Bitcoin Breaking Out—Can the Bulls Drive the Price Above $110 as Bears May Be Positioned at $109.7K?

After a brief consolidation, the Bitcoin price has begun to rise and has entered the pivotal resistance, which is the final barrier before the ATH

Although the bulls have initiated an upswing, the path to a new ATH may not be as simple as bears may again try to drag the levels back below $105K.

The Bitcoin price broke out and is less than 4% away from the current ATH at around $111,980. With this, the star token has again unlocked a price discovery possibility as the volatility or the deviation has been done. As it continues to retest its re-accumulation range successfully, it has been stuck there for 4 straight weeks. Therefore, the BTC price is in an effort to transition into the second phase of price discovery, while the question now appears: Will the bears allow the crypto to surge past $109,800?

The two-week Bitcoin downtrend seems to have reached the end as the price has convincingly broken the resistance zone between $106K and $107.6K. Meanwhile, the bulls are working hard to sustain the levels until the daily close, which could validate a positive reclaim signal, as any dip into $106.6K would likely constitute a retest attempt. This rise occurs when BlackRock’s BTC ETF smashes $70 billion in record time and becomes the fastest fund to surpass this milestone.

Whales Make Huge Moves While Plebs Sleep

The Bitcoin reserve over the exchanges has been constantly dropping since December 2024 and has reached the lowest levels not seen in the past few years. At the same time, the US Bitcoin demand has surged as Coinbase Premium has hit a 4-month high while more than 550K BTC has left the exchanges. This suggests an increase in accumulation, aligning with reduced selling pressure. But the question arises, who is accumulating? Whales or retail investors?

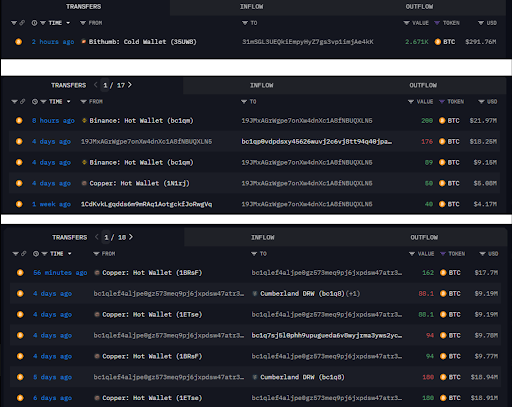

In the past few days, the markets witnessed a couple of BTC price movements, as reported by an anonymous analyst, The Data Nerd

- 2,671 BTC worth around $291.7 million has been transferred from Bitthumb

- A popular whale, 19JMx, withdrew another 200 BTC from Binance

- Cucumberland withdrew another 162 BTC worth around $17.7 million

This suggests that the whales have begun to make huge moves, as $291M from Bitthum’s cold wallet storage, plus $39.7M worth of BTC exiting Binance and Cumberland. When liquidity providers reshuffle, BTC’s sound money displays strength, which was seen during the latest price rise. Does this suggest the whales are preparing for the next bullish move?

Here’s Where the 2025 Bitcoin Top Could Be

Bitcoin price just experienced a great short squeeze, clearing the consolidated zone around $106,000. As the bulls are trying extensively to push the price above $110,000, the downside risk after the short squeeze seems to be emerging. However, after a short-term consolidation, the price is expected to rise and mark the market top of 2025.

The historical chart of Bitcoin suggests the token still has more room to grow. Whenever the 200-week SMA crosses the previous cycle’s all-time high horizontal level, the top is usually in. This hints towards more upside potential, which could elevate the BTC price towards the 2025 top, somewhere around $160K to $170 in the coming days.

Therefore, Bitcoin appears to be under the influence of excessive institutional adoption and whale movements. Hence, the token is expected to maintain a strong ascending trend as it may not allow the price to drop below $100K, or until they book their profits.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.