Ethereum price consolidates near $2,050 inside a bearish pennant

Volume Z-Score at -0.39 signals trading activity below 30-day average

Breakdown target from pennant formation points to $1,136

The Ethereum price is hovering near $2,050 while compressing inside a bearish pennant on the 3-day chart. After retreating from levels above $3,000 in previous months, ETH/USD is now consolidating within converging trendlines and the pattern suggests potential continuation to the downside, with a projected breakdown target near $1,136.

That’s the technical setup. But the underlying volume dynamics add another layer to the story.

Bearish Pennant Takes Shape On Ethereum Price Chart

On the higher timeframe, the Ethereum price chart shows a classic post-drop consolidation. A sharp initial move lower was followed by tightening price action between descending resistance and rising support.

Typically, a bearish pennant forms after a strong downward impulse and resolves in the direction of the prior trend. In this case, that would imply further weakness if support gives way. The cited breakdown target stands at $1,136.

Still, patterns are conditional. The structure remains intact only as long as price respects the converging boundaries. A confirmed break below support would validate the formation. Until then, it’s compression.

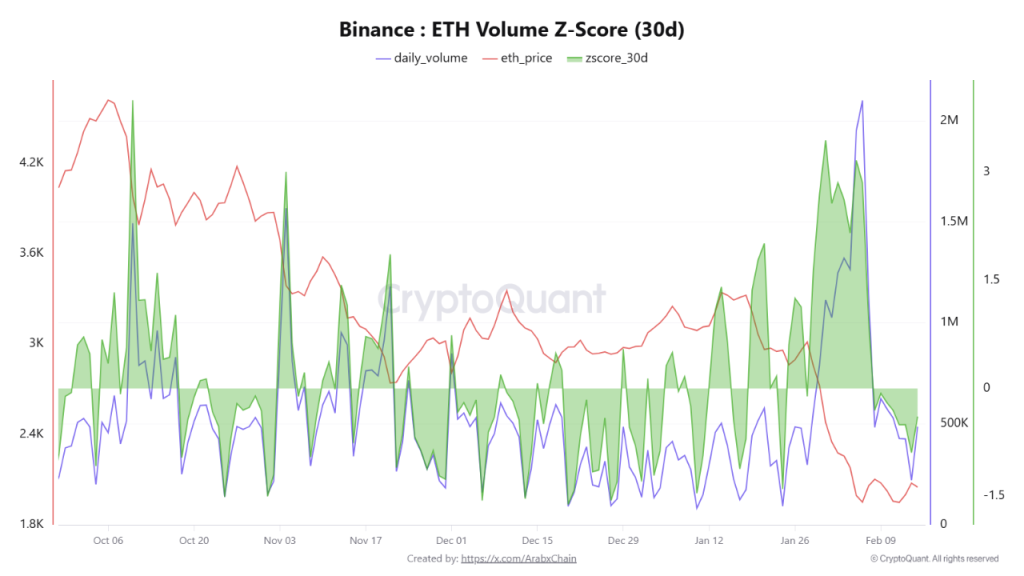

Volume Z-Score Turns Negative

Meanwhile, Binance data shows daily trading volume around 486,000 ETH, with Ethereum price still trading near around $2,050. The Volume Z-Score sits at approximately -0.39.

In simple terms, that’s below the 30-day moving average. When the Z-Score drops below zero, it indicates current activity is lighter than usual. Historically, that tends to reflect calmer liquidity conditions, to be precise, consolidation or repositioning rather than aggressive trend expansion.

Cooling Market, Unclear Direction

ETH/USD isn’t flashing explosive momentum in either direction. Instead, it’s compressing. Liquidity is cooling. Participation is below average. And Ethereum price remains trapped within a narrowing range.

Whether this resolves into a sharp breakdown toward $1,136 or a broader consolidation phase depends on which side of the structure gives way first. For now, the Ethereum price analysis reflects more like compression, and has no clear confirmation.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.