Critical Support at $4,200: Ethereum’s price action hinges on holding above $4,200; a break lower could trigger major long liquidations.

High-Volatility Zone Ahead: Price clusters show potential for both a downside cascade to $3,800 or an upside short squeeze above $4,500–$4,700.

Breakout Targets $5,000: Sustained momentum above $4,869 could push ETH toward $5,000, while a drop below $4,271 risks a deeper correction.

Ethereum (ETH) has long been a key player in the crypto market, but recent volatility has investors on edge. Analysts are now closely watching the $4,200 mark, a crucial support level that could determine ETH’s short-term trajectory. A drop below this threshold is believed to trigger a wave of selling, impact market sentiment, and influence DeFi and NFT ecosystems built on Ethereum. Could the ETH price bounce back to $4,500, or are we heading toward a bearish slide toward $3,800?

Massive Liquidation Risk for ETH Holders

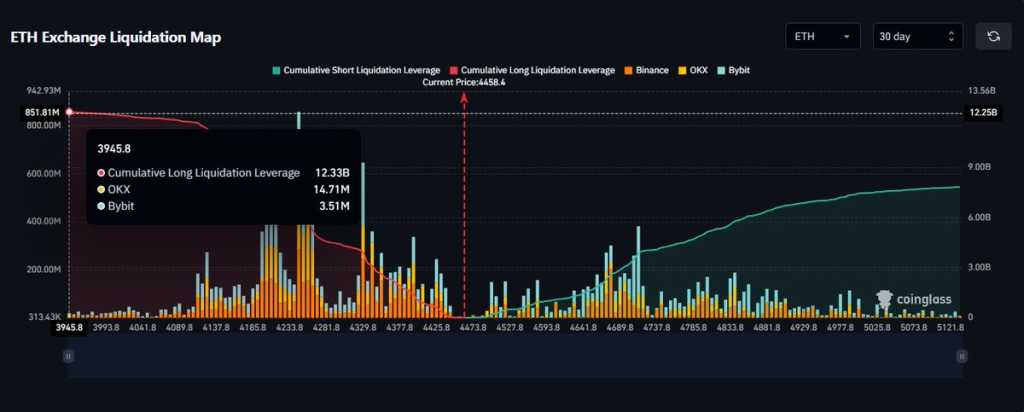

Ethereum has been steadily trading above $4,000 for over a week now, displaying the growing strength of the bulls. The latest ETH exchange liquidation map from Coinglass, shared by Ted, highlights a critical setup for price action. The chart reveals a significant concentration of leveraged long positions between $3,945 and $4,200. If Ethereum were to dip into this zone, it could trigger a wave of long liquidations, potentially accelerating a move lower as cascading sell orders amplify downside pressure.

On the other hand, a sizable cluster of short liquidations is forming above $4,500 to $4,700. A sustained breakout above these levels could set off a short squeeze, forcing traders to cover their positions and fueling a rapid price rally.

Overall, the data suggests Ethereum is approaching a high-volatility zone. Price could either sweep lower liquidity levels before rebounding or break higher and liquidate shorts aggressively. Traders should watch the $4,200 support area closely and monitor whether ETH can reclaim and hold above $4,500, which could open the door to a strong bullish continuation.

What’s Next for the ETH Price Rally?

The ETH price had been facing immense resistance at $4000 as the bears prevented it from rising above the range. Meanwhile, after surpassing the resistance, the bulls have firmly held above the levels. This hints towards a potential breakout that could help price to achieve fresh highs.

Ethereum is consolidating near $4,470 after a strong uptrend that started in May, trading within a well-defined ascending channel. Price action shows ETH holding above its mid-channel support and the 20-day Bollinger Band basis line, signaling sustained bullish momentum. The RSI is hovering near neutral levels around 55, suggesting room for a potential continuation move. Immediate resistance lies at $4,869, while key supports remain at $4,271 and $4,050.

A break above $4,869 could pave the way to $5,000 and the upper channel trendline, whereas a drop below $4,271 could result in a deeper correction toward channel support for the Ethereum (ETH) price rally.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Yes, if Ethereum holds above $4,200 and breaks through resistance near $4,500, it could rally toward $4,700 or higher, especially if a short squeeze occurs.

Liquidations can amplify price moves. A drop to $4,200 may trigger long liquidations (selling), while a rise above $4,500 could force short liquidations (buying), accelerating momentum.

With ETH consolidating near $4,470, monitor the $4,200 support. Holding above it may offer an opportunity, but a break below could signal a deeper correction. Always assess risk.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.