Rising wedge pattern raises fears of a potential trend reversal.

Whale accumulation rises while retail selling accelerates.

Analysts suggest bullish patterns formation hinting at a $135K upside breakout.

The Bitcoin price USD has nearly doubled since U.S. President Donald Trump returned to office, reaching an all-time high of $123,231. However, the recent shift into consolidation has triggered investor concerns, and experts are in a tug of war between bullish and bearish views, creating an uncertain atmosphere for its price action.

The altcoins showing selling spikes are creating chaos for top crypto, as many are raising doubts that the current rally may be nearing exhaustion and a fall could be on the horizon. While others advocate it as a healthy halt.

Bitcoin Price USD Shows Signs of Exhaustion Near $123K

After a strong rally through the first half of the year, the Bitcoin price has successfully marked its latest peak at $123,231. This level was a new all-time high, pushing bullish sentiment to fresh highs. Yet, over the past few days, the rally has paused, and the Bitcoin price USD has transitioned into a sideways consolidation phase.

When writing, the Bitcoin price today is exchanging hands at $118,681 with a 24-hour volume of $73.62 billion. Overall, it remains in a broader uptrend on the daily Bitcoin USD chart.

However, market watchers are becoming cautious, particularly due to the rising wedge pattern forming in multi-month price action, which is raising the sweat. This pattern is typically associated with trend exhaustion and raises the possibility of a reversal, especially if selling pressure builds.

Bull Flag and Pennant Patterns Signal Potential Continuation

Despite concerns, some technical analysts believe the ongoing BTC price behavior may be a temporary pause rather than a topping formation.

Prior to this consolidation, the Bitcoin price USD had broken out of a bullish flag pattern and its upside potential target is anticipated to be between $130K and $135K.

Moreover, following the brief retreat from $123,231, BTC USD price action now appears to be forming a smaller bullish pennant, which is a continuation pattern that often emerges mid-rally.

The breakout from this pennant has already occurred, and Bitcoin appears to be retesting for liquidity around the $118K – $120K zone, suggesting possible readiness for a renewed upward move.

Retail Exit, Whale Entry: Supply Shift Could Drive Next Leg

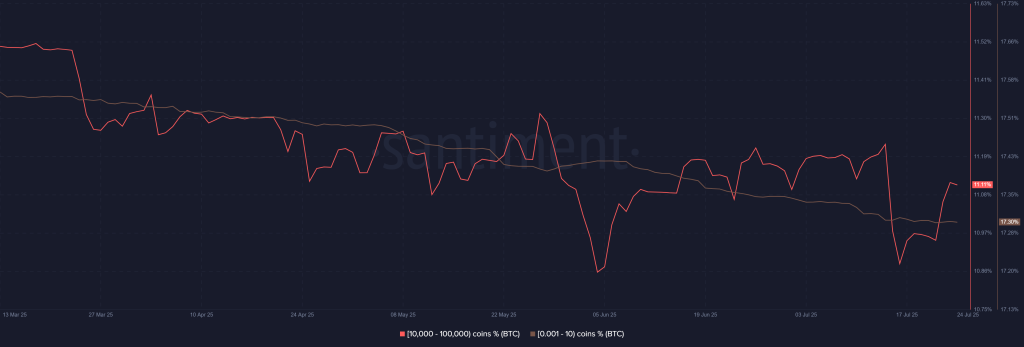

Beyond technical patterns, the on-chain data is another factor that adds optimism to the analysis. The data reveals that the wallets holding between “0.001 to 10 BTC” (largely considered retail investors) have shown a steady decline in activity. This is reflecting an ongoing trend of profit-taking and fear that the consolidation could mark a market top.

In contrast, whale wallets holding “10,000 to 100,000 BTC” have increased their holdings during this pullback. This accumulation trend among large players hints that institutional confidence remains intact, and that the Bitcoin price USD could still make another attempt at new highs.

Such a shift in supply ownership from retail to whale wallets hints towards the bullish BTC price continuation.

Christmas Risk Looms if Whale Sentiment Shifts

However, there remains one key risk that could threaten this outlook. If the current consolidation triggers not just retail exits but also prompts whales to offload their holdings to secure profits, then downside pressure could intensify.

In such a case, the Bitcoin price might slip back below $100,000, potentially extending the correction into the Christmas season.