Amid the bearish market sentiment, Cardano’s (ADA) price prediction has become a key topic among traders as they assess the asset’s next move. This follows a breakdown from consolidation, which has shifted the overall market sentiment toward ADA tokens.

Cardano (ADA) Price Action and Upcoming Level

According to expert technical analysis, ADA has finally turned bearish and is poised to continue its price decline in the coming days. This shift in sentiment follows the breakdown of a consolidation phase that ADA has been experiencing between the $0.69 and $0.75 levels for several weeks.

Based on recent price action and historical momentum, there is a strong possibility that ADA could see a 5% price drop until it reaches the $0.625 level. Meanwhile, if the decline continues and a daily candle closes below the $0.622 level, there is a strong possibility that ADA’s price could plummet by 30% until it reaches the $0.425 level.

As of now, ADA is trading below the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating a bearish trend and weak price action for the asset.

Current Price Momentum

Despite these fluctuations, ADA is currently trading near $0.66, having recorded a price decline of over 1% in the past 24 hours. Meanwhile, during the same period, the asset’s trading volume dropped by 30%, indicating lower participation from traders and investors compared to previous days.

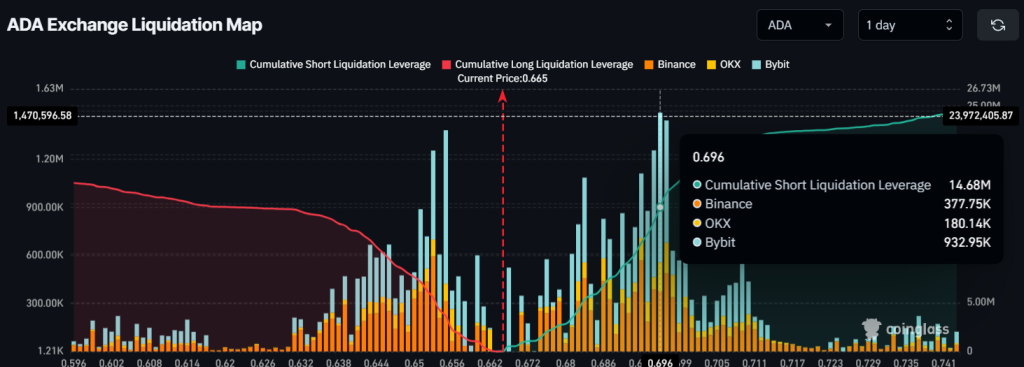

Key Liquidation Levels

With this bearish price action and continuous decline, traders’ market sentiment remains unchanged as they continue to favor the bearish side.

Data from the on-chain analytics firm Coinglass shows that traders are currently over-leveraged, with key levels at $0.655 on the lower side and $0.696 on the upper side. They have built $3.62 million worth of short positions and $14.80 million worth of combined long and short positions.