ETH price dips 2.23% to $4,632, still up 18.65% this week

Break above $4,872 could trigger $2B short liquidations

Key support stays at $4,500, resistance near $4,878–$4,891

The crypto market today has faced the brunt of macroeconomic conditions. This has led to major assets dropping on their charts. The largest altcoin, Ethereum, is at $4,632.79, down 2.23% in 24 hours but still up 18.65% over the past week. This pullback follows ETH’s sharp weekly rally, making it vulnerable to profit-taking.

Successively, derivatives markets show signs of stress: $800M in crypto liquidations in 24h, including $50M in ETH longs, as open interest surged 16% to $895B. Adding to the sell pressure, Turkish exchange BtcTurk suspended withdrawals after a $48M security breach, including suspicious ETH transfers.

Wondering if a new ATH is still on the cards? Join me as I take you through analyst views and short-term Ethereum price analysis.

What Does the Analyst Have to Say?

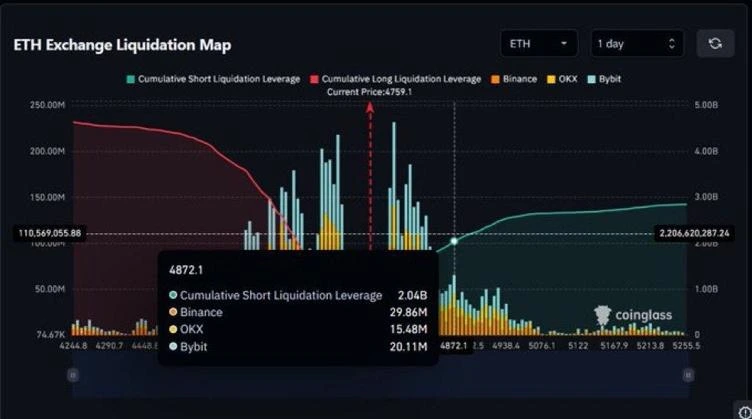

Market analyst Peter notes that according to Coinglass data, a push above $4,872 could liquidate more than $2 billion in short positions. Which would be on major exchanges such as Binance, OKX, and Bybit. These overleveraged shorts sit in a vulnerable zone, and if Ethereum breaks through this level, it could ignite a powerful short squeeze.

Successively, such a move would likely attract momentum buyers and push ETH into uncharted territory above its previous all-time high. He further highlights that, historically, similar setups have triggered rapid upside rallies. Thereby making Ethereum’s price reaction near $4,800 and trading activity around $4,872 crucial signals to watch for a breakout confirmation or a potential fakeout trap.

ETH Price Analysis

Technically speaking, the Ethereum price is holding support around the $4,500 psychological level. This is with a deeper pullback, potentially exposing $4,144, which aligns with the 38.2% Fibonacci retracement. That being said, a sell-off cascade could drag the price down to $3762.34.

On the upside, resistance remains in the $4,878–$4,891 zone near the previous all-time high, and a breakout above this range could spark a rapid move toward $5,067 as short liquidations fuel buying pressure.

FAQs

ETH fell due to a market-wide correction, leverage flush-out, and a security breach on the BtcTurk exchange.

It could trigger over $2B in short liquidations, driving a sharp upward move.

Support sits at $4,500, with deeper downside risk toward $4,144. Resistance is near $4,878–$4,891, and a breakout above that zone targets $5,067.