Does Rising Hashrate Signal a Recovery in Bitcoin Price or Are Miners Still Capitulating?

Bitcoin price trades at $68,820 amid a public clash over miner behavior and recovery signals.

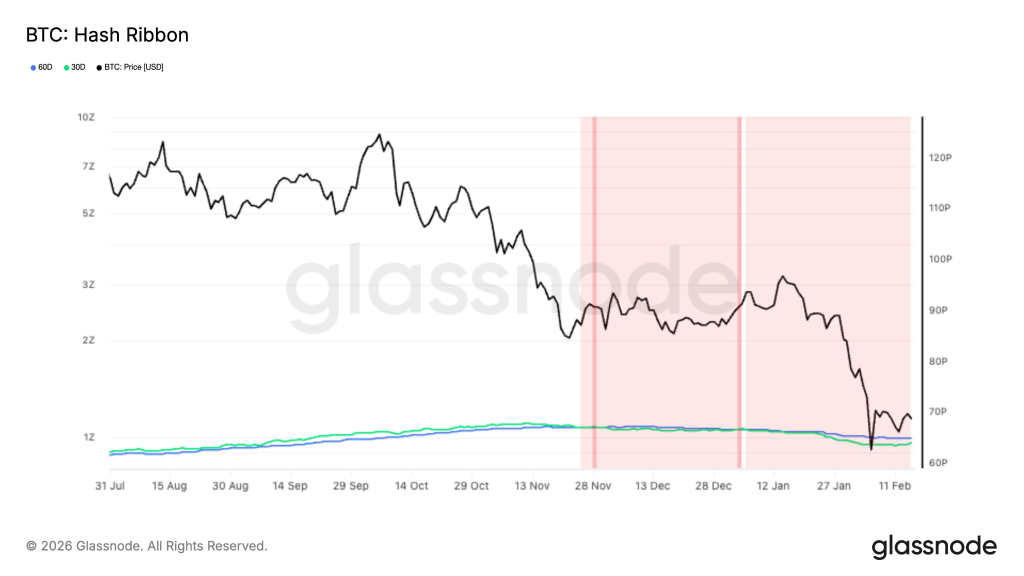

Rising BTC hashrate is cited by cryptorand as historically aligned with past market bottoms.

Ongoing miner selling and ETF outflows suggest capitulation may not be over.

The Bitcoin price is trading at $68,820, and a fresh debate over miner behavior and hashrate strength is now shaping the recovery narrative. With BTC price today hovering near recent lows, a public clash broke out between two of the most renowned analysts, “cryptorand’ and ‘alicharts’ over whether on-chain signals are flashing a bottom or signaling more downside.

Bullish Case: Hashrate and Panic Selling

One side of the argument from cryptorand is coming straightforwardly. He believes that historically, every major market bottom has coincided with three signals: a strong or recovering BTC hashrate, the end of miner capitulation, and widespread retail panic selling. According to this view, he announced that all three conditions are either visible or developing right now.

In particular, this analyst focused more on rising hashrate as the key driver of his analysis. As this shows, the network health and miner conviction are strong and rising, as he described.

Meanwhile, retail sentiment appears deeply shaken, a classic component of prior cycle troughs. From that angle, the current environment doesn’t look like a collapse, and it looks like a setup phase.

The logic is rooted in past observations. Where evidently previous bottoms formed when weaker hands exited, miners endured pressure, and the network itself remained resilient beneath the surface. Based on this, the analyst has argued that the same structure may now be unfolding again.

Bitcoin Price Bearish Counterpoint: Capitulation Isn’t Done

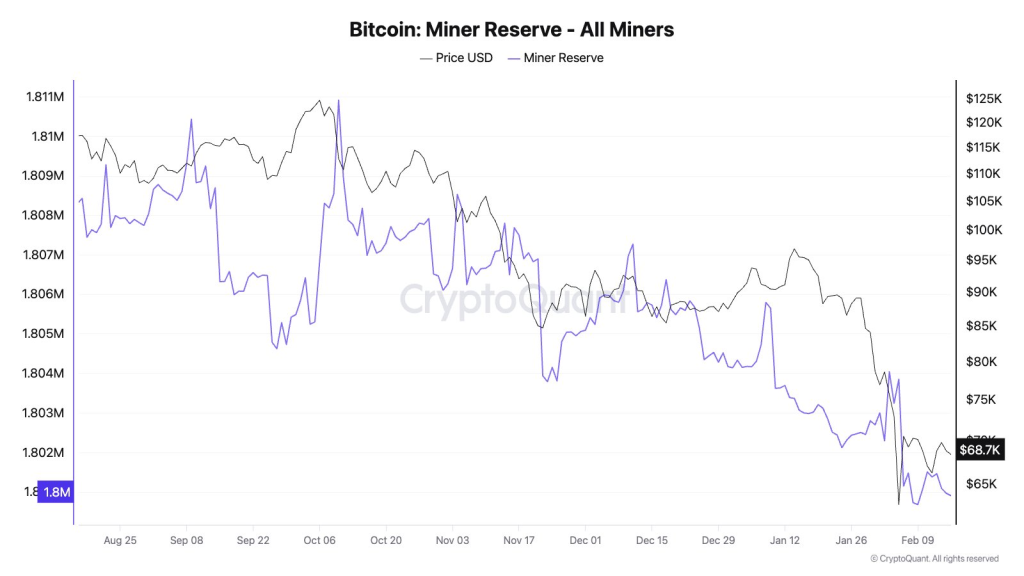

At the same time, a competing narrative from the analyst alicharts points to ongoing miner distribution and ETF outflows. The claim is that capitulation has not ended.

Miners, according to this view, are still selling into weakness. If true, that implies sustained pressure on supply. The Bitcoin Miner reserve metric becomes critical here. Persistent outflows from miner wallets would signal that forced selling hasn’t fully cleared.

Meanwhile, Bitcoin ETFs also selling adds another layer of complexity. Institutional flows can amplify directional momentum, especially when they align with broader risk-off dynamics. That means Bitcoin price action isn’t just a function of retail fear, infact it’s influenced by capital rotation at scale.

So while hashrate strength may look constructive, but ongoing distribution tempers the optimism.

Hashrate vs. Supply Pressure

From a technical perspective, the Bitcoin price chart sits at an inflection point. The $68,820 level reflects a market that hasn’t yet decisively reclaimed upside momentum nor broken into a new wave of capitulation.

Still, the chart suggests a tug-of-war. On the one hand, rising BTC hashrate implies operational commitment from miners, potentially signaling long-term confidence in Bitcoin’s crypto fundamentals.

On the other, continued miner selling and ETF outflows imply liquidity still needs to be absorbed before stabilization can take hold. That tension is what defines the current phase.

The bullish argument hinges on history repeating itself, that network resilience eventually overpowers short-term selling. On the contrary, the bearish case leans on real-time flows, arguing that as long as distribution persists, relief rallies could struggle to sustain traction.

In this standoff of opinions between cryptorand and alicharts, neither side is relying solely on speculation. Both point to measurable data: hashrate trends, miner reserve behavior, ETF activity, and visible retail panic.

Whether the Bitcoin price stabilizes from here or extends lower may ultimately depend on which force exhausts first, capitulating supply or sidelined demand waiting for confirmation.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.