As of June 4, 2025, the Bitcoin price is $105,779, up 0.40% from the previous day, with a tight daily range.

On-chain metrics indicate a resurgence of long-term bullish momentum, with institutional investors accumulating BTC.

Meanwhile, Retail participation remains low, with smaller transfers declining, reflecting cautious sentiment.

As of June 4, 2025, Bitcoin price today is trading around $105,779, showing a modest 0.40% gain from the previous day. The daily range has remained tight.

As Bitcoin continues to hover above the $105,000 mark, recent on-chain metrics suggest that BTC bullish long-term bullish momentum is resurging and institutional investors are loading up for a new wave of bullish momentum. However, retail euphoria, which is often seen as the final push in a true bull run, has yet to arrive.

The current developments shows bullish undercurrent despite the short-term bearishness.Keep reading to know more.

Binance Spot Volume And LTH Realized Cap On Rise

According to CryptoQuant’s analysis there has been a significant advancement from 26% to 35% in spot trading volume on Binance. This uptick in volume is a strong signal that big players are actively accumulating BTC.

Another bullish sign is the behavior of long-term holders, as many wallets that have held Bitcoin for over 155 days are not moving their assets, and the rise of these wallets have crossed $20 Billion suggests smart money accumulation is advancing.

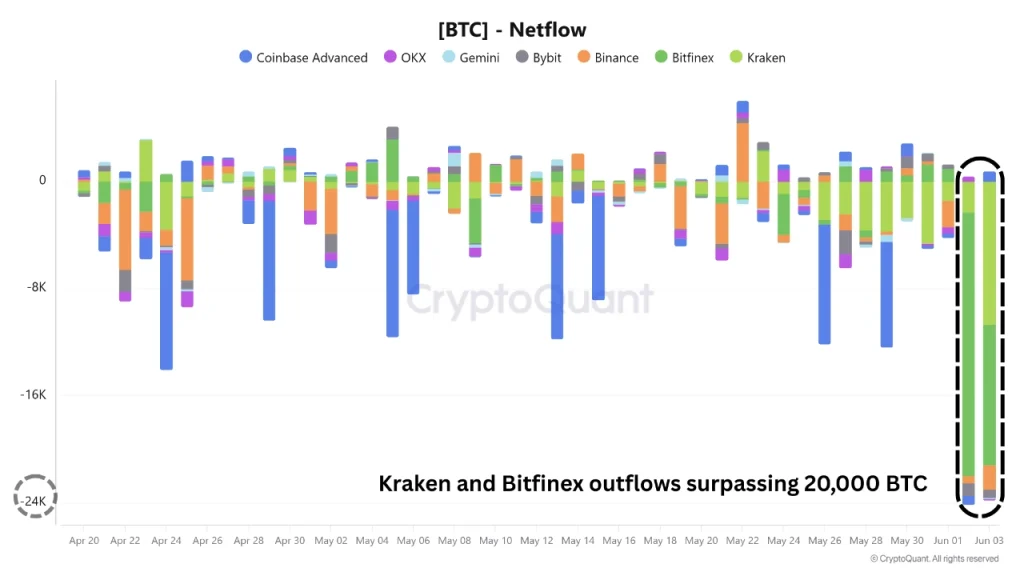

Moreover, Kraken and Bitfinex in recent days saw major outflows exceeding 20,000 BTC, which is largest in recent months of this year. The long-term Bitcoin price prediction paints a bullish picture, as declining BTC reserves and LTH’s underlying demand suggests that uptrend will continue in coming months and is far from over.

Retail Participation Still Low: WHat This Means For BTC?

While institutions and seasoned investors are showing renewed confidence, retail traders appear hesitant. A separate CryptoQuant analysis reveals that on-chain activity involving smaller transfers (under $10,000) has declined by 2.45% over the last 30 days.

Their absence could either mean the bull run is still in its early stages or that cautious sentiment remains from the Q1 2025’s market downturns.

The current state of the Bitcoin price shows a divergence between institutional optimism and retail hesitation, which is not good for BTC price returns. The Bitcoin price prediction suggest that If this divergence continues then it could offer a period of sustained growth without the rapid, volatile spikes driven by retail FOMO.

However, for the BTC price to break into new all-time highs, lets say for instance the nearest one is $120K then a return of widespread retail participation may still be needed.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

With a potential surge, the Bitcoin (BTC) price may close the month with a high of $110,000.

As per Coinpedia’s BTC price prediction, the Bitcoin price could peak at $168k this year if the bullish sentiment sustains.

With increased adoption, the price of Bitcoin could reach a height of $901,383.47 in 2030.