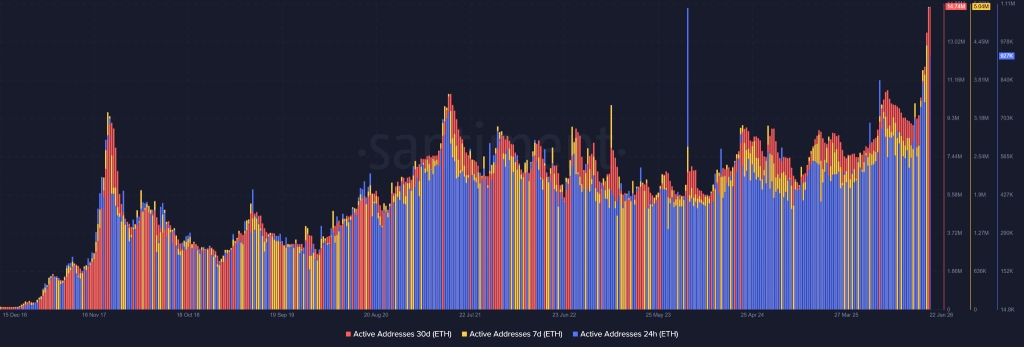

The ETH price utility has reached an all-time high in 2026, with a record 14.74 million active addresses on the 30-day moving average.

Bitwise reports that crypto-native company revenues are now outperforming traditional equity sectors, reflecting the successful monetization of blockchain infrastructure.

Stablecoin market capitalization has officially surpassed $300 billion, providing a massive liquidity cushion for the next leg of the ETH price recovery.

Bitwise, recently compared the ETH price current setup mirrors the structural recovery seen in early 2023. According to recent analysis by the firm, the broader crypto market likely formed a bear market bottom in the final quarter of 2025, setting the stage for a new growth cycle. While market sentiment remained fragile during that period, the underlying ETH price USD fundamentals had improved sharply, showing a significant divergence between stagnant price action and record-breaking on-chain activity.

Whale Momentum and the Supply-Side Crunch

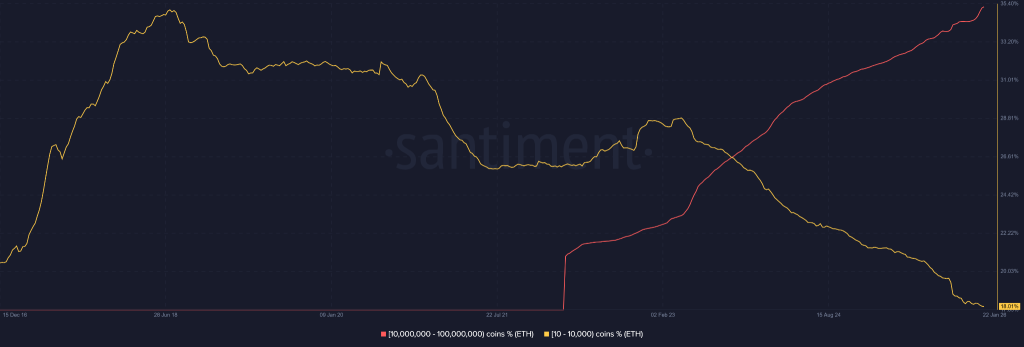

The current ETH crypto environment seems to be turning green. As on-chain data confirms that while smaller addresses holding between 10 and 10,000 coins have been reducing their exposure, entities holding between 10 million and 100 million ETH are aggressively absorbing the supply.

This strategic accumulation is further validated by a surge in whale transaction counts for orders exceeding $100,000 and $1 million. Historically, when these transaction peaks occurred last, most notably in September 2025 that’s when ETH price was at an all-time high of $4955. As these transactions begun rising on the 30-day MA again after Q4 2025 decline, a similar impulsive rise appears likely in Q1 2026.

ETH Price Chart Analysis and Resistance Levels

Examining the ETH price chart, a clear multiyear trendline has emerged as the most critical psychological and technical floor, currently holding firm near the $3,000 support zone.

Throughout December and into January 2026, the price has attempted to reclaim the 200-day EMA, though macro uncertainties have created temporary rejections. This rejection has compressed the daily price action between the trendline and the EMA band, creating a “coiling” effect that often leads to high-volatility breakouts.

If the bulls can maintain this momentum and flip the 200-day EMA into support, the ETH price prediction points toward immediate targets of $3,827 and $4,218.

The Road Ahead for Ethereum in 2026

As Q1 is ongoing, the ETH price USD trajectory will likely be influenced by major catalysts such as the proposed CLARITY Act and expanded access to crypto ETFs through traditional brokerage platforms.

Bitwise draws a compelling parallel to the early 2023 “stagnation” phase where the market was declared “dead” right before a massive expansion.

With exchange reserves continuing to decline and decentralized exchange volumes consistently outperforming centralized counterparts, the structural groundwork for a bullish ETH price forecast is more robust than ever.

Once the current bearish momentum fully settles, the combination of institutional backing and extreme network utility should drive the ETH price toward its next major milestone.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.