The Ethereum price is experiencing a significant upward pressure after hitting the local highs, yet is defending the psychological barrier at $3000

Despite the pullback, the technicals and on-chain data suggest, the ETH price is primed to reach $3500 in a short while

Bitcoin recently surged above $90,000 and marked an intraday high close to $91,000, which triggered the entire crypto market. With this, the second-largest crypto, Ethereum, also marked highs at around $3,148. However, the price slipped below $3100 as the BTC price lost the gained resistance at $90,000. With this, the question arises whether the bullish strength has faded. Fortunately, the technicals and the on-chain indicate, the ETH price is primed to defend the support at $3000.

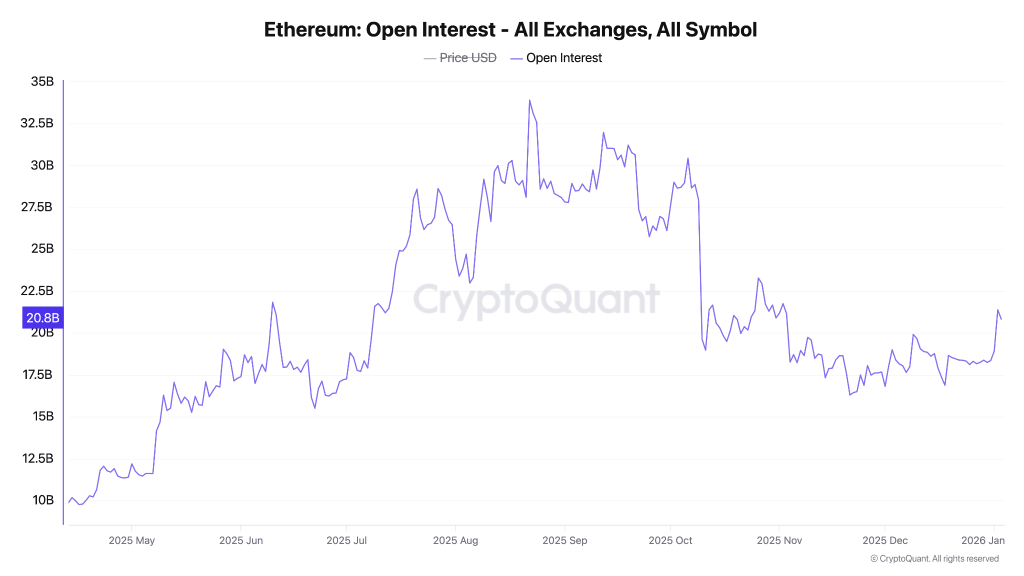

Open Interest has reset, Not Overheated

Open interest is defined as the number of open positions, including both long and short. After consolidating within a range, the OI has triggered a steep upswing, which indicates more liquidity, volatility, and attention coming to the derivative market. However, the ETH open interest is around $20 to $21 billion; leverage is well below prior peaks near $30 billion. This could reduce forced-liquidation risk near $3000 and hence prevent the possibility of a sharp breakdown.

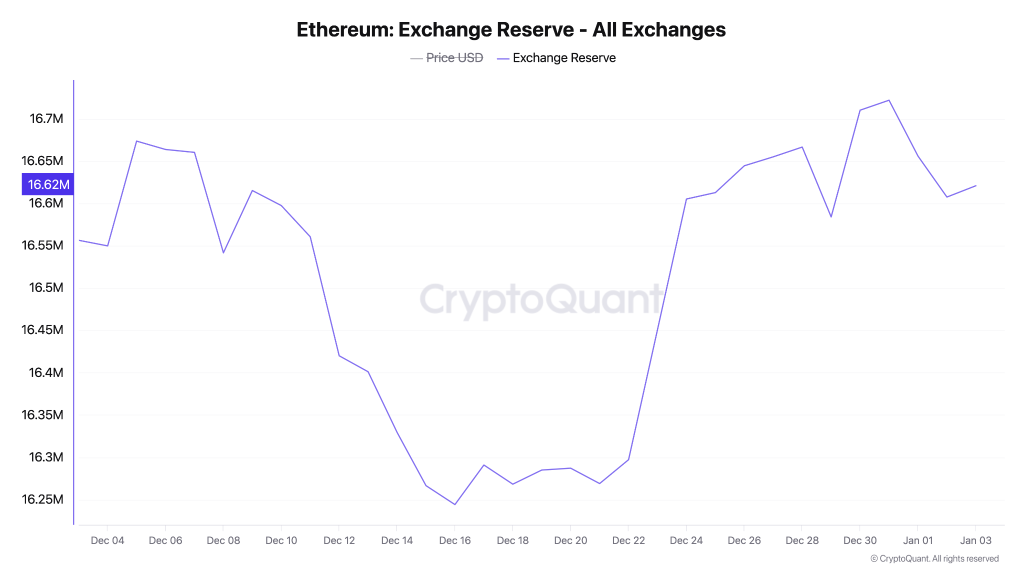

Exchange Reserves are High, But Stable

The exchange reserve suggests the total number of coins held in the exchanges, which is around 16.6 to 16.7 million. Some of the tokens had moved back to the exchanges as the reserves surged from 16.25 million. However, this sharp rise does not point towards a panic selling, but the stability around these levels supports consolidation rather than a sudden drop below $3000.

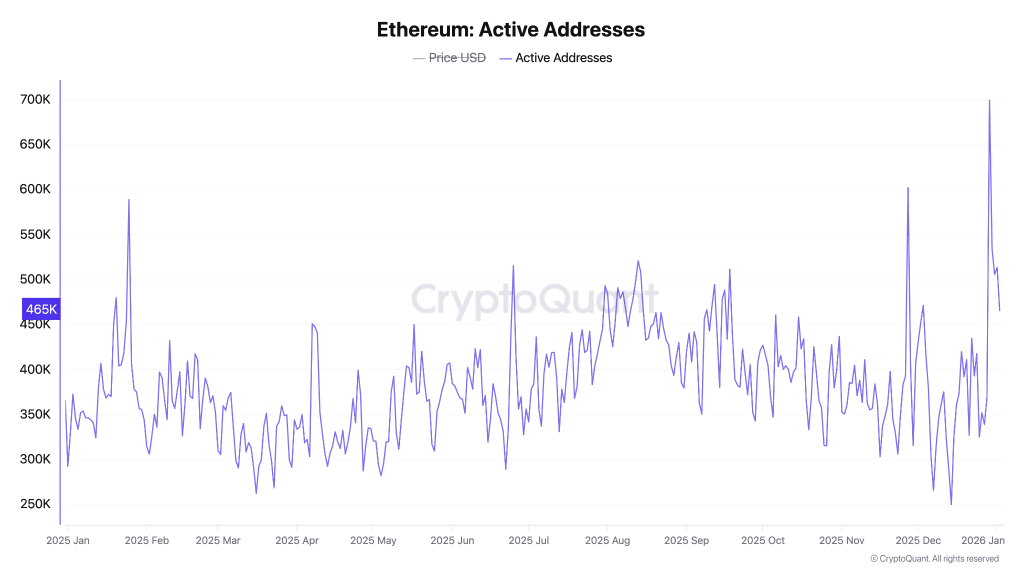

Active Addresses Continue to Rise

These are the total number of addresses interacting with the platform to perform a trade, including buy, sell or swap. These levels have recently spiked towards 700K, followed by a stabalisation near 456K, which points towards an improving network activity. This could also be a strong fundamental reason for the bulls to defend the psychological barrier at $3000.

Ethereum Price Analysis: Here’s What’s Next for ETH Price

The Ethereum price has been trading within a bullish pattern since December, and the recent upswing has pushed the token above a pivotal range. Although the volume has remained restricted within an average range, the bulls seem to have gained significant control. Therefore, the ETH price seems to be primed for a bullish continuation, reaching $3200.

The ETH price has surged above the 50-day MA for the first time since the October fallout, reviving the bullish momentum. The RSI has been rising for the past few days, holding along the rising trend line. As the strength of the rally is increasing, the possibility of a continued upswing remains pretty high. Currently, the token is experiencing some upward pressure, and if it absorbs it, the next price action could be huge.

What’s Next for Ethereum Price—Can ETH Reach $3,500?

Looking ahead, Ethereum is more likely to consolidate before expanding, rather than rally straight to $3,500. The current data supports defense of the $3,000 zone, but not an immediate breakout. For ETH to push toward $3,500, two things need to happen: exchange reserves must start trending lower, and price must reclaim the $3,200–$3,300 resistance range with strong volume.

If Ethereum holds above $3,000 and network activity remains elevated, a gradual move toward $3,500 later this month is possible. However, without fresh demand or a broader market catalyst, ETH is likely to trade in a range first. In short, $3,500 is achievable—but only after confirmation, not by assumption.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.