Bitcoin Longs Are Rising While the Demand Halts— What This Means for the BTC Price Rally?

Bitcoin price is becoming more sensitive to downside risk as long positioning remains elevated, while demand growth slows

Since the start of December, the Bitcoin price has largely traded sideways, oscillating between roughly $85,000 and $90,000, with no sustained follow-through on either breakouts or breakdowns. Daily ranges have narrowed, and volatility has continued to compress, signalling a market stuck in balance rather than a trend. While this calm price action may appear stable on the surface, it has created conditions where positioning and demand dynamics carry more weight.

As volatility remains subdued, shifts in trader behaviour and underlying demand are becoming increasingly important in determining how the BTC price reacts once this range finally breaks.

Bitcoin Long Position Rising—Have Traders Turned Optimistic?

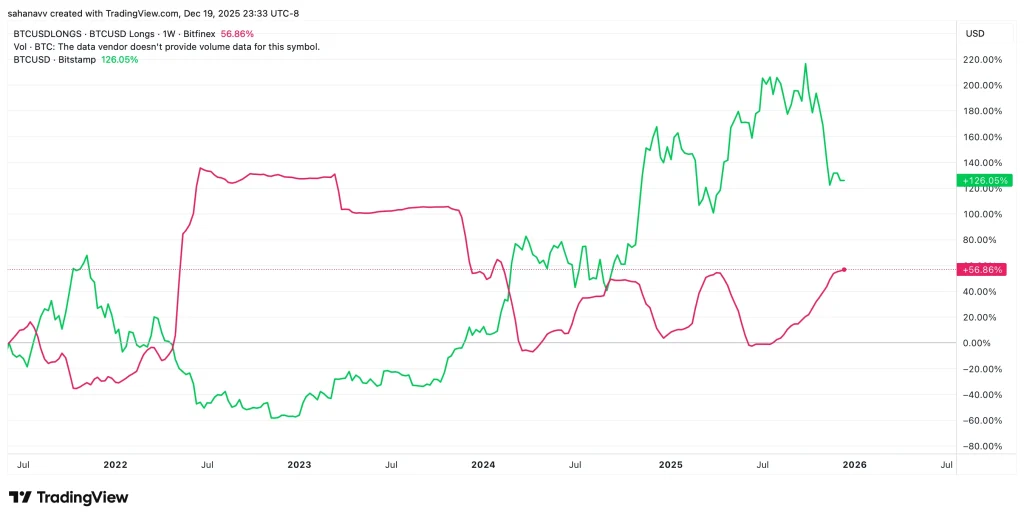

Bitcoin longs, where the traders bet on the rising BTC price over time, highlight the growing confidence in the crypto. A massive rise was recorded at the beginning of 2022, which elevated the BTC price from its historical lows close to $15,000. Currently, the longs appear to be stronger than before, as they have reached a 22-week high. This tells us that traders are increasingly positioning for upside in anticipation, rather than in response to confirmed price strength.

The chart compares Bitcoin long positioning with price action and highlights a recurring inverse relationship. Historically, spikes in long positions have often coincided with local price pullbacks, while periods of declining longs have aligned with price recoveries. A similar pattern has played out multiple times since 2024. Currently, long exposure has climbed toward recent highs, even as Bitcoin price trades closer to the lower end of its range. This divergence increases downside sensitivity.

If price fails to regain momentum, the buildup in long positioning could amplify a corrective move, potentially dragging Bitcoin toward deeper support zones rather than extending the current consolidation.

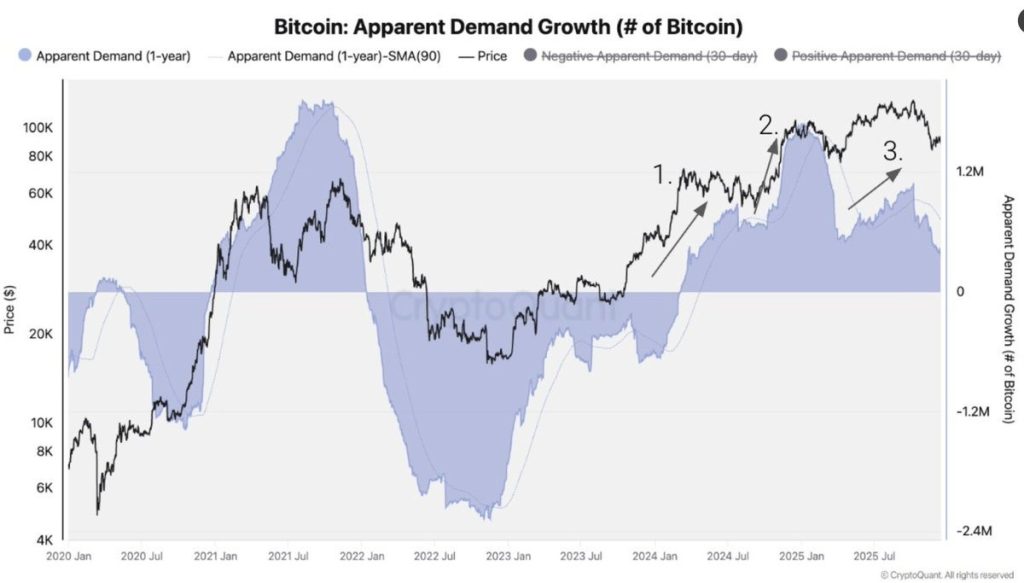

Demand Is No Longer Expanding to Absorb Risk

At the same time, on-chain data suggests that Bitcoin’s apparent demand growth is flattening, according to data from CryptoQuant. This does not signal collapsing demand, but it does indicate that fresh buying pressure is no longer increasing.

When demand is expanding, it acts as a cushion. New buyers absorb sell pressure and reduce the impact of positioning imbalances. When demand growth slows, price becomes more dependent on trader behaviour. In that environment, positioning matters more than usual—and crowded trades become riskier.

This setup typically leads to one of two outcomes. Either the price corrects quickly, flushing out early longs and resetting positioning, or it grinds sideways long enough to wear down impatient traders before a more sustainable move develops. In both cases, the market tends to punish anticipation rather than reward it.

Conclusion

Bitcoin’s price may still be holding its range, but the balance underneath is tilting toward risk. With long positioning stretched, volatility compressed, and demand no longer expanding, the price is becoming increasingly vulnerable to a downside reaction if support fails. A loss of the $83,000–$82,000 zone would likely expose Bitcoin to a deeper corrective move toward $78,000–$75,000, where stronger historical demand has previously stepped in.

These levels are not targets to chase but zones where market behaviour is likely to change. Until Bitcoin (BTC) price can reclaim higher levels with strong acceptance, the risk of a sharper pullback remains elevated, and traders should treat stability as conditional rather than secure.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.