Ethereum Price Prediction 2025: Can ETH Recover or Will It Crash Further?

-

ETH $ 1,881.65 (0.42%)

ETH $ 1,881.65 (0.42%)

Ethereum struggles as ETF outflows hit $409M; whale deposits 6,131 ETH amid market panic. Is a deeper selloff ahead?

ETH risks dropping below $1,793, triggering major liquidation. Macro bearish trends signal a tough road ahead for Ethereum in 2025.

The wider cryptocurrency market opened the last week of the first quarter of 2025 with a bearish outlook. The crypto market experienced a bearish outlook on Monday, during the early Asian session, after Chinese and Japanese stock markets recorded notable losses.

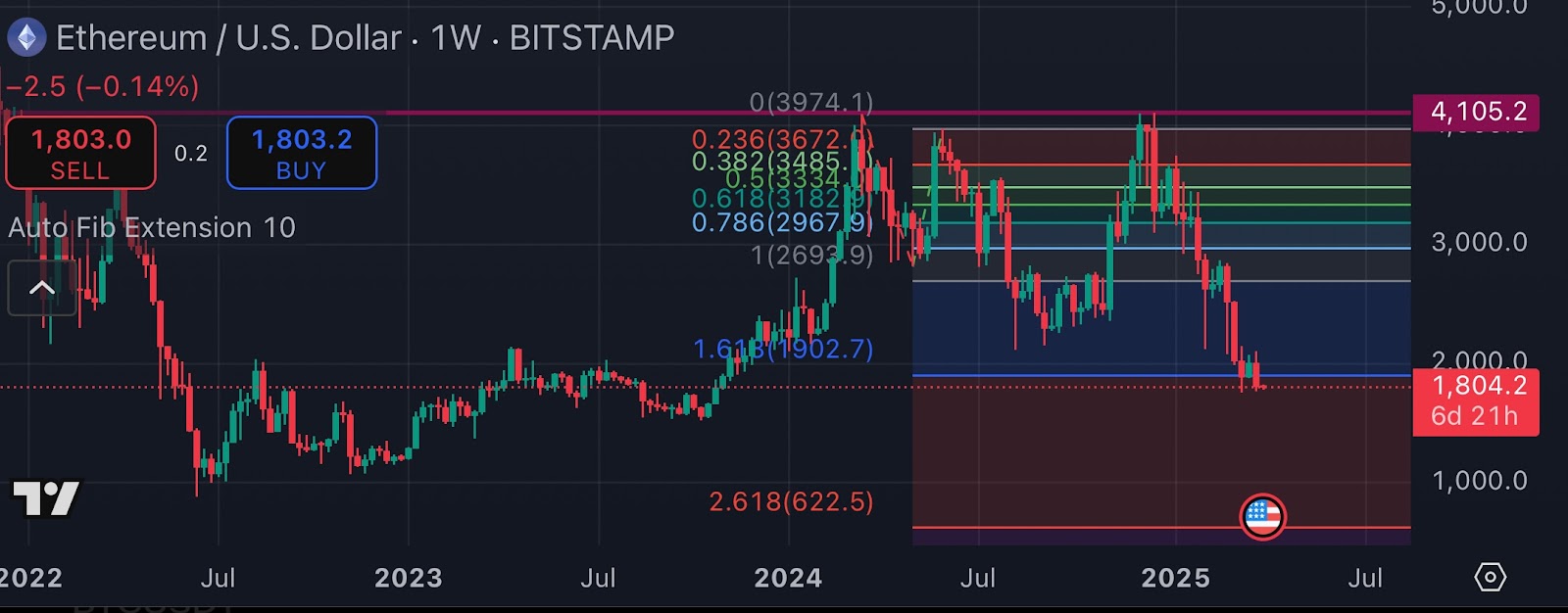

The total crypto market cap slipped nearly 4 percent in the past 24 hours to hover about $2.74 trillion at the time of this writing. Ethereum (ETH) price dropped over 9 percent last week to trade around $1,809 on Monday, March 31, 2025. The large-cap altcoin, with a fully diluted valuation of about $218 billion, has continued to suffer a more macro bearish outlook.

Ethereum Whales Signals Distress

For the first time since October 2024, the U.S. spot Ether ETFs will record a monthly net cash outflow of nearly $409 million in March 2025. Amid the rising fear of further market volatility, on-chain data shows a major whale deposited 6,131 ETH, worth about $10.94 million, to the Binance exchange earlier today.

Meanwhile, another major whale crypto investor who leveraged long $110 million of ETH on MakerDAO is about to be liquidated if the altcoin drops to $1,793.

What Next?

After experiencing a major resistance level of around $4,105, in the past 12 months, Ethereum price has been trapped in a bearish outlook. Following last week’s close below $1,907, which coincided with the 1.618 weekly Fibonacci Extension, Ether’s price has now confirmed a possible macro bear market, with a potential capitulation below $1,000.

As more investors flee the crypto market to the gold and stablecoins market, Ethereum price faces major headwinds in the coming quarter. Ahead of the April 2, reciprocal tariff by the United States, the fear of further crypto selloff is palpable across global markets.