Bitcoin Price Rises While Social Sentiment Stays Pessimistic—A Setup for the Next Bullish Move?

Bitcoin price rose above the consolidated zone, while the traders appear to be in disbelief as the sentiments turn against the price action

The growing fear among the market participants may fuel the bullish momentum and eventually push the BTC price to $100K.

Bitcoin (BTC) price is back in motion after a tight consolidation phase by pushing higher even as the broader market remains cautious. Typically, a breakout invites optimism. This time, the reaction looks different: sentiment indicators suggest traders are still hesitant to trust the move, and social commentary is skewing more negative despite the upside.

That mismatch, price rising while conviction lags, is often where rallies can surprise. When the crowd stays fearful, it leaves room for sidelined capital to re-enter and for short positioning to unwind, both of which can add fuel to continuation. With BTC now holding above its previous range, the focus shifts to whether disbelief fades or whether it powers the next leg toward the $100K psychological mark.

Traders Stay Skeptical Even as Bitcoin Breaks Out

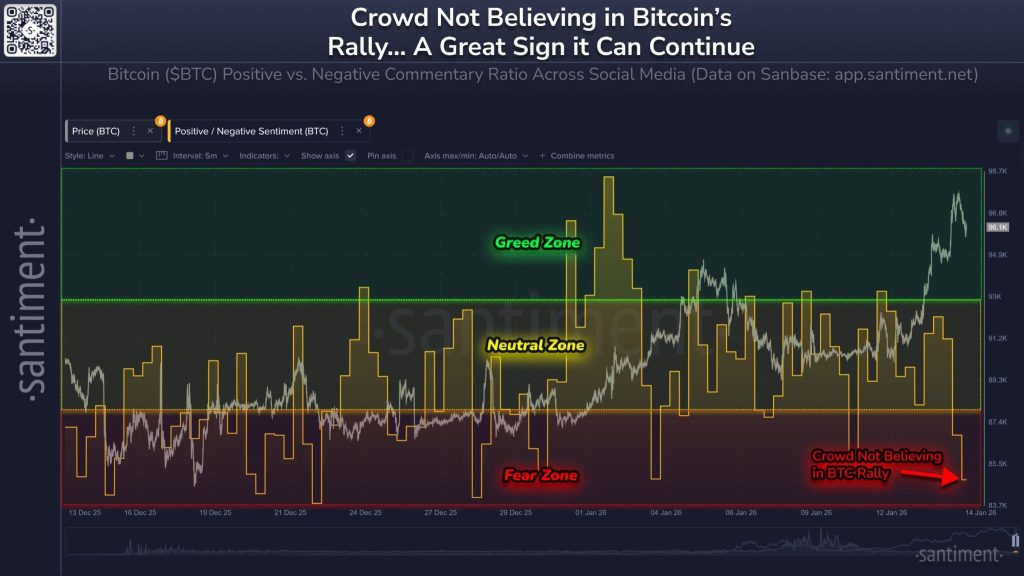

In strong trends, price often moves first and sentiment follows later. Right now, Bitcoin is showing that classic disconnect: it’s pushing higher after breaking out of consolidation, yet the crowd still looks unconvinced. Santiment’s positive vs. negative commentary ratio underscores this shift, dropping into the fear zone even as BTC trends upward on the price line.

That combination typically signals a “disbelief rally,” where traders hesitate to chase, shorts remain active, and sidelined capital waits for a pullback that may not come. Ironically, that caution can help extend upside because the market isn’t overcrowded with euphoric longs. The key is follow-through: if BTC holds above the breakout range, this pessimism can act as fuel, keeping the $100K psychological level firmly in focus.

Bitcoin Price Outlook: Can Sentiment Fuel a Run Toward $100K?

With BTC holding above its former consolidation band, the next phase depends on whether buyers can defend the breakout while sentiment stays cautious. When disbelief lingers, rallies often grind higher because dips get bought and bearish bets unwind in waves. A steady push toward $100K becomes more likely if Bitcoin price keeps printing higher highs and higher lows and avoids slipping back into the previous range.

That said, the risk is straightforward: if BTC loses the breakout level and sentiment remains fearful, the market can interpret it as a failed move, triggering profit-taking and a deeper pullback. For bulls, the cleanest confirmation would be continued closes above the prior range, followed by a successful retest. For now, Santiment’s fear-zone reading suggests the rally isn’t overcrowded, which can keep upside momentum intact—provided price structure doesn’t break.

FAQs

If Bitcoin continues upward, it may restore confidence across altcoins and DeFi projects, encouraging more trading activity and potentially attracting new institutional and retail investors.

Active short positions create potential for short squeezes, where forced buying drives BTC higher. This dynamic can amplify upward moves even if overall sentiment remains cautious.

Retail traders, institutional investors, and crypto-focused funds are most impacted, as holding or entering positions during the breakout can influence portfolios and trading strategies.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.