The cryptocurrency market, led by Bitcoin, experienced a 1.51% decline triggered by the release of CPI report.

Bitcoin took a significant 4% hit, witnessing a massive $307 million in leveraged positions.

Other major cryptocurrencies like Ethereum, Solana, Avalanche, and Cardano ADA also faced declines.

The cryptocurrency market witnessed a notable downturn on Tuesday, with a 1.51% decline spurred by the release of October’s Consumer Price Index (CPI). The ensuing ripples were felt across the crypto landscape, impacting even the king Bitcoin, which saw a substantial 4% drop from $37,000 to $35,000.

All we see around us right now is red. What does the future hold?

Understanding the CPI Impact

The Consumer Price Index (CPI) plays a big role in how currencies are valued. When inflation goes up, the value of money drops, and you need more money to buy the same things. This inflation pressure is closely watched by central banks, and they might change their policies, impacting financial markets, including cryptocurrencies.

Experts point out that the cryptocurrency market is particularly sensitive to CPI fluctuations—rapid changes in the CPI signal market instability.

The market downturn hit Bitcoin hard. According to CoinGlass, a whopping $307 million in leveraged cryptocurrency long positions were wiped out in a single day – the biggest since August 17. This happened as Bitcoin’s price suddenly dropped from over $28,000 to around $25,000 in just a few minutes.

How Is the Market Doing?

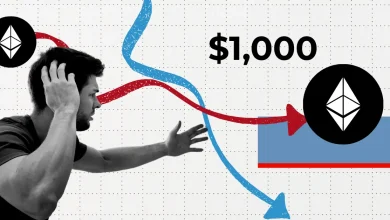

Ethereum Holds Steady

Ethereum, which had been on a bullish trend, experienced a modest drop of 0.99% to $2033.7. Despite trading close to its middle range for the past five days, Ethereum’s price is still 8.49% above its five-day low and 4.73% below its five-day high. The current trading pattern suggests Ethereum is near its support level, with a significant gap before hitting resistance.

Solana’s Ride

Solana (SOL) went down by 3.05%, putting its value at $55.3. Despite this, its volatility is average compared to other cryptocurrencies, showing a decent level of stability.

Avalanche’s ‘Slide’

Avalanche saw a noticeable drop of 6.68%, trading at $16.96, with a 24-hour trading volume of $760.73 million, reflecting the market downturn’s impact on various cryptocurrencies.

Cardano Couldn’t Escape Either

Cardano ADA experienced a 3.50% drop, settling at $0.3622, with a 24-hour trading volume of $421.06 million, adding to the overall dip in digital currency values.

Looking at the Bigger Picture

The recent cryptocurrency market dip, triggered by the latest CPI data, shows how digital currencies are influenced by broader economic indicators and central bank decisions. While Bitcoin faced a setback, Ethereum, Solana, Avalanche, and Cardano ADA also saw declines. Investors need to navigate carefully in these uncertain times, keeping an eye on broader financial indicators that affect the crypto market.