Bitcoin White Paper 17th Anniversary: BTC Nears $110K Amid ETF Momentum and Fed Rate Cut

Bitcoin white paper celebrates its 17th anniversary as BTC stands strong near $109,980.

Institutional adoption, spot ETFs, and macro shifts fuel Bitcoin’s continued dominance and resilience.

Policy decisions and liquidity inflows could define Bitcoin’s year-end trajectory.

As the Bitcoin white paper marks its 17th anniversary, the world reflects on how a simple email from Satoshi Nakamoto transformed global finance. Seventeen years in, BTC crypto is now leaving its adolescence and entering adulthood. From its humble beginnings at $0.00076 to today’s Bitcoin price USD of over $109,980, Bitcoin’s story displays the world’s largest rise of a decentralized financial revolution.

How the Bitcoin White Paper Sparked the Digital Currency Revolution

On October 31, 2008, Satoshi Nakamoto introduced the Bitcoin white paper to a mailing list of cryptography enthusiasts under the subject line “Bitcoin P2P e-cash paper.”

The mail was pretty brief, describing a peer-to-peer digital currency system. This laid the groundwork for what BTC has turned out to be today, as the world’s first decentralized monetary network.

Just over a couple of months later, in early 2009, the first Bitcoin block, known as the Genesis Block, was mined. That began as a small experiment, which later evolved into a financial revolution.

In its early days, Bitcoin crypto traded at mere fractions of a cent on platforms like New Liberty Standard in 2009, according to a Reddit discussion post, where a single BTC was valued at just $0.0007639.

Fast forward to 2025, and the Bitcoin price chart tells a completely jaw-dropping and bone-breaking story. Today’s Bitcoin price USD is near $109,890, representing an astronomical 14.6 million percent gain since its inception. This is an achievement unmatched in the history of modern finance, having surpassed every shiny metal in existence in terms of the fastest gains.

Seventeen Years of Change: From Skepticism to Global Integration

“Seventeen years to the Bitcoin Whitepaper! This isn’t just an anniversary; it’s the moment when the entire crypto space transitioned from idea to reality.

It still holds the crown, accounting for over half of the market cap, and every innovation we see can be traced back to that one document. The legacy is simple: the future of finance is built on transparency, technology, and the collective belief in an open system.”-Edul Patel, CEO of Mudrex.

Over the past 17 years, perceptions around Bitcoin have undergone a complete transformation. What was once dismissed by institutions and governments is now recognized as a strategic asset of importance.

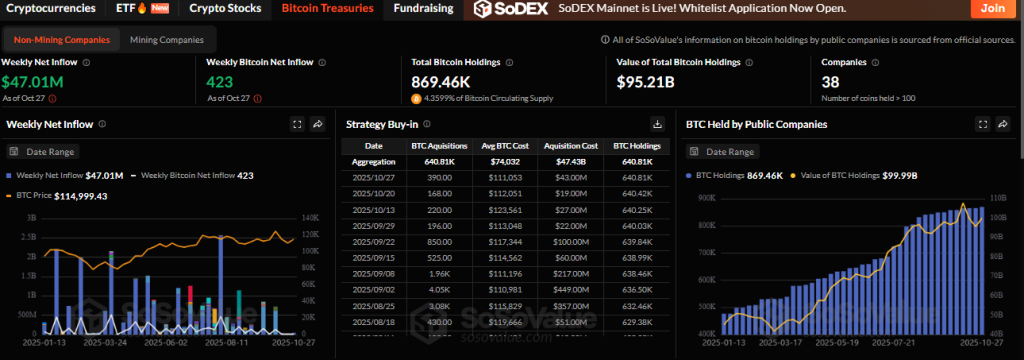

As a result of its demand, the price has increased significantly, which is clear evidence of this. Major corporations now hold Bitcoin in their treasuries, while nations like US, China, El Salvador, and others have integrated it into their official reserves.

The launch of spot Bitcoin ETFs in Q1 2024 marked another significant shift, providing institutional investors with secure, regulated exposure to BTC. The BTC ETF total net assets have reached $143.94 billion with 12 ETF issuers.

This move strengthened Bitcoin’s legitimacy and deepened its integration into global financial systems. The Bitcoin white paper 17th anniversary arrives at a time when Bitcoin commands a $2.18 trillion market cap and dominates 59.4% of the entire crypto market.

Its scarcity is even more attractive than gold. With a hard cap of 21 million coins, its value proposition as “digital gold” has only grown stronger. This remained Bitcoin’s defining feature, and its fast growth on its Bitcoin price chart is clear evidence.

Combined with growing institutional frameworks and an inflation-hedge narrative, Bitcoin continues to attract new waves of capital amid global economic uncertainty.

- Also Read :

- Is It Too Late to Buy Bitcoin and Crypto in 2025?

- ,

Macro Tailwinds and Year-End Price Outlook

Despite recent volatility, Bitcoin price today remains resilient, holding firm near $109,980 even as global markets faced risks from the U.S. government shutdown. The Federal Reserve’s recent 25-basis-point rate cut, coupled with its decision to end quantitative tightening (QT) on December 1, 2025, could prove pivotal for Bitcoin’s next move.

If these monetary shifts inject new liquidity into markets, Bitcoin price prediction models point toward a potential retest of $120,000 in the short term or even a retest of its ATH level.

However, the long-term BTC narrative remains strongly bullish, with $126,296 being flipped, $135K would be the first target out of many higher.

As 2025 approaches its final months, the Bitcoin white paper legacy stands as a testament to resilience, innovation, and unstoppable global adoption.

FAQs

The Bitcoin White Paper, released by Satoshi Nakamoto in 2008, introduced the concept of peer-to-peer digital money, sparking today’s crypto revolution.

When Bitcoin launched in 2009, it traded at just $0.00076. Today, it’s worth over $109,000—one of the biggest financial rises in history.

Bitcoin has grown from a niche tech idea to a global asset, embraced by institutions, governments, and ETFs, shaping the future of digital finance.

Analysts expect Bitcoin could retest $120,000 or higher by year-end as easing U.S. monetary policy and rising adoption fuel fresh market optimism.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.