Bitcoin Price Drops Below $107k, Crypto Liquidations Tops $1.2B; Is Bull Market Over?

The crypto market has turned bearish in the midterm since the Fed released its funds rate on Wednesday.

Heavy liquidations of long traders amounting to over $1B has weighed down on midterm crypto bullish sentiment.

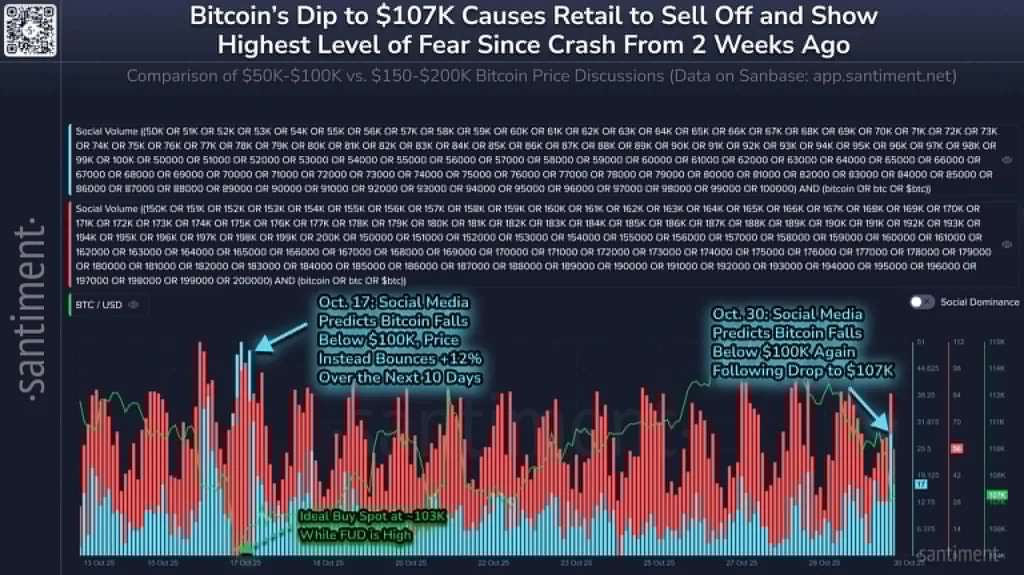

Santiment has cautioned traders of a potential relief rally amid rising calls of a bearish outlook.

Bitcoin (BTC) has led the wider crypto market in a correction on Thursday, October 30. BTC price dropped 4% during the past 24 hours to reach a today’s range low of about $106,861 during the mid North American session.

The total crypto market cap dropped 5% during the last 24 hours to hover about $3.6 trillion at press time. The altcoin market was heavily impacted by today’s correction, led by Ethereum (ETH), Solana (SOL), Dogecoin (DOGE), Cardano (ADA), and XRP.

Main Reasons Why Crypto Dropped Today

Heavy liquidation of long traders: Impact of a long squeeze

The wider crypto market experienced the impact of a long squeeze on Thursday after a heavy liquidation of long traders. According to market aggregate data from CoinGlass, out of the $1.24 billion liquidated from leveraged crypto trading, around $1.1 billion involved long traders.

Sell-the-news fear after the Fed’s monetary policy change announcement

The wider crypto market also recorded bearish sentiment on Thursday partially fueled by the sell-the-news impact. On Wednesday, the Federal Reserve initiated its second rate cut of 25 bps to between 3.75% and 4% as investors expected.

Additionally, the Fed announced that its Quantitative Easing (QE) will begin on December 1, 2025. However, the Fed noted that the December policy decision will be impacted by the ongoing government shutdown amid the political impasse in Washington DC.

As such, crypto traders have depicted mid-term fear of further market correction.

What’s Next for the Crypto Bull Market?

The crypto bull market is hanging on by an edge despite the end of tariff wars between the United States and China. From a technical analysis standpoint, BTC price must rebound from the current support level of around $107k to invalidate further correction.

According to market data analysis from Santiment, BTC price tends to record a relief rally every time the crowd shows heightened fear of capitulation.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.