Ethereum and Solana Lead Stablecoin Growth: What It Means for ETH and SOL Prices in 2025

Ethereum remains the backbone of stablecoin liquidity, offering steady long-term support for the ETH price as DeFi and institutional adoption expand

Solana is experiencing faster stablecoin growth, making SOL more sensitive to adoption surges and potentially driving stronger short-term upside

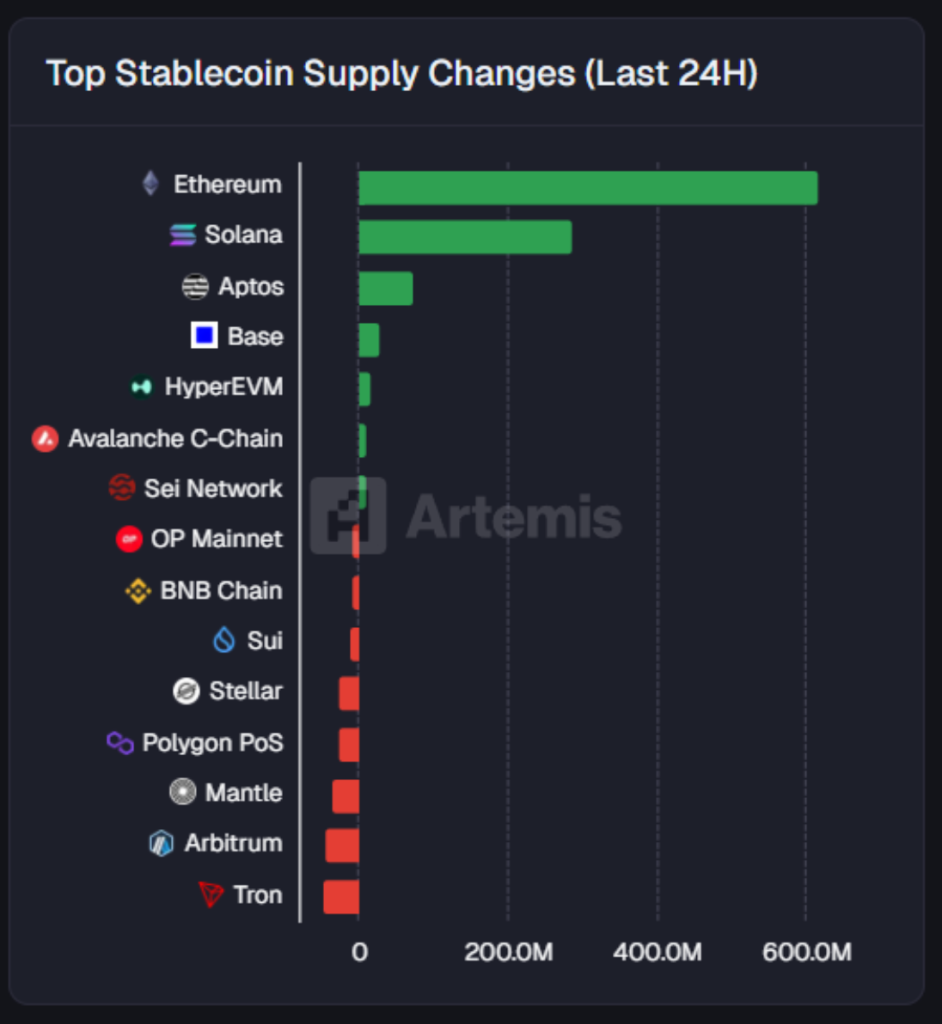

Stablecoin flows are reshaping the crypto landscape, with Ethereum and Solana absorbing the majority of fresh supply in 2025. As these digital dollars drive liquidity into DeFi and payments, they directly impact gas usage, validator rewards, and ultimately the price trajectory of ETH and SOL. Can Ethereum’s stablecoin dominance push ETH price beyond $5,000, or will Solana’s explosive growth fuel a rally toward $300 and beyond? The answers lie in how stablecoin dynamics evolve across both chains.

Stablecoins Power the Next Phase of Crypto Liquidity

Stablecoins function as the digital backbone of liquidity across the crypto market. They fuel trading, lending, and yield strategies while also serving as gateways for institutional and retail money.

The combined stablecoin supply now exceeds $280 billion, and according to Artemis, Ethereum and Solana account for the bulk of this growth:

- Ethereum commands the lion’s share, reinforcing its role as the settlement hub for DeFi and institutional capital

- Solana has seen its stablecoin supply expand more than 2× this year, signaling adoption momentum in payments and retail trading.

Stablecoins as a Growth Catalyst: Why it Matters for ETH & SOL Prices

Every stablecoin transfer on Ethereum consumes ETH for gas, and under EIP-1559, part of those fees are burned. As stablecoin flows rise, the supply dynamics of ETH tighten, adding a deflationary push. Stablecoin activity boosts ETH liquidity pairs, supports DeFi, and enhances institutional trust. Analysts anticipate that ETH will retest $3,800–$4,200 if inflows remain strong, with the potential for fresh highs should macroeconomic tailwinds align.

Meanwhile, Solana’s low fees and high throughput make it an ideal choice for retail payments, remittances, and high-frequency DeFi transactions. Rising stablecoin adoption here means higher demand for SOL, which powers fees and staking rewards. Surging adoption strengthens Solana’s ecosystem credibility and attracts new liquidity. Sustained inflows could push SOL toward $180–$200, with a breakout scenario pointing to $250 as the next resistance.

Conclusion

The surge of stablecoins on Ethereum and Solana is more than a liquidity story—it’s a catalyst shaping future price movements. For Ethereum, dominance in stablecoin supply strengthens its position as the settlement backbone, supporting ETH toward the $5,000 zone. Solana’s rapid expansion, meanwhile, amplifies upside potential, with $280-$300 targets in sight if adoption momentum holds. Ultimately, the trajectory of stablecoin flows could determine which blockchain captures the next major wave of crypto market growth.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.