BTC price could explode as scarcity index rises for the first time since June.

Hidden bullish divergence signals macro trend continuation.

Institutional buying reinforces bullish BTC price forecast.

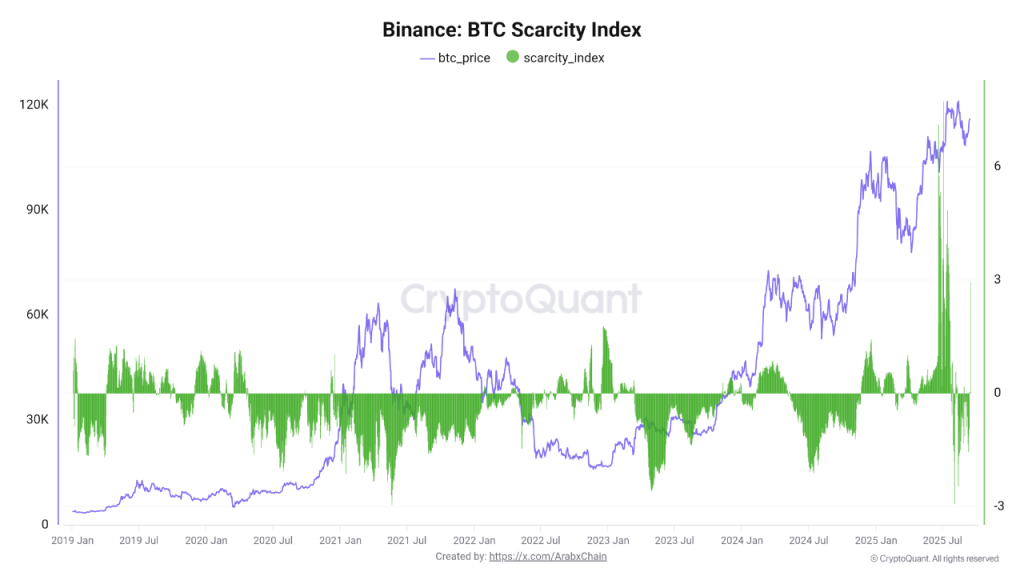

The BTC price is drawing attention after the Bitcoin Scarcity Index on Binance has once again recorded its first spike since June, which strongly suggests renewed buying pressure.

With BTC price today hovering near $114855, the sudden shift in scarcity has raised questions about whether a fresh accumulation phase could be underway that could send BTC higher from the current price.

Scarcity Spike Signals Renewed Buying Pressure In Bitcoin Price

The most recent update comes from tracking an onchain metric “Bitcoin Scarcity Index“. This tracks the balance between immediate buying power and the available supply on exchanges.

When the index rises sharply, it typically signals that either sell orders have declined or large investors are withdrawing Bitcoin from the platform.

This week’s jump suggests that demand has suddenly exceeded supply, which gives a hint at the entry of whales and institutions.

Notably, a similar spike last June preceded a strong rally that pushed the Bitcoin price chart toward the $124,000 region.

That said, if the current move sustains over several days, it could reflect the start of another accumulation phase.

Institutional Accumulation Strengthens Bullish Case

Adding weight to the bullish narrative, Michael Saylor’s disclosure revealed today that 525 BTC were recently acquired by “Strategy” for approximately $60.2 million at an average price of $114,562 per Bitcoin.

This purchase brought total holdings to 638,985 BTC, acquired for about $47.23 billion at an average price of $73,913 per coin, he said.

Such large-scale accumulation highlights growing institutional confidence aligning with CryptoQuant analysis and signals that significant players still view Bitcoin crypto as a long-term store of value.

Divergence Pattern Points to Macro Continuation

Amid the scarcity shift, the Bitcoin price USD also triggered a hidden weekly bullish divergence on its technical chart.

This signals underlying strength in the broader trend. It suggests that while short-term sentiment may appear mixed, the macro cycle still leans toward continuation of the bullish trend.

Historically, Bitcoin has shown similar setups before significant rallies. If the divergence plays out, the BTC price forecast suggests that it could lean bullish heading into the final quarter of the year.

Cyclical Patterns Hint at Strong Fourth Quarter

Meanwhile, a separate analysis comparing historical market cycles noted that Bitcoin rallied 72% from October to December last year.

Applying that same pattern to 2025 price action implies the possibility of BTC reaching near $200,000 before year-end if the rally repeats.

While not guaranteed, this perspective adds to the growing market optimism surrounding the BTC price prediction for the coming months.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The Bitcoin Scarcity Index on Binance measures the balance between buying power and available supply on the exchange. A spike suggests that demand is exceeding supply, often hinting at renewed accumulation.

Institutional accumulation, like the recent purchase by Michael Saylor, signals strong confidence from major players. This can add significant buying pressure, validating Bitcoin’s role as a long-term store of value.

Some analysis, based on historical market cycles, suggests a possibility of Bitcoin reaching $200,000. However, this is not guaranteed and depends on sustained bullish momentum through the end of the year.

The recent scarcity spike and institutional buying suggest renewed interest, which may signal the start of an accumulation phase. However, individual investors should conduct their own research and consider their risk tolerance.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.