Mid-sized whales are aggressively accumulating, signalling high confidence in Bitcoin’s upside potential.

If the BTC price clears $100K, momentum could quickly drive Bitcoin toward $110K–$115K, with a long-term target of $130K+.

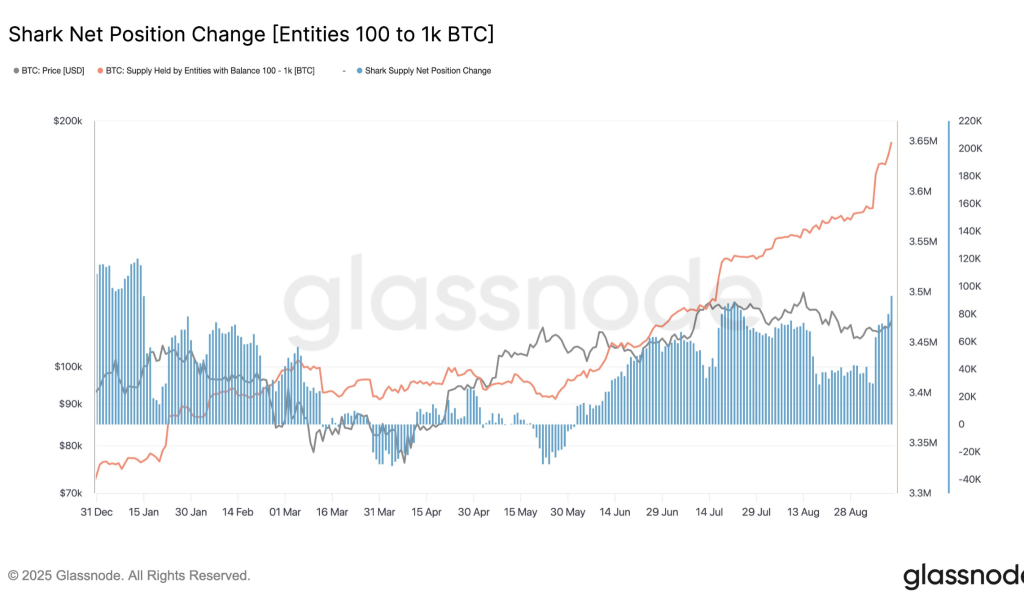

Bitcoin (BTC) price continues to trade in a tight range between $90,000 and $100,000, but on-chain data reveals that mid-sized whales, also known as “sharks” (wallets holding 100–1,000 BTC), are quietly reshaping the market. According to Glassnode, these entities have ramped up their accumulation aggressively since July 2025, pushing their total holdings to a fresh all-time high of over 3.65 million BTC. This growing concentration of supply in stronger hands could have a significant impact on Bitcoin’s next major price move.

Shark Accumulation at Record Highs

The latest data shows that shark entities are not only accumulating but doing so at the fastest pace seen this year. The Shark Net Position Change has turned strongly positive, meaning these holders are consistently adding to their stacks rather than selling into rallies. This type of accumulation has historically preceded major bullish phases in Bitcoin, as it reflects strong conviction from entities with substantial capital at stake.

The data from Glassnode suggests that Bitcoin entities holding 100 to 1000 BTC, which are called ‘Sharks,’ have been accumulating the token progressively. In the past seven days, their holdings have risen by nearly 65,000 BTC, with the total holdings recording nearly 3.65 million. This aggressive buying from large holders is pushing BTC net supply into a deficit, with these holders absorbing both new issuance and secondary market coins.

Why It Matters for Bitcoin’s Price

Bitcoin is holding above the critical $112,000 support, which has acted as a strong demand zone in recent weeks. Moreover, the latest jump above $113,800 has attracted huge buying across the platform. As a result, the momentum has flipped in favour of the bulls, suggesting a continuation of a breakout. However, to do so, the BTC price is required to clear a major resistance that could elevate the token above bearish influence.

Bitcoin (BTC) is consolidating around $113,957, with Bollinger Bands tightening, hinting at a volatility-driven move. Key resistance levels stand at $114,827 and $118,617. A breakout above $115K could open the path toward $120,000–$125,000 in the short term. On the downside, immediate support is at $113,345, followed by $107,274 and $103,950. A breakdown below $103K could extend losses toward $98,200. Overall, holding above $113K keeps the bias bullish, with the next upside target set at $125K.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.