Crypto Market Crash: $380B Wiped Out as $2.6B Liquidations Push Bitcoin to $60K. What’s Next?

Bitcoin breaking below major support levels shows that sellers are in control, and confidence has taken a hit across the broader crypto market.

Bear market risk is rising but not confirmed, as BTC price is expected to reclaim lost levels as selling pressure is believed to ease in the coming sessions.

Bitcoin price recorded one of its sharpest single-day declines in recent years, a move not seen since the FTX collapse. The largest crypto crashed to an intraday low near $60,000, marking its first visit to this level since October 2024 and fully erasing gains made after the US presidential election.

The downside pressure quickly spread across the broader crypto market. Ethereum slipped below $1,800, while Solana broke under $70 for the first time since December 2023. Dogecoin also plunged below the $0.10 mark, intensifying risk-off sentiment and triggering panic across retail-heavy tokens.

With key supports breached across major assets, traders are now questioning whether Bitcoin and the wider crypto market have officially transitioned from a correction into a full-fledged bear market.

Top Reasons Why Bitcoin Price Dropped to $60,000

Since Bitcoin slipped below the psychological $100,000 level, market sentiment has shifted sharply. Both traders and institutions appear increasingly cautious, with confidence fading faster than in previous pullbacks.

Unlike past market crashes, triggered by systemic shocks such as the ICO bubble, COVID-led liquidity stress, the Terra ecosystem collapse, or the FTX failure, the current decline lacks a single catastrophic event. Instead, the sell-off reflects a technical breakdown in market structure, compounded by weakening conviction and reduced risk appetite among participants.

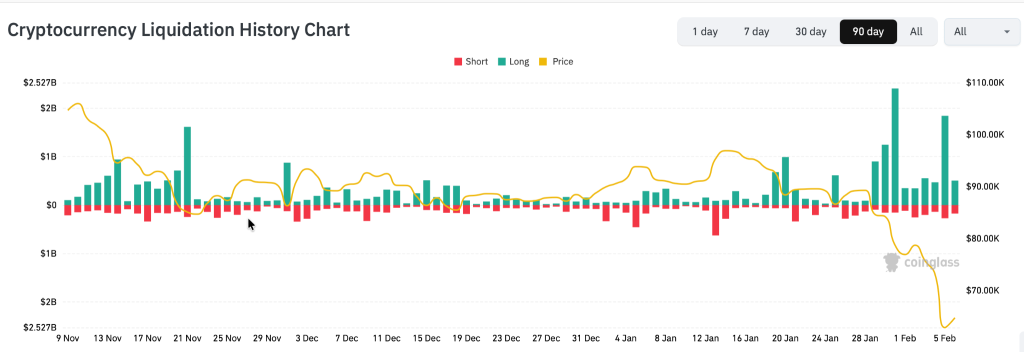

Massive Long Liquidations Took Control

Over the past few days, the crypto market has been under intense pressure, with liquidation numbers repeatedly crossing $1.5 billion to $2 billion. The latest sell-off was especially brutal, wiping out over $1.85 billion in long positions, making it the second-largest liquidation event of 2026, after the $2.4 billion flush seen on January 31.

The impact was widespread and painful. More than 500,000 traders were forced out of their positions as leverage unravelled across exchanges. The largest single liquidation—a Bitcoin long worth more than $12 million—was recorded on Binance, highlighting just how exposed even large players were to the downside move.

Bitcoin Price Dropped Below Key Technical Support

Bitcoin’s fall to $60,000 was driven by a clear technical breakdown rather than a headline-driven shock. The sell-off accelerated after BTC decisively lost the $65,000–$62,000 support zone, an area that had held multiple pullbacks over the past few weeks.

Once Bitcoin slipped below $62,000, stop-loss orders clustered in this range were triggered rapidly. This led to a sharp increase in sell pressure and opened the way to the next major liquidity pocket near $60,000, where the price briefly stabilised.

The breakdown was further confirmed as Bitcoin dropped below key trend indicators. BTC lost support at both the 50-day and 100-day moving averages, levels closely watched by swing traders and short-term institutions. The failure to reclaim these averages turned them into immediate resistance, strengthening the bearish bias.

Weak Dip Buying at Key Levels—Why Buyers Stepped Back

One thing that stood out during Bitcoin’s slide to $60,000 was how quietly buyers stepped back. When the price fell through the $65,000–$62,000 zone, there was no strong rush to buy the dip, unlike earlier pullbacks. Any short-term bounce was quickly sold, showing that traders were more focused on cutting risk than building new positions.

With volatility high and liquidations piling up, many chose to stay on the sidelines and wait for clarity. That lack of conviction left Bitcoin exposed, allowing sellers to stay in control and push the price down toward the $60,000 level.

The Bottom Line—Has the Crypto Market Officially Entered a Bear Market?

The recent sell-off has clearly changed the mood across the crypto market. Bitcoin losing the $60,000 level, repeated billion-dollar liquidation events, broken supports, and a lack of strong dip buying suggest this move is more serious than a normal correction. Confidence has weakened, risk appetite has dropped, and traders are no longer quick to step in on dips.

Still, calling this an official bear market may be too early. Bear markets usually show prolonged weakness and repeated failures to recover key levels, not just a sharp breakdown. Right now, the market feels stuck in between—no longer bullish, but not fully broken either.

What happens next matters most. If Bitcoin fails to reclaim lost levels and selling pressure continues, this phase could easily turn into a full-fledged bear market. For now, crypto stands at a decisive crossroads.

FAQs

Over $1.8B in long liquidations forced selling across exchanges, accelerating Bitcoin’s drop and dragging Ethereum, Solana, and memecoins lower.

Not officially yet. The market has turned fragile, but a true bear market needs sustained weakness and repeated failures to reclaim key levels.

$60,000 is critical short-term support. A failure to recover $62,000–$65,000 could signal deeper downside and stronger bearish momentum.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.