-founder Arthur Hayes acquired 420,000 ETHFI worth about $517,000 as part of an $8.4 million DeFi buying spree. Which also included LDO and PENDLE. Such high-profile purchases often trigger copycat trades. With on-chain data showing whales now control around 42% of ETHFI’s supply. This accumulation, while bullish in the short term, raises centralization concerns if profit-taking occurs near resistance levels.

Ethereum’s price rally to $4,300 is driving capital into liquid restaking protocols. ETHFI’s TVL has rebounded to $6.7 billion, with revenue up 58% month-over-month. A new partnership with Superstate to use weETH as collateral for yield funds reinforces ETHFI’s utility in RWA strategies. That being said, sustained Ethereum strength above $4,200 remains critical for ETHFI’s staking demand.

ETHFI Price Analysis

ETHFI price broke above its 7-day SMA at $1.21 and the Fibonacci 23.6% retracement level at $1.29, signaling a trend shift. The RSI-14 reading at 64 is neutral-bullish, while the MACD histogram turning positive suggests strong momentum.

Traders are eyeing $1.54, the 127.2% Fibonacci extension, as the next upside target. However, the 24-hour pivot point at $1.31 could act as immediate resistance. If ETHFI fails to hold above $1.25, profit-taking could drag prices toward $1.09 support. Conversely, a clean breakout above $1.30 may accelerate gains toward the $1.50–$1.60 zone.

FAQs

Whale accumulation led by Arthur Hayes and Ethereum’s broader rally have boosted demand.

If momentum holds, traders are watching $1.50–$1.60, with $1.54 as a key Fibonacci level.

Failure to hold $1.25 or whale profit-taking near $1.54 could trigger a pullback.