Ethereum's price surged from $1,400 to over $2,700 in Q2, driven by the Pectra upgrade.

Arthur Hayes predicts ETH could reach $10,000 by year-end if it surpasses $5,000.

The ETH/BTC price ratio has increased by 38%, signaling potential altcoin outperformance.

In the second quarter, the Ethereum price made a remarkable comeback, climbing from a low of $1,400 to over $2,700. This surge can be largely attributed to the successful launch of the Pectra upgrade, which significantly boosted investor confidence.

Coincidentally, this upgrade also coincided with a positive geopolitical development, which was on May 8th, the US and UK announced a trade deal, marking a historic first. The mere certainty of this agreement sent optimism wave to all altcoins and top coins.

Even Arthur Hayes, in a recent interview, agrees that more than technical factors, the sentimental factors led the rise in ETH crypto. He believes that still ETH price presents a unique investment opportunity. Hayes even sets an ambitious target of $5,000 for Ethereum, suggesting that by the end of the year, a price of $10,000 could be within reach.

Regardless of the challenges ahead, Ethereum appears poised to play a significantly important role in the crypto landscape of 2025. Its continuous developments and institutional preference could establish it as the leading platform among its competitors, marking a significant turning point for the entire crypto ecosystem. Keep reading to know more.

Arthur Hayes Predicts Ethereum Price Run To $10,000

In a recent macro-focused interview on the Bankless podcast, Arthur Hayes, the former CEO of BitMEX and current CIO of Maelstrom, shared his optimistic Ethereum price Forecast.

He suggested that if ETH price surpasses $5,000, it could have potential projection to $10,000 or even $15,000 by the end of the year. This ETH price prediction came during a final discussion in the interview when he asked where Hayes sees ETH price this year.

In the video, when talked about the second top crypto next to BTC recent run in May, Hayes attributed the ETH price performance to market sentiment rather than any significant technical factors.

He noted that the Ethereum price resurgence was long overdue, especially after being overshadowed by Solana and other high-beta tokens in recent years. However, he cautioned that Ethereum crypto’s journey may not be straightforward.

While acknowledging ETH crypto’s underperformance compared to Bitcoin thus far, he strongly believes that the Ethereum price moment is approaching.

This is especially due to regulatory clarity seems higher chance of improving or if decentralized finance (DeFi) regains momentum with sustainable cash flows. He highlighted projects like EtherFi and Pendle as examples of token ecosystems that could finally validate their valuations based on fundamentals.

As the interview wrapped up, the host inquired about Hayes’ personal holdings. He revealed that his crypto portfolio consists of approximately 60% Bitcoin, 20% Ethereum, along with a variety of other altcoins and tokens. On the non-crypto side, he mentioned holding physical gold, gold mining stocks, and T-bills.

Will Ethereum Price Show Exceptional Performance?

On the daily price chart, the Ethereum price is currently fluctuating between key resistance and support levels, with mixed signals from technical indicators.

After a notable bull run in May, momentum appears to be waning, as the Relative Strength Index (RSI) has retreated from the overbought territory, now sitting at 68.70. At present, ETH price is priced at $2,528, accompanied by an intraday trading volume of $23.47 billion.

The future movement of the Ethereum price hinges on its ability to break through the $2,800 resistance level.

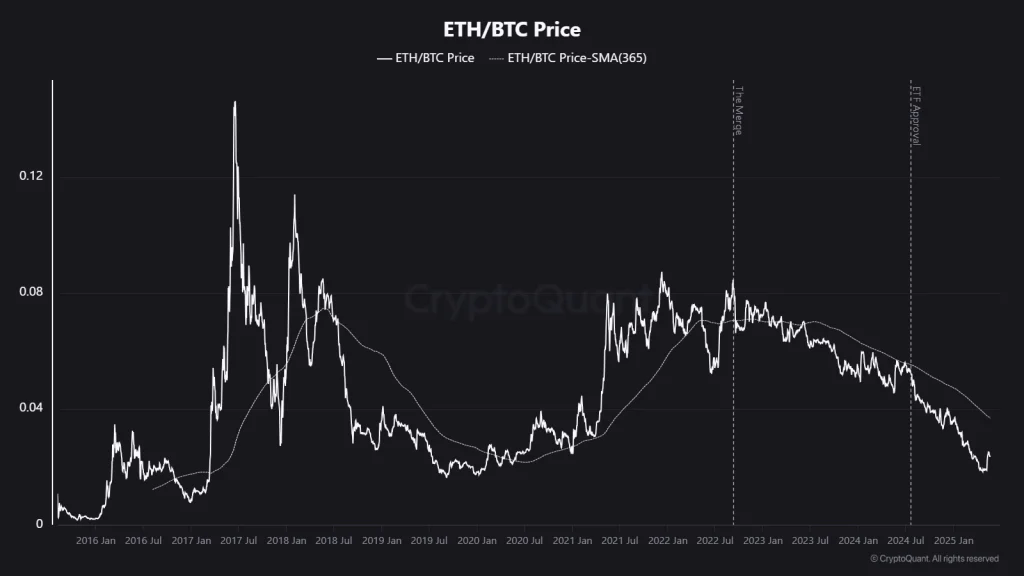

Moreover, on-chain data also adds to the optimism, as highlighted in CryptoQuant’s weekly crypto report. The relative price of ETH compared to Bitcoin may have reached a bottom, potentially signaling the onset of an “Alt season.”

The ETH/BTC price ratio has surged by 38% over the past week, following a dip to its lowest point since January 2020. Historically, this ratio has indicated a relative bottom for Ethereum, often leading to broader outperformance among altcoins.

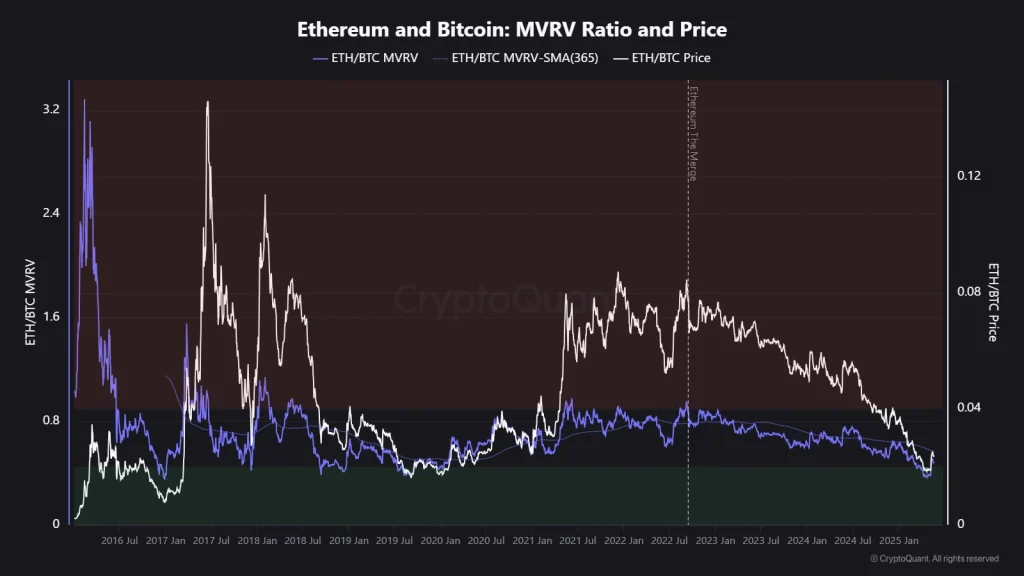

Additionaly, Ethereum crypto has entered an extreme undervaluation zone relative to Bitcoin, as indicated by the ETH/BTC Market Value to Realized Value (MVRV) metric, marking the first occurrence of this since 2019.

In the past, similar conditions in 2017, 2018, and 2019 were followed by significant periods of Ethereum outperforming Bitcoin, suggesting a strong potential for mean reversion.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Yes, the ETH/BTC MVRV metric shows ETH is in an undervaluation zone not seen since 2019, hinting at potential upside.

The Pectra upgrade boosted investor confidence, helping drive ETH’s price recovery and positioning it for future growth.

As per our ETH price prediction 2025, the ETH price could reach a maximum of $5,925.