Bitcoin surges to $91.5K as the crypto market adds $130B ahead of Thanksgiving, but traders expect quiet volatility and key retests before the next big move.

A shift in macro forces and improving market structure fuel hopes for a December breakout, with Bitcoin eyeing $100K if resistance levels hold after the holiday.

The crypto market today is roaring ahead of Thanksgiving, adding more than $130 billion in the last 24 hours and reclaiming the $3.2 trillion mark.

Bitcoin price led the move, jumping to around $91,500 early Thursday. This was largely expected, as holiday periods like Thanksgiving often lead to small, low-volume price boosts.

Traders warn that volatility will likely remain quiet until Sunday, making this a time for patience. After such a sharp move up, fresh long positions are risky, while shorts still require proper confirmation. Many are simply watching major key support levels as the holiday calm sets in.

Analysts like Michaël van de Poppe view the break above $90,000 as encouraging but caution that consolidation is needed before another surge.

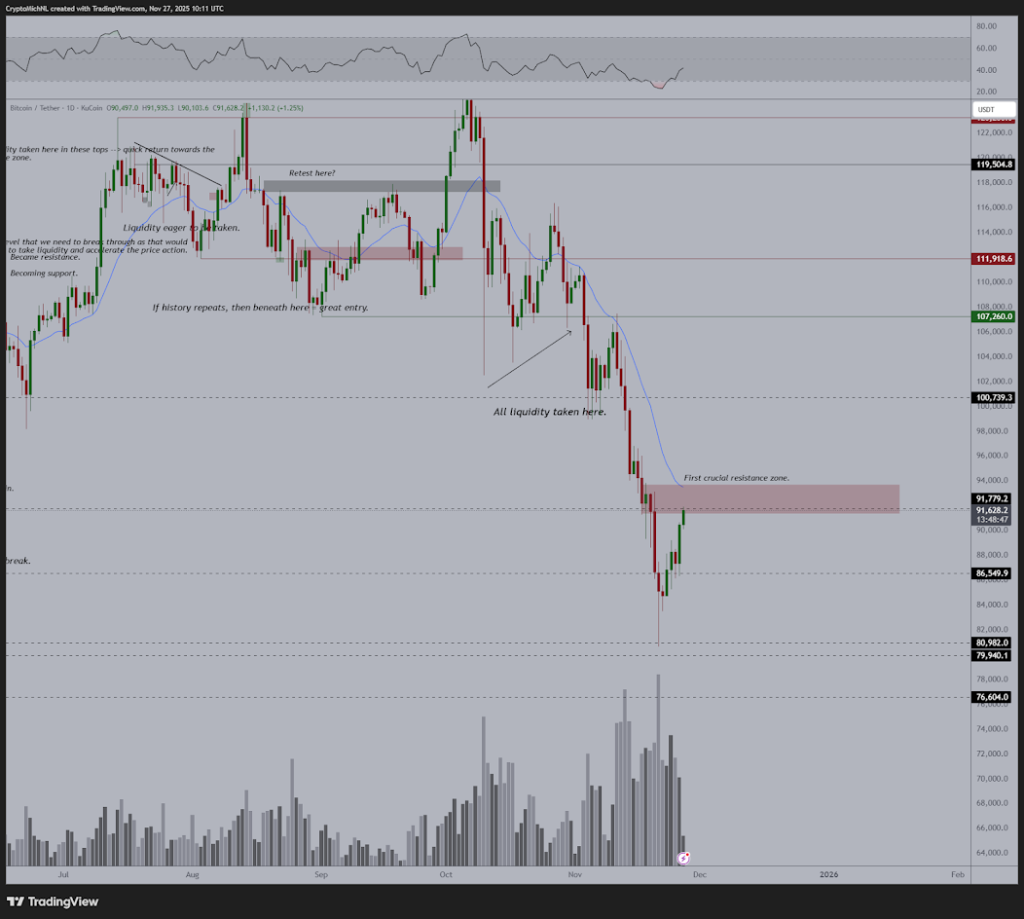

Short-term traders are eyeing the $91,000–$92,000 region for a possible short setup later this week, while others would prefer a healthy retest around $88,000 to strengthen the trend. Liquidity remains heavily stacked to the upside, though notable clusters are forming between $85,000 and $86,000, hinting at where volatility may return after the weekend.

Technically, Bitcoin is forming a descending broadening wedge on the four-hour chart, often seen during bottoming periods.

A confirmed breakout above $100,000 would give bulls a strong setup heading into December.

- Also Read :

- Crypto Market Rallies: Top Reasons That Lifted Bitcoin (BTC) Price Back Toward $91,000

- ,

Macro Trends Point to a Changing Bitcoin Cycle

Beyond the charts, broader market forces are influencing Bitcoin’s behavior. Some analysts argue that the traditional four-year Bitcoin cycle is shifting, shaped more by fiscal policy and liquidity flows than by miner halvings.

They point out that much of the rally from late 2022 to 2025 was driven by fiscal spending, AI-driven growth, and steady liquidity injections.

The Federal Reserve is expected to end quantitative tightening in December, but experts say Treasury issuance and fiscal dominance will continue to drive overall liquidity conditions. With risk assets supported and Bitcoin defending key support zones, the market is showing early signs of stabilizing after recent fear-driven moves.

Overall, Bitcoin’s bounce is strong, the structure is improving, and the next reaction at resistance will determine whether the market is preparing for a December breakout toward $100,000. The coming days, especially after the holiday pause, will reveal whether this rally has more room to run.

FAQs

The market is climbing on low holiday trading, fresh liquidity, and Bitcoin’s break above key levels, boosting short-term confidence.

Shifts in liquidity, fiscal spending, and the Fed ending tightening may support risk assets, helping Bitcoin stabilize after recent pullbacks.

A breakout above $100K is possible if momentum builds after the holiday pause, but bulls need strong confirmation at current resistance levels.

With increased adoption, the price of Bitcoin could reach a height of $901,383.47 in 2030.

As per our latest BTC price analysis, Bitcoin could reach a maximum price of $13,532,059.98

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.