Bitcoin price debate intensifies as NUPL suggests capitulation isn’t complete

2,486 BTC purchased at ~$67,710, total holdings now 717,131 BTC

Monthly RSI below 40 opens possibility of $50,000 cycle support

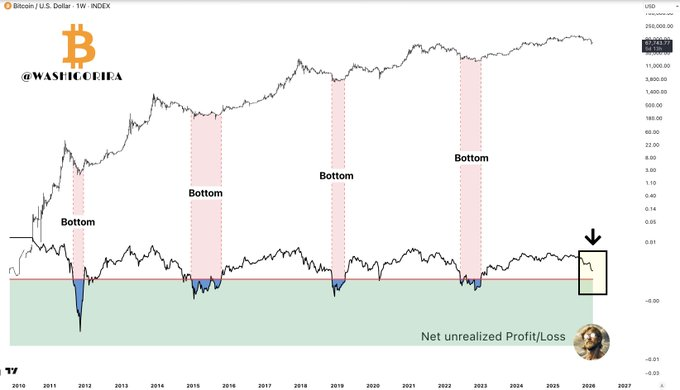

The Bitcoin price is once again caught in a tug-of-war between on-chain caution and aggressive corporate accumulation. NUPL data suggests most participants are not yet underwater, where its underwater conditions are evident in past true cycle bottoms. Yet fresh purchases from MSTR hit the tape loud today.

NUPL Says Capitulation Incomplete

Historically, its evident that when cycle lows form when the majority of holders are sitting at unrealized losses. That’s when fear peaks and forced selling exhausts itself. But according to current Net Unrealized Profit/Loss (NUPL) readings, the market hasn’t reached that pain threshold.

Compared to prior cycles, NUPL remains elevated. In practical terms, that implies the capitulation phase may not be finished. From a Bitcoin price chart perspective, this metric has often aligned with deep-value zones only after profitability collapses across the board. We’re not there yet, at least based on this dataset.

Well, sentiment may feel awful, but structurally, most holders haven’t experienced maximum stress, yet.

Saylor’s Strategy Buys the Dip

Meanwhile, corporate conviction continues. A fresh acquisition of 2,486 BTC worth approximately $168.4 million was made at around $67,710 per coin, by Michael Saylor’s Strategy. That brings total holdings to 717,131 BTC, acquired for roughly $54.52 billion at an average of $76,027 per coin.

That’s not exactly hesitation. From a Bitcoin price prediction standpoint, aggressive accumulation at lower levels signals long-term confidence from at least one major entity. However, it doesn’t automatically confirm a market-wide bottom, yet but institutional buying can coexist with extended drawdowns.

At the same time, the BTC/USD structure still reflects uncertainty rather than confirmed reversal.

Bitcoin Price to $50,000 in Play?

Adding fuel to the discussion, another widely circulated view points to the monthly RSI dropping below 40. Under this the four-year cycle, that interpretation opens the possibility of $50,000 as a potential 2026 bottom zone.

Still, monthly RSI weakness doesn’t guarantee a specific downside target, but it does suggest broader trend fatigue. Historically, such readings have accompanied prolonged corrective phases rather than quick rebounds.

So, where does that leave the Bitcoin price? On one side, NUPL argues true capitulation hasn’t arrived. On the other, large-scale buying continues near $67,000 while some analysts model $50,000 as a deeper support region. The Bitcoin price currently sits between structural accumulation and incomplete pain, a phase where conviction and caution coexist.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.