El Salvador's IMF deal and Bitcoin policy adjustments triggered a sharp decline in the crypto market.

Memecoins bucked the trend, with Solana's Fartcoin surging 608% amidst the market turmoil.

While the SEC's potential approval of new ETFs could provide long-term stability, short-term sell-offs are likely to continue.

The cryptocurrency market has been hit by a surprising development: El Salvador has struck a $1.4 billion deal with the International Monetary Fund (IMF), agreeing to adjust its Bitcoin policy.

Naturally, this has sent shockwaves, triggering immense bearish momentum. While major cryptos plummeted, meme coins are thriving in the chaos. Why? Let’s uncover.

Bitcoin Dips, Altcoins Follow

Bitcoin (BTC) saw a significant decline of 3.32%, trading at $97,697. In the past 24 hours, its price ranged between $95,537 and $102,747. Its market cap is now $2.05 trillion, and trading volume has slightly decreased to $39.57 billion.

A major factor behind the drop is a massive $682.04 million outflow from spot Bitcoin ETFs, with big names like Fidelity and Grayscale reporting large withdrawals.

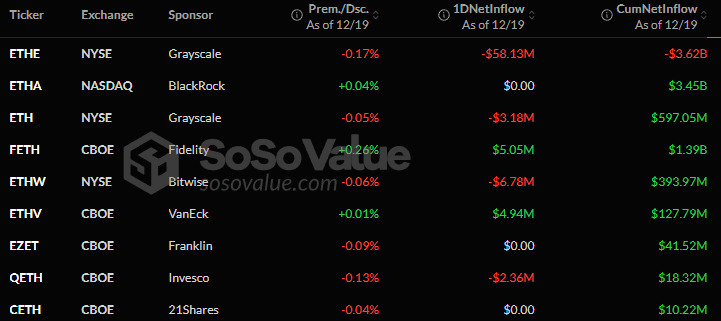

Ethereum (ETH) dropped 6.52% to $3,420. Grayscale’s Ethereum ETFs saw $58.13 million in outflows, although Fidelity and a few other firms reported small inflows. However, the overall sentiment is negative. Total spot ETH ETF outflows reached $70.45 million, adding to the selling pressure on Ethereum.

Solana (SOL) wasn’t spared either, falling 6.09% to $196.56. Although Solana’s trading volume increased slightly, it wasn’t enough to offset the losses. Analysts believe the bearish trend could continue, especially for major altcoins, given the current market conditions.

Meme Coins Defy the Trend

Amid the market chaos, meme coins are thriving. Solana’s Fartcoin, for example, has surged by an incredible 608%, reaching a market cap of $1.18 billion since December 5. This shows that even in tough times, some investors are still willing to chase risky, high-reward opportunities.

XRP has had a rollercoaster journey. After plunging 13% following the RLUSD stablecoin launch, it managed a modest recovery of 1.51%. While this bounce is small, it suggests that XRP investors are starting to regain some confidence.

Market Outlook: Bearish Now, but It Gets Better

The market looks uncertain, to say the least. Bitcoin and Ethereum could see more sell-offs as traders cash in on any opportunity amid the current volatility. But there’s some hope—the SEC’s approval of new ETFs might boost crypto’s integration into mainstream finance, giving the market some long-term stability.

For now, the Fear and Greed Index stands at 62, meaning investors are cautious but not yet in panic mode. If you’re watching the market, expect more volatility in the short term.

The market waits in suspense, but as always, the true test will come soon.