Crypto Selloff – Bitcoin, Ethereum, XRP, and Altcoins Prices Fall as Liquidations Surge

Cryptocurrency market cap slips 2.74% to $4.16T as short-term momentum stalls.

Bitcoin dominance edges up to 57.6%, but average RSI signals oversold sentiment across altcoins.

Nearly $687.94M in liquidations and ETF outflows ignite a wave of risk-off selling.

The global cryptocurrency market today is facing a sharp cooldown. The total market capitalization dropped 2.74% in the last 24 hours to settle around $4.16 trillion. Even though trading volumes jumped to $240.649 billion, the overall sentiment has turned cautious. As I see it, this crypto selloff is driven by fading short-term momentum, heavy liquidations, and ETF outflows shaking confidence across digital assets.

That being said, Bitcoin continues to dominate with a 57.6% share, while Ethereum follows at 12.6%. The Altcoin Season Index stands at 53/100, suggesting the market is balanced rather than tilted toward altcoins. The Fear & Greed Index also cooled from yesterday’s 62 to a neutral 55, showing traders are becoming more defensive after days of aggressive buying. Meanwhile, the average RSI across the market sits at a low 42.72, hinting that several coins are nearing oversold zones.

Technical and Sentiment Analysis

When I checked the TradingView market cap chart, the price action seemed to struggle at the upper Bollinger Band after a short-lived rally. The latest candles show rejection signs, suggesting a temporary pause or pullback. RSI readings have slipped below 60, and the moving average is trending down, signaling that the crypto market news today points to more consolidation in the near term.

Also, as per CoinMarketCap, the CMC20 Index, which tracks large-cap cryptocurrencies, fell 3.09% to $264.41. This drop confirms that both Bitcoin and altcoins are facing widespread selling pressure.

Liquidation and ETF Flows Intensify Selling

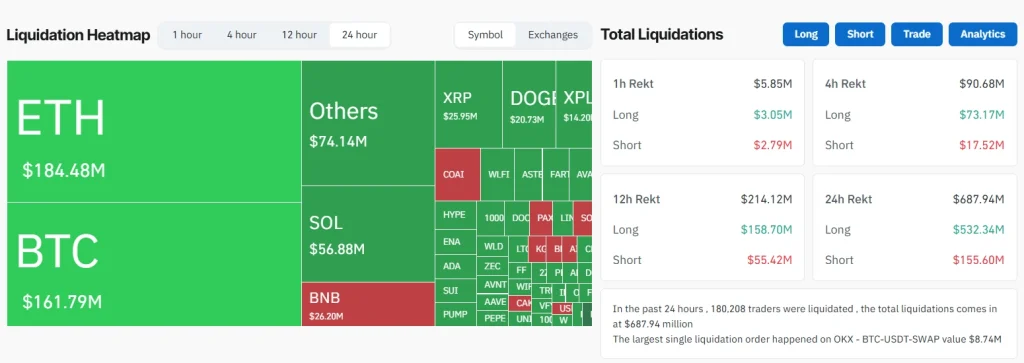

A big reason behind today’s decline is the surge in derivatives liquidations. According to Coinglass, almost $687.94 million worth of positions were wiped out in the last 24 hours. It is worth noting that those were mostly long trades accounting for about $532.34M. Bitcoin and Ethereum saw the largest hits, with liquidations of $161.79M and $184.48M, respectively. Major altcoins like BNB, SOL, and XRP also took damage as leverage washed out.

ETF activity added more weight to the selloff. Grayscale’s Bitcoin ETF recorded $28.6 million in net outflows, reversing its previous streak of inflows. Combined with a 22% jump in perpetual futures volume to $540T, these trends show traders are turning defensive. The dip in the Fear & Greed Index and Bitcoin’s failure to hold its $126k high only added fuel to the risk-off move dominating crypto news today.

Bitcoin, Ethereum, XRP, and Top Movers

Bitcoin led the decline, falling 2.61% in 24 hours to $121,413.99. It’s clear that Bitcoin’s struggle to hold new highs triggered a chain reaction. Where whales booked profits, and automated selling kicked in as exchange inflows crossed $5.7 billion.

The Ethereum price also felt the heat, plunging 5.98% as traders rotated back into Bitcoin ETFs. Breaking below key supports triggered stop-losses, worsening the fall. XRP slipped 4.9% after failing to hold support, while mixed ETF sentiment kept traders uneasy.

Not everything was red, though. Below are the top gainers and top losers.

Top Gainers & Losers:

CAKE managed to gain 5.7%, with WBNB and BNB showing modest rebounds between 1.9% and 2%. On the flip side, XPL tanked 17.1%, ENA fell 10.7%, and PENGU dropped 10.2%, underlining how volatile the cryptocurrency market today remains.

FAQs

The crypto market cap fell by 2.74% in the last 24 hours, settling at $4.16 trillion.

Roughly $687.94 million in liquidations hit the market as ETF outflows and a surge in derivatives volume increased risk-off sentiment, triggering automated selling and profit-taking.

Top gainers include CAKE with +5.7%, BNB with +2%, and WBNB with +1.9%. Top losers are XPL at -17.1%, ENA at -10.7%, and PENGU at -10.2%.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.