BTC price holds above $117K as institutions absorb retail selling

On-chain data shows accumulation while retail takes profits

Fed rate cut adds fuel as BTC eyes $124K-$130K range

The BTC price has held firm this September with candles mostly green in past 18 days, supported by steady institutional accumulation even as retail holders realize gains.

With strong on-chain signals for a coming rise, resilient support zones, and the most recent boost from the Fed’s recent rate cut, Bitcoin crypto appears to be inching closer to reclaiming its $124K all-time high, again.

Institutional Accumulation Outpaces Retail Selling

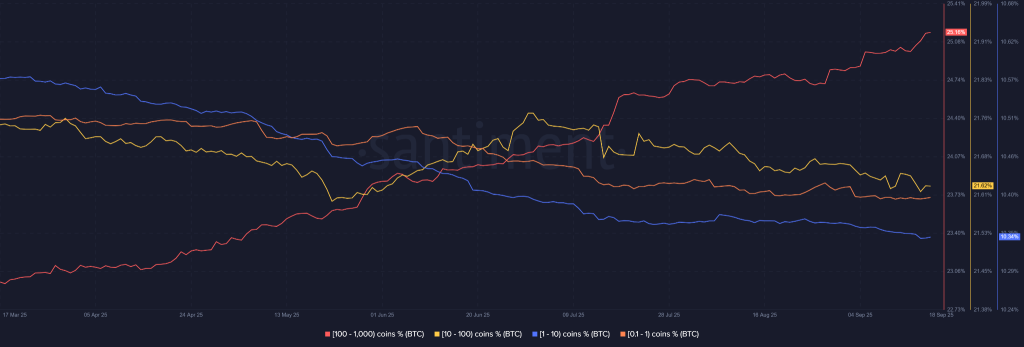

Recent on-chain data from Santiment charts shows that the retail holders are scared for losing on current gains, particularly those owning between 0.1 and 100 BTC. These addresses have been offloading their holdings to secure their profits.

This ongoing wave of retail selling has currently slowed the recovery pace in BTC, capping momentum in the short term.

However, from retail holders selling the larger holders are getting benefits as larger entities appear to be absorbing this supply. This is suggesting a structural transfer of Bitcoin from smaller hands to long-term institutional holders.

According to the santiment’s supply distribution metric, these institutions are not showing signs of distributing yet, reinforcing the idea that they are positioning and accumulating instead for a potential move toward new highs.

On-Chain Metrics Signal Optimism For Bitcoin Price

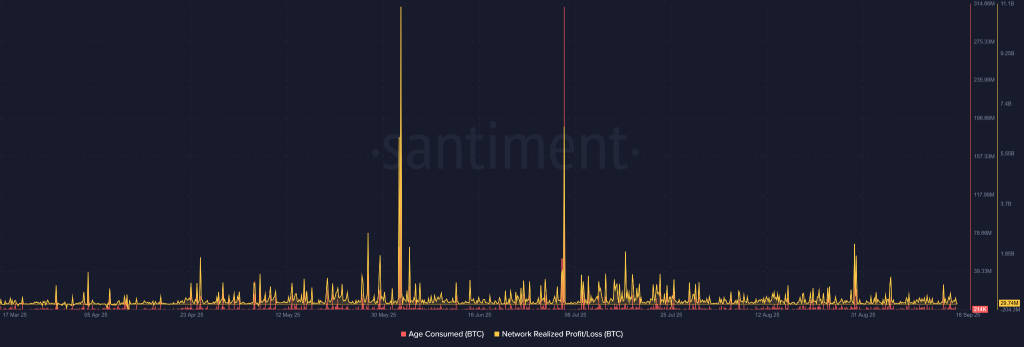

Further supporting this view, age-consumed metrics and the network realized profit/loss (NRPL) data reflect no significant selling activity through Q3 2025. Historically, a lack of major profit-taking while prices consolidate often signals strong accumulation phases.

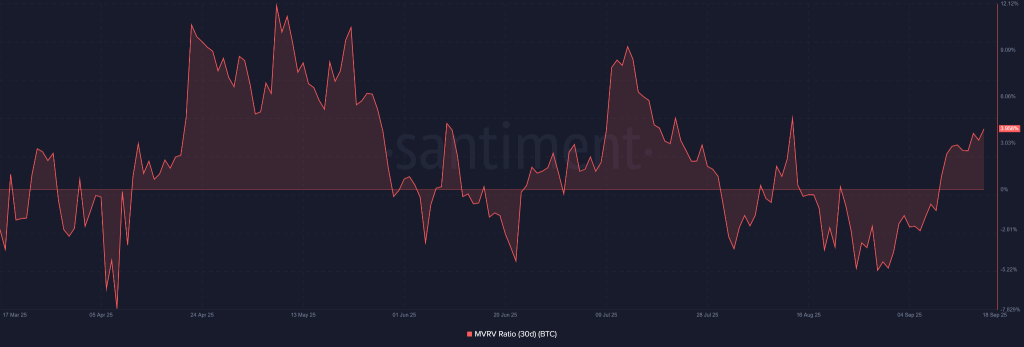

Meanwhile, the MVRV 30-day metric has flipped bullish this month, moving from -4.94% to +3.95%. This transition suggests that short-term holders are back in profit, adding another layer of confidence to the current BTC price forecast narrative.

The combination of steady hands accumulating and minimal profit-taking suggests the groundwork is being laid for the next major breakout.

September Strength Could Push BTC Toward $130K

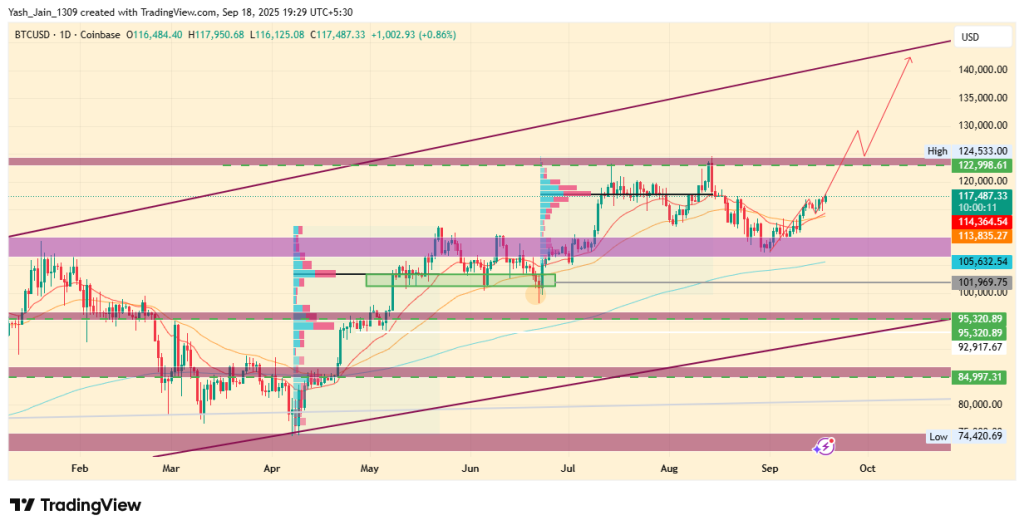

Price-wise, September has been marked by resilience. After taking support near $107K, BTC price today has climbed to around $117,475, which represents nearly 10% gains this month and a 1% intraday boost following the U.S. Federal Reserve’s 0.25 bps rate cut.

The Fed has also hinted at two more cuts this year, which could inject further liquidity into risk assets like Bitcoin crypto.

Technically, the Bitcoin price chart shows that the $107K zone, once a resistance area during July and August rallies, has now flipped into a solid support base.

Over the past 18 days, BTC has steadily climbed from this region, hinting at renewed momentum. If this trend sustains, reclaiming $124K appears likely, with some BTC price predictions eyeing a potential push toward $130K in the near term and even $150K in Q4.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.