Bitcoin has strengthened against Gold amid anticipated capital rotation to crypto.

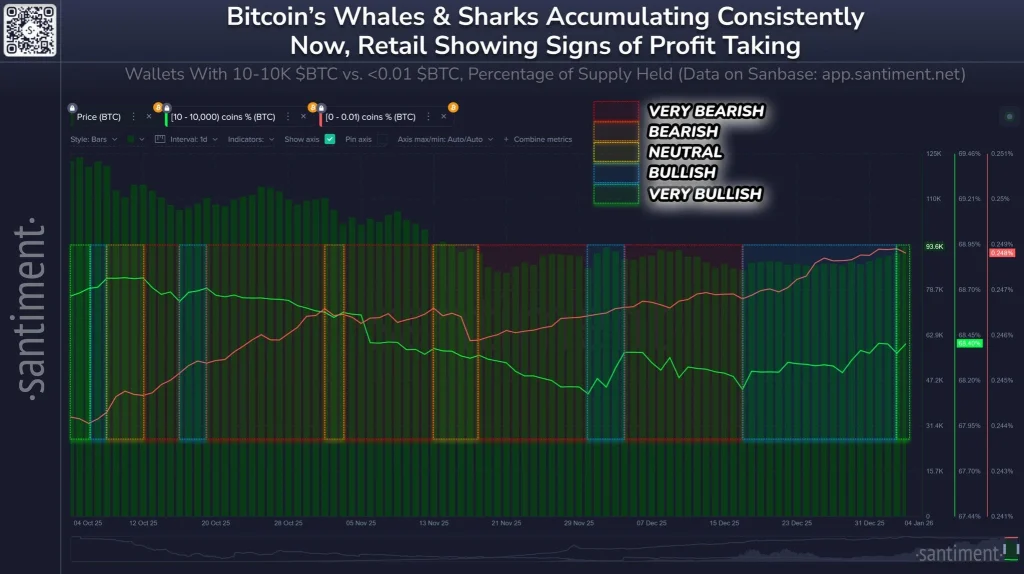

Onchain data shows Bitcoin whales have been accumulating amid increased profit-taking from whales.

Institutional investors have increased risk-on behavior on BTC led by Strategy and American Bitcoin.

Bitcoin price has rebounded over 7% since the calendar flipped for 2026 last week. The flagship coin has since retested a crucial liquidity level around $94k on Monday, January, 2025.

Why Is Bitcoin Up Today?

Capitulation of retailers amid renewed whales demand

According to onchain data analysis from Santiment, Bitcoin whales, with a balance of between 10 and 10k have gradually increased their holdings in the past few days. On the other hand, Bitcoin holders, with less than 0.01 BTC have increased their profit taking.

Historically, Santiment has shown that a rising accumulation from whales amid retail capitulation is a bullish recipe and vice versa.

The rising demand for Bitcoin from whale investors can be demonstrated through major treasury companies. For instance, American Bitcoin, a treasury company backed by President Donald Trump, increased its holdings to 5,427 BTCs, valued at over $505 million.

Strategy Inc also increased its Bitcoin holdings by 1,287 BTCs to currently hold about 673,783 coins. The risk-on investment behavior in Bitcoin from institutions is backed by the robust cumulative fundamentals in 2025, including notable cash inflows to the spot BTC ETFs.

Bullish technical tailwinds

From a technical analysis standpoint, BTC price is well positioned to rally beyond $100k towards a new all-time high in the near term. In the daily timeframe, Bitcoin price rallied beyond a crucial supply level around $93k to trade about $94,316 at press time.

Crypto analyst @Osemka8 on X noted that Bitcoin price has been following a similar bullish pattern to its 2023 market reversal. With the rising global money supply amid the notable predictions of a gold topout, Bitcoin price is well positioned to experience a parabolic rally in the near future.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.