Bitcoin price has followed Gold in bullish breakout amid anticipated Q4 rally.

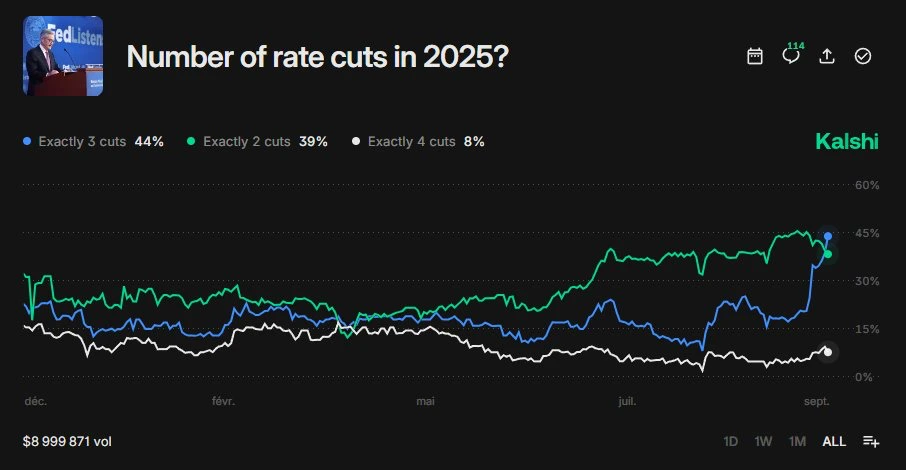

The odds of three Fed rate cuts in 2025 have overtaken two as President Donald Trump advocates for a big rate cut.

The cooler than expected PPI data has increased the chances of a Fed rate cut next week.

Bitcoin (BTC) price has rallied above $114k for the first time in more than two weeks on Wednesday, September 10. The flagship coin surged above a key midterm resistance level around $113.5k during the mid-New York session, after three failed attempts in the past two weeks.

The wider altcoin industry followed in tandem, led by Binance Coin (BNB) and Solana (SOL), thus pushing the total crypto market cap above $4 trillion again.

Bitcoin Price Edges Higher on Rising Odds of Fed Rate Cuts

Bitcoin and the wider crypto market rallied on Wednesday following the release of August PPI inflation, which fell to 2.6% below the expectations of 3.3%. Additionally, the Core PPI dropped to 2.8%, below the market expectations of 3.5%, thus increasing the odds of Fed rate cut next week.

According to market data from Kalshi, the chances of a 25 bps Fed rate cut is at 80% while the odds of a rate cut higher than 25bps is at 18%. Meanwhile, Kalshi traders project the chance of 3 rate cuts at 44%, higher than 2 rate cuts at 39%, which overtook it for the first time since April.

Wells Fargo on Fed Rate Cuts

Wells Fargo analysts expect the Federal Reserve to deliver five 25 bps rate cuts through mid 2026. The bank projects that the Fed will lower its benchmark interest rates to 3.5% and 3.75% by the end of this year.

Meanwhile, President Donald Trump urged Fed Chair Jerome Powell to lower rates in a big way during the next meeting. Moreover, the weakening labor market amid low inflation are great conditions for the Fed to lower its interest rates to boost the economy.

What’s Next for Crypto?

The crypto market is expected to record bullish sentiment if the Fed initiates rate cut next week. The demand for risky assets is expected to surge in tandem with the growing global money supply during the fourth quarter.

Furthermore, Gold price recently broke out of its consolidation and has since rallied to a new all-time high of above $3,670 per ounce. Bitcoin price is well positioned to rally towards a new ATH if it consistently closes above the resistance level around $120k.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.