Ethereum Traders Pivot to Extreme Bullish Amid Renewed Whale Demand; Is ETH Price Rebound Next?

Ethereum price has been retesting a crucial bull run support level in the past few days.

Tom Lee’s BitMine has led whale investors in buying the Ethereum dip.

The crypto industry has experienced extreme fear of a full-blown bear market.

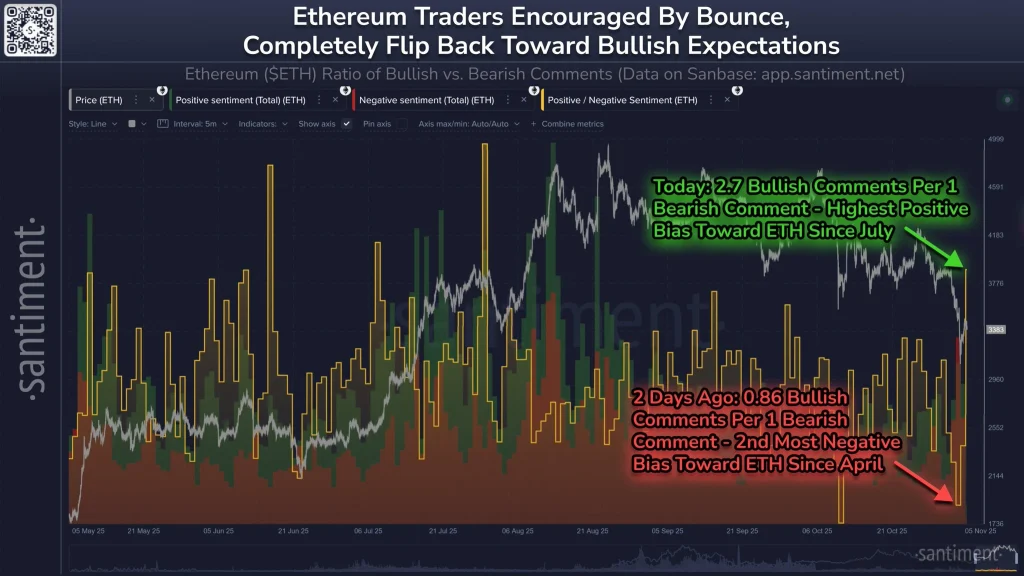

Ethereum (ETH) traders have quickly pivoted to extreme bullishness after the recent crypto market crash. According to market data analysis from Santiment, Ethereum traders have been expecting a strong rebound in the coming days following a series of deleveraging.

Source: Santiment

However, Santiment cautioned Ethereum traders for turning extremely bullish as history has proven that the market often moves in the opposite direction of the crowd’s expectations.

Why are Ethereum Traders Getting Extremely Bullish?

Renewed Demand from Whale Investors amid Supportive Macro Backdrop

Ethereum traders have turned extremely bullish in the recent past following the notable deleveraging and renewed demand from whale investors. For instance, on-chain data analysis shows Tom Lee-led BitMine has been buying the recent market dip, whereby it withdrew ETH valued at about $70 million on Thursday.

The Ethereum traders have been expecting a bullish rebound as Wall Street gradually turns to altcoins. Ahead of the anticipated Fed’s Quantitative Easing (QE), institutional investors have been building on Ethereum via Digital Assets Treasuries (DATs), spot Exchange-Traded Funds (ETF), and tokenization of real-world assets (RWA).

Technical Tailwind ahead of the anticipated altseason 2025

From a technical analysis standpoint, ETH price has been retesting a crucial support level, which previously acted as a resistance level for long.

Source: X

With the ETH’s daily Relative Strength Index (RSI) hovering around oversold levels, a potential rebound towards a new all-time high is highly likely. However, if Ether price consistently dips below the support level above $3000, a full-blown bear market will be inevitable in the subsequent months.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.