ETH price holds $4K as exchange balances drop to 9-year lows

ETF inflows slow, but long-term accumulation remains strong

Resistance flipped into support, signaling bullish market structure

ETH price today is navigating turbulent conditions after briefly dipping below $4,000. Despite short-term pressures from macroeconomic factors and ETF inflow slowdowns, exchange balances have plunged to nine-year lows, signaling strong accumulation. This dynamic could set the stage for a future supply shock and renewed momentum for ETH crypto.

Macro Factors Weigh on ETH Price

Ethereum’s dip below the psychological $4K level was driven by a mix of technical breakdowns, global risk sentiment, and cascading liquidations. While the U.S. Federal Reserve cut interest rates by 25 basis points in September, the move failed to spark the expected market-wide rally.

Adding to the cautious mood, Ethereum spot ETFs recorded subdued inflows this month. Net inflows total roughly $110 million so far in September, far below the $3.8 billion seen in August. This contrast highlights how institutional demand has slowed, limiting immediate upside momentum for ETH price USD in the short term.

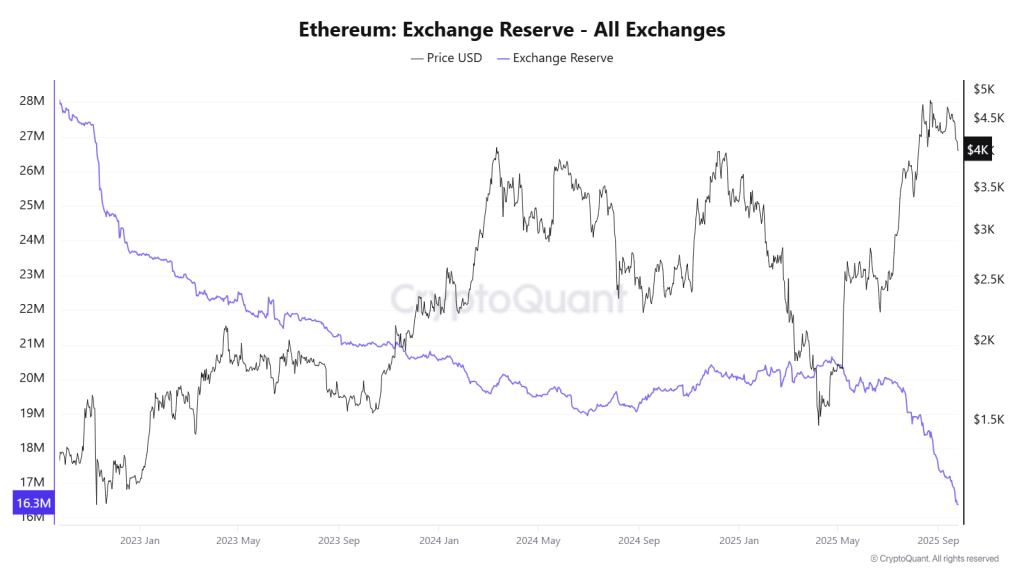

Exchange Balances Fall to Nine-Year Lows

Yet, beneath the surface, on-chain signals tell a different story. Ethereum exchange balances have dropped to their lowest levels in nearly a decade, showing a decisive trend toward long-term holding. Millions worth of ETH have been withdrawn from centralized exchanges in recent weeks, reflecting accumulation rather than panic.

For ETH price prediction models, such withdrawals often suggest reduced selling pressure. By prioritizing self-custody and staking, both whales and retail participants are creating conditions that may trigger a supply shock. If demand strengthens while liquidity remains low, the Ethereum price chart could shift into an accelerated uptrend.

Key Levels Flip from Resistance to Support

On the technical side, ETH price forecast sentiment improved after the asset cleanly retested a critical resistance zone, turning it into new support. Previous attempts at this level had ended in rejection, but the recent breakout marked a stronger market structure shift.

Every retest typically sparks short-term panic in ETH crypto markets. However, with support now confirmed, momentum suggests that Ethereum may be consolidating for another leg higher. Traders view this setup as a potential launchpad for ETH price to retest its prior all-time highs if buying pressure persists.

Institutional Confidence and Long-Term Outlook

Despite weaker ETF inflows, the overarching accumulation trend shows growing institutional conviction in Ethereum’s long-term prospects. Reduced liquidity on exchanges, combined with staking incentives and capital rotation from stablecoins, strengthens the ETH price forecast. The ETH price today, around $4,014, could be a staging ground for larger moves as supply conditions tighten further.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Ethereum’s price dipped due to a slowdown in ETF inflows, broader market risk-off sentiment, and cascading liquidations pushing it below the key $4,000 support level.

While recent ETH spot ETF inflows have slowed compared to last month, on-chain data shows a growing trend of long-term holding and accumulation, suggesting continued institutional conviction.

Despite short-term volatility, the long-term outlook for ETH is positive due to significant on-chain accumulation, declining exchange balances, and growing institutional confidence, all of which point to a potential supply shock.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.