ETH price steadies above $4.5K as Fund Market Premium turns positive

Neutral-to-positive on-chain sentiment signals rising institutional interest

Higher user activity and FOMC decision could fuel next leg higher

The ETH price has shown remarkable price action in recent weeks after it reached an ATH. Now, when writing, it is holding steady today above $4,500 while institutional demand strengthens.

The onchain data is turning positive, as the specific metric “Fund Market Premium ” (FMP) suggests that the curve is shifting back into positive territory and on-chain activity is climbing.

Therefore, the current market environment has brought renewed excitement to the ETH market, as today’s important decision from the FOMC would set the trajectory for the rest of the year.

But, opinions are tilting on the bullish side that could support a potential rally toward the $6,800 zone.

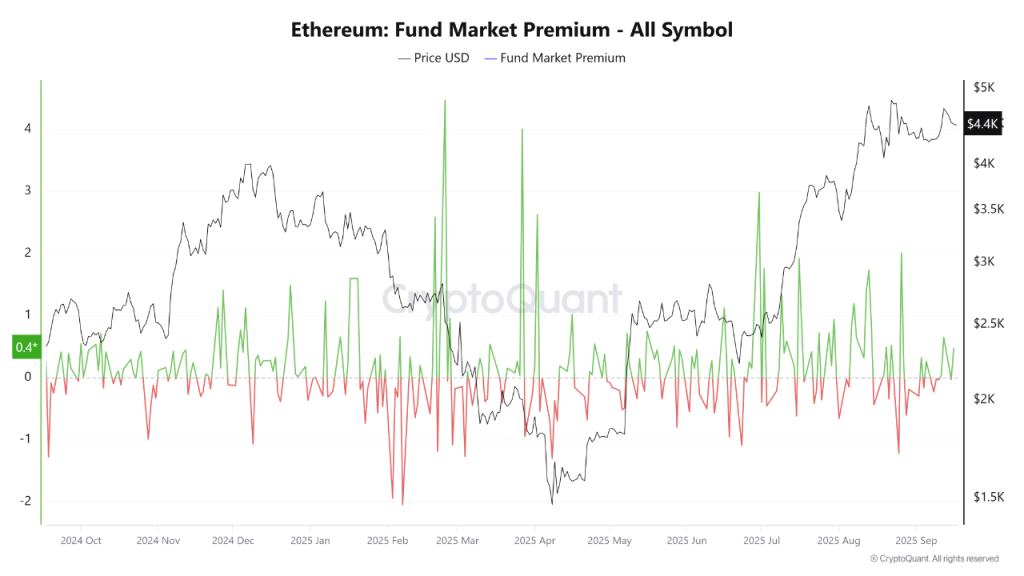

Positive Fund Market Premium Supports ETH Price Momentum

The Fund Market Premium (FMP) on CryptoQuant, which measures the price gap between futures contracts and spot markets, has been turning positive again.

Whereas, when the premium is positive, it means that for an asset, futures are trading at a premium over and above its spot market. It even represents the added demand from institutional investors that results in stronger, sustainable rallies.

That said, this trend was last played out in November 2024 until January 2025, during which a large pump was seen. After long months of waiting, now, once again, from July 2025 to now, as ETH continued its ascent.

This suggests that institutional confidence is returning, with buyers showing a willingness to pay a premium to secure positions in Ethereum crypto.

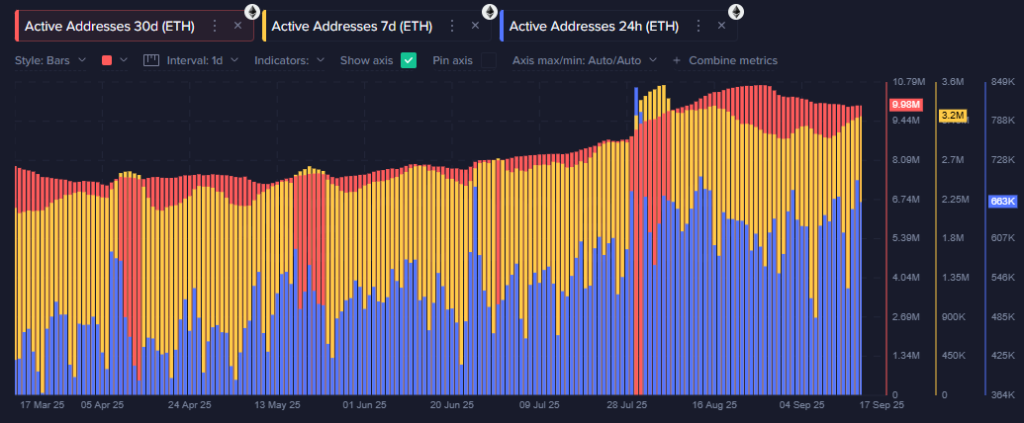

Rising Activity and FOMC Outcome Could Drive Further Upside

Another noteworthy factor supporting the bullish stance for the ETH price today is the rise in active addresses throughout Q3, based on on-chain data from Santiment.

This growing user activity clearly reflects broader participation on Ethereum’s network.

Additionally, macro event could further influence momentum and set the tone for sessions and even months ahead.

Today’s scheduled FOMC meeting has been speculated to be the most important meeting of the month, where a critical decision on interest rate cuts will take place.

If rates are reduced, it would be very good news for assets like Bitcoin and Ethereum, which will likely receive more capital inflow, boosting buying pressure that should take the ETH price to $6,800 within a few weeks.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.