Bitcoin Price Drop is Likely a Pause and Not a Reversal; LMAX Strategist Joel Kruger Says

LMAX’s Kruger noted that Bitcoin’s fundamentals remain strong amid a historic bullish fourth quarter.

The crypto market drop today has triggered a debate on whether it was a bear trap or the end of the bull market.

On-chain data analysis shows a significant whale selloff amid notable capital outflows.

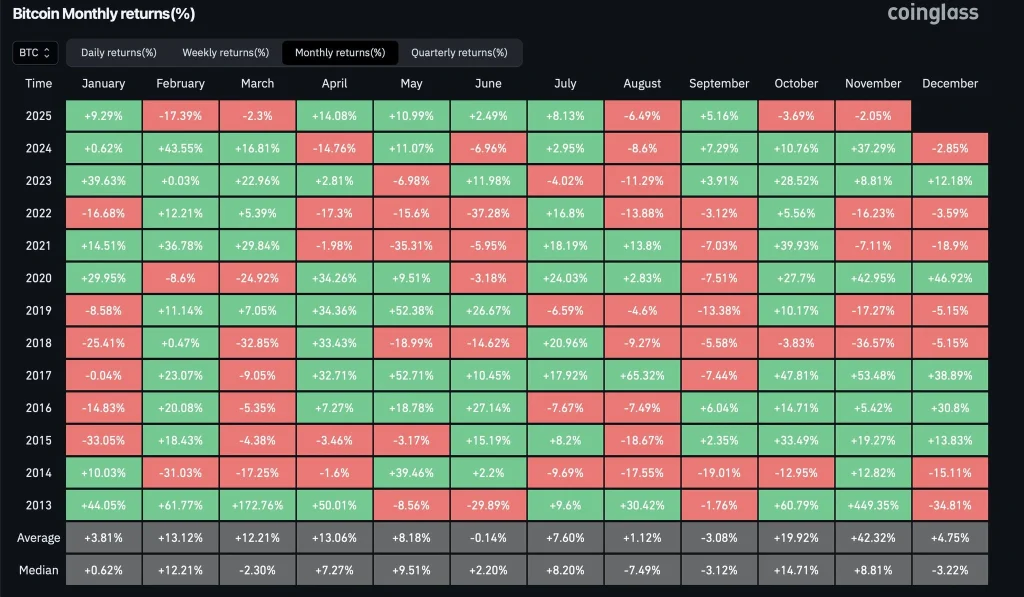

The bearish November start for Bitcoin (BTC) is not necessarily the end of the bull rally. According to Joel Kruger, a strategist with LMAX, the Bitcoin price may rebound after its first October bearish close in six years.

Kruger noted that the ongoing Bitcoin price drop is likely a pause and not a reversal. Furthermore, Kruger pointed out that Bitcoin has accumulated robust fundamentals amid a historic bullish fourth quarter.

Why is Kruger Bullish on Bitcoin Price Amid Low Whale Demand?

BTC Price Falters Fueled by Low Demand from Whale Investors

Bitcoin price has been trapped in a choppy consolidation amid heightened fear of further crypto capitulation triggered by a bearish close in October. For the first time in six years, the Bitcoin price recorded a bearish October.

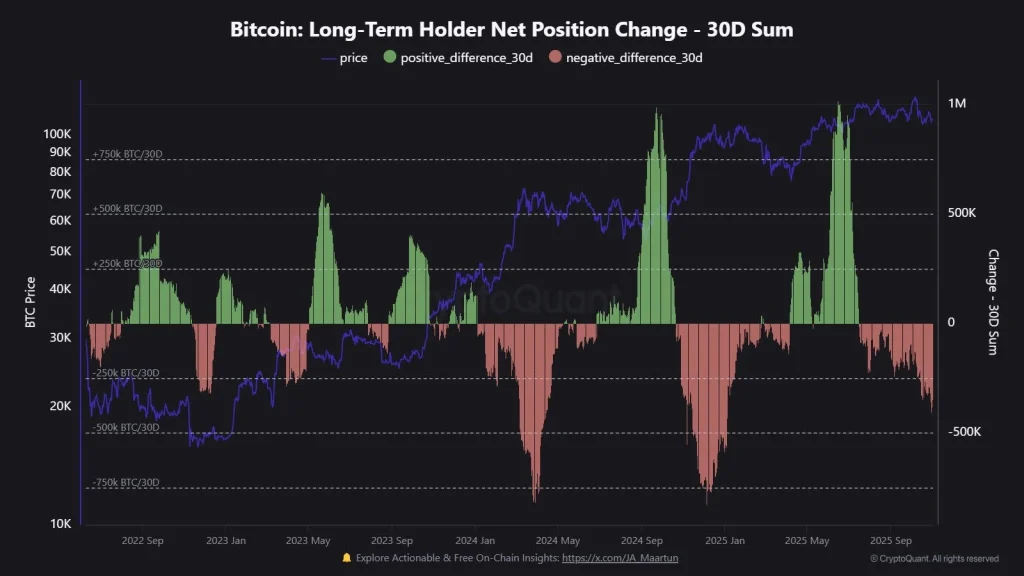

The midterm bearish sentiment has been exaggerated by the low demand from investors. For instance, on-chain data analysis from CryptoQuant shows long-term holders have offloaded over 400k BTCs in the past 30 days.

Meanwhile, the weekly report from CoinShares shows Bitcoin’s investment products recorded a net cash outflow of $946 million last week.

Technical Tailwinds Amid Robust Fundamentals

Macro BTC Price Uptrend Remains Strong

From a technical analysis standpoint, the BTC/USD pair has been retesting a rising logarithmic support trend line. In the weekly timeframe, the BTC/USD pair has not experienced a euphoric rise akin to its prior bull run cycles since its bear market reversal.

As such, for as long as the BTC/USD pair remains above its weekly rising logarithmic support trend line, a potential reversal towards a new all-time high is highly probable before the end of this year.

Cumulative Fundamentals to Consider

The Bitcoin market has accumulated robust fundamentals in the past year amid its choppy consolidation. For instance, the flagship coin has been adopted by dozens of companies, led by Michael Saylor’s Strategy, as a treasury management tool.

The mainstream adoption of Bitcoin has been bolstered by supportive regulatory frameworks in several major jurisdictions led by the United States.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.